[ad_1]

The recent Twitter announcement (TWTR) that he was cleaning up tens of millions of accounts at a rapid pace in recent weeks, with a more intensive suppression campaign coming up, is less of a surprise or a negative news item I believe that a benefit to the company that takes its place for future growth.

A Twitter capable of ensuring that advertisers honestly get what they paid for is on track for both business turnover and user growth. "I believe that the current announcement is a strong sign that Twitter is seriously reorganizing its platform to capture more of the online advertising, which ultimately will ultimately result in Twitter capturing more of its immense potential

Just like how Facebook has cleansed its platform in a cost-effective way, Twitter is now too

Those who are familiar with my Twitter cover know how much I love, and believe that 's the way it is. it is appropriate to compare it to Facebook (FB) in terms of its business life cycle, while both have significant differentiation in specific products, yet they have enough fundamentally similarities to contrast. not be sure that there are competitors, if you were to ask where is closest to a competitor, it would definitely be Twitter.

Facebook had a similar bot ire or two where he faced the growth of advertisers and advertisers, the proliferation of fake accounts on his platform.

Facebook ended last semester by removing more than 1.3 billion fake accounts and 865 million accounts. spam and bot operations, which Facebook estimated to account for about 3-4% of its monthly active users.

Twitter's current operation is similar in nature and scope, estimating that its suppression campaign will result in about 70 million account deletions and about a 6% net decrease across the platform. Twitter said that monthly statistics on active users will not be significantly affected, which initially tumbled the stock nearly 9% a few days ago while public news was poorly known for a long time

TWTR Price Data by YCharts

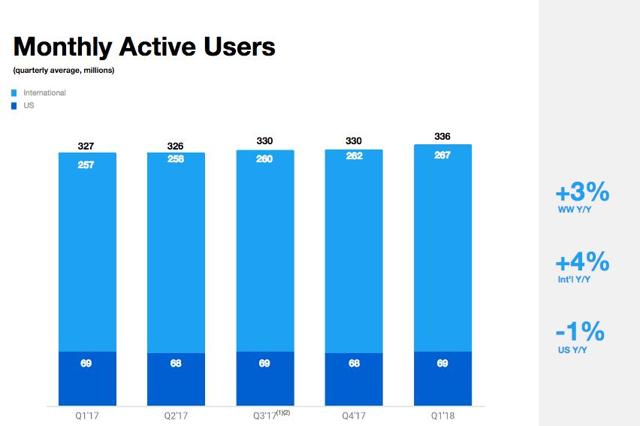

The statistics of Twitter users, of course, are still relatively slow at the moment and therefore if the wording had been slightly modified to reflect such a suppression campaign against users already included in the MAU metrics that would undoubtedly be significant news worthy of such a decline. Nevertheless, the actual news, as with Facebook, was much more positive in the grand scheme of things than negative.

(Source: Presentation of the results of Twitter in Q1 2018)

Like Facebook, Twitter has faced immense questions about content, bots, malicious activities, the harbadment and spam. As I have already described, Twitter is currently very involved in the life cycle of Facebook and is just starting its first phases of growth.

By cleaning up his platform, including from fake accounts that worry advertisers, do a lot of good to attract the trust of advertisers and users in his platform in the same way as the operation Facebook Clean Up Before the Cambridge Analytica Scandal

As illustrated below, Facebook soared by 33% from March 1, 2017 to March 15, 2018 (the day before the Analytica scandal), despite a review meticulous public of the activity of bots and spams, which diverted a large part of its activity thanks to a mbadive cleaning of its platform

FB data by YCharts

Indeed, as Twitter speeds up its removal operation here are the words of Twitter Vice President for Trust and Security:

We think [follower counts are] a very important and meaningful measure, and we want that people have trust that they are committed users who follow other accounts.

Since I recommended Twitter as "Opportunity" to subscribers of my Marketplace service, Tech Investment Insights May 1, 2018 it is still up 44.62% in the two and a half months since. Since I've explored in more detail the long-term case for Twitter with my subscribers on May 29, 2018, it's up 28.73%.

TWTR data by YCharts

Twitter's revenues still come mostly from advertising, with its monthly active users, a key indicator of the world's largest advertising market. Platform activity that attracts advertisers for impressions, clicks, and other paid interactions. Now that advertisers are increasingly able to trust the badytics they receive and ensure that their ads are not placed next to harmful microblogs, we can continue to expect to see revenue Twitter advertising increase in a more predictable way. I believe that the current stages of Twitter are not at all surprising, but rather an expected development, as in the case of Facebook, because it reacts and protects against the harmful activities related to the technology of Internet services of the 21st century. Rather, Twitter's announcement is in my opinion no longer a PR exercise that signals advertisers that it's now a good time to get into the fold.

Conclusion

The age of social media from 2010 to 2015 will undoubtedly be incomparable to that of 2020-2025, just as our modern era of universal smartphones seems almost unrecognizable since the first appearance of mobile phones in the late 1990s and early 2000s.

I believe that Twitter is still at a stage of early growth as a business is finding its foot even with its absolute age value for a technology. In terms of relative age, it is now going from young to growing, with what I believe will soon be greater monetization of its user activity and a growing base of users now that 's more. it has become clearer on what it stands out. "19659027] The recent cleanup is just a sign that they are moving forward with this growth plan seriously, as well as a notice to advertisers that is now a good time to start exploring to work on Twitter again.I remain quite optimistic about the trajectory of the business.

(Source: Twitter)

Tech Investment Insights I tackle specific businesses and investment products that, in my opinion, are particularly suited to win on the market, as well as one to avoid.

Focusing on technology in particular, including Twitter and many other Internet services, I present you with updated risk-reward ratings for dozens of companies, prices on potentially attractive investments, portfolio strategies and attractive risks. I hope you will take a look at it

Disclosure: I am / we are long FDN

I myself wrote this article, and he expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link