[ad_1]

Not surprisingly here, Cover growth (CGC) had a limited reaction in reporting net income growth of 282% in the fourth quarter. The stock advanced by a few percentage points as the sector continues to signal a mixed signal on growth potential, leaving the investment community puzzled over the long-term outlook.

My investment thesis maintains a negative bias while recognizing the potential for an irrational rebound if the stock exceeds a resistance higher than 50 USD.

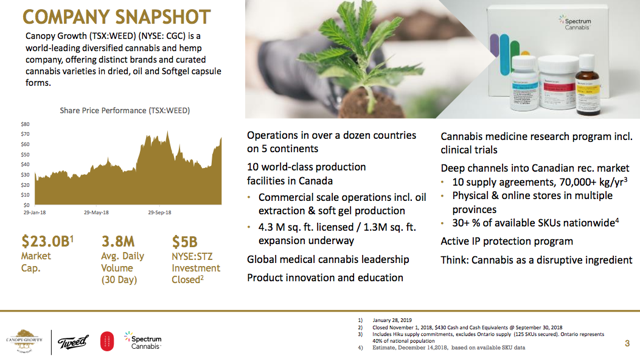

Source of Image: Canopy Growth website

Confusing message

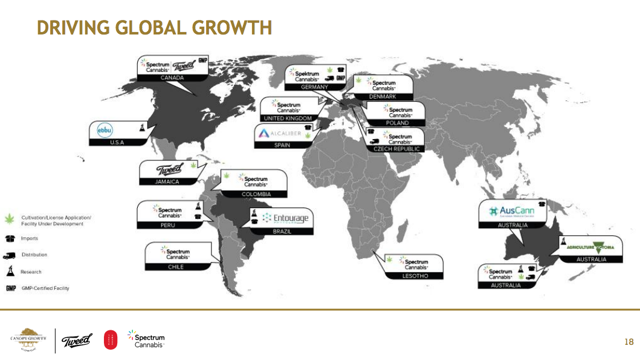

When looking at investor literature on Canopy Growth, the opinion is that of an international player in the medical cannabis industry focused on the recreational cannabis industry. The reality seems very different.

Canopy Growth has spent most of 2018 on a message that does not match actual results for the December quarter. The company presents in the snapshot that Canopy Growth operates in dozens of countries and focuses primarily on medical cannabis.

Source: February presentation of Canopy Growth

With the legalization of cannabis use by adults in Canada on October 17th, Canopy Growth has a business model very different from that presented by the company as recently as February's corporate presentation. In the December quarter, more than 80% of products sold were destined for the Canadian leisure market. In addition, the famous international trade in medical cannabis is virtually non-existent in 2019.

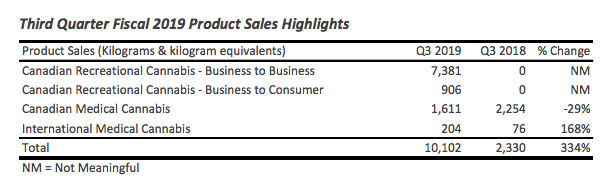

Source: Publication of Canopy Growth FQ3 Results # 19

The Canadian and international medical cannabis divisions saw their kilograms increase from 2,329 in the last quarter of 2007 to just 1,815 kilograms in the last quarter. The company sold 2,197 kilograms in the previous quarter and in fact hinted that the number of medical patients would have decreased due to legalization.

One of the reasons that makes a big difference is that premium prices are in the medical sector. The ability of cannabis companies to brand high quality cannabis strands will eventually allow them to sell products at high margins.

The results of FQ3 suggest that consumers will retreat to recreational products now available at retail. The average selling price decreased 12% from the previous quarter to C $ 7.33 per gram. More importantly, the price had fallen significantly from Can $ 9.87 per gram in the previous quarter just prior to legalization.

Source: Publication of Canopy Growth FQ3 Results # 19

The average selling price of cannabis for recreational purposes was only $ 6.96 per gram on a quarter when the legalized industry was under-supplied. Canopy Growth sold 10,102 kilograms in the quarter, while its competitor Aurora Cannabis (ACB) only sold 6,999 kilograms during the period.

Canopy Growth has the right to claim a leading position in the Canadian market, but competition is increasing production faster than Canopy Growth. Aurora Cannabis is forecasting a production capacity of 25,000 kilograms by the June quarter and in fact exceeds Canopy's growth for the quarter, from 7,822 kg to 7,556.

The problem here is that market share leadership could become an ephemeral indicator for a sector that is clearly moving into the recreational market. According to Statistics Canada, a market that is not growing because of legalization and the fact that it is a matter of going from illegal sources.

According to the National Cannabis Survey, consumption rates have not increased in Canada, remaining stable at 15% of the population. Consumption rate by province from November 13 to December 10 compared to the law prior to legalization:

- Alberta – 16%, down 17%

- Nova Scotia – 22%, down 23%

- Newfoundland – 19%, up 16%

- New Brunswick – 19%, up 14%

- Prince Edward Island 18%, up 15%

- British Columbia – 15%, down 20%

- Manitoba – 15% compared to 19%

- Ontario – 15%, up from 15%

- Quebec – 14%, up 10%

- Saskatchewan 17%, up 16%

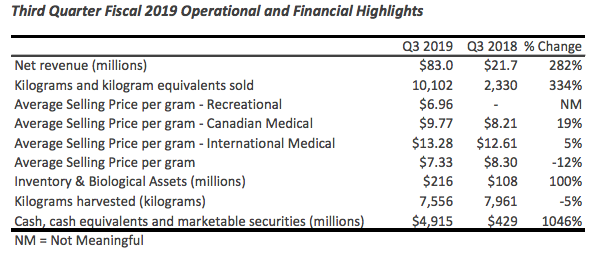

Worse still, a high percentage of the population focuses on the lowest price. The good news is that the majority of the population is focused on quality and safety, probably because of the problems of the illegal market of the past, but the quality of the competition will make it a mute point, driving prices higher in the world. # 39; s equation.

Source: National Cannabis Survey Q4 – 18

In the absence of a growth in domestic consumption and a price-sensitive market, the flow of cannabis production must depend on international exports. International exports are promising, but Canopy Growth sold only 204 kilograms to Germany during the quarter. Not exactly a robust distribution of countries or product quantities.

Upcoming stomach burns

December's quarterly results show the mistake of an international expansion plan where real sales are very limited. During the quarter, Canopy Growth recorded an operating loss of C $ 157 million and generated cash flow from operations of C $ 97 million, while generating a loss of $ 25 million. Adjusted EBITDA of Can $ 75.1 million.

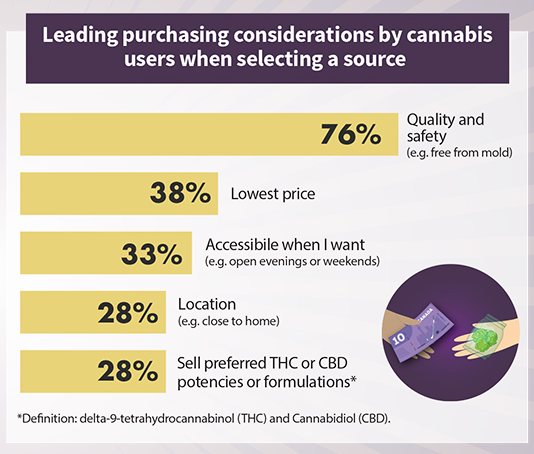

Source: February presentation of Canopy Growth

Substantial equity compensation that includes both employee costs and acquisition milestones would make any start-up in Silicon Valley envious. SBC costs of about $ 64 million Canadian contributed to the average increase in the number of shares outstanding at 316 million shares. The closure of Constellation Brands The agreement (STZ) is another important part of the inventory of the number of shares, as the average number of shares will continue to increase in the coming quarters.

The company has spent an additional $ 202 million on property, plant and equipment. Constellation Brands' $ 5 billion investment will be very useful as Canopy Growth continues to expand at breakneck speed. The latest initiative is a project to increase hemp production in the United States after the approval of the Farm Bill. President and CEO Bruce Linton has apparently spoken of his intention to increase spending from $ 100 million to $ 500 million now.

All of these far-flung business plans in different countries and targeting different markets will result in substantial start-up expenses, while the company is actually just a glorified company in the recreational pot industry. The business plan is particularly troubling for a stock whose market capitalization is set at 21.5 billion Canadian dollars.

Strong resistance at $ 50

As mentioned in the previous article, $ 50 remain a strong resistance. The stock climbed up to $ 49 as a result of FQ3's initial earnings reaction and it quickly bounced back to $ 47.56 on Friday.

To take away

The main benefit to investors is that Canopy Growth has many fundamental reasons why the stock has peaked at the current price. The industry has put forward high-end concepts such as medical cannabis and international exports, but statistics for the quarter and the December survey continue to support an industry focused on cheap and recreational use in competition with the industry. illegal supplies.

The market is being inundated with new offers as its competitor Aurora Cannabis alone is expecting to increase its production by more than three times by the June quarter. Given that Canopy Growth has traded primarily based on the dynamics of its history, investors should understand that a move above $ 50 and a breakout from the previous high of around $ 55 would support a bullish short-term view. The title may be trading irrationally because of the hype surrounding the market's potential, but it's clear that a higher valuation placing Canopy Growth at a valuation close to $ 30 billion Canadian and quarterly earnings of the order of 83 million Canadian dollars are not supported.

Any real investor should avoid hype.

Warning: The information contained in this document is for informational purposes only. Nothing in this article should be considered as a solicitation to buy or sell securities. Before you buy or sell shares, you must do your own research and reach your own conclusions or consult a financial advisor. The investment includes the risks, including the loss of capital.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link