[ad_1]

Investment thesis

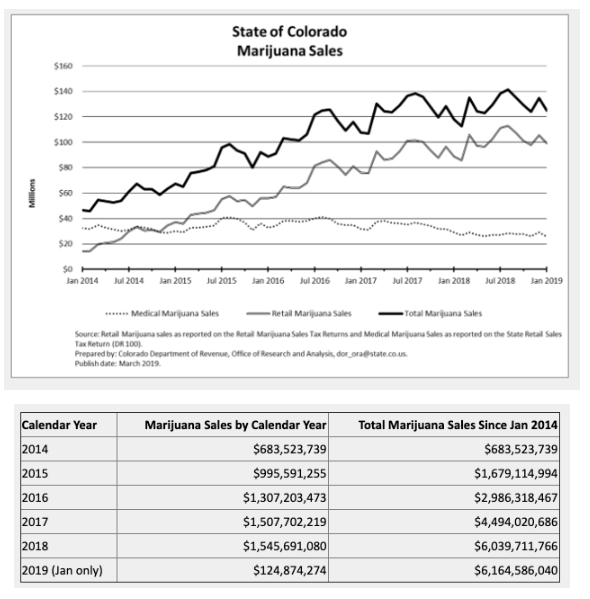

A few weeks ago, I published a DCF analysis on Canopy Growth Corporation (CGC) titled Is Canopy Stock Blowing Bubbles and Smoke? where I put forward key arguments about CGC's revenue, namely that CGC will derive most of its revenue from its recreational activities, which will likely be limited to the Canadian market because of the unlikely easing of international regulations to allow sales on international markets at any time. I also forecast the value of the Canadian leisure market based on Colorado's growth rates after legalization. Growth rates were 90% to 50%, 30%, 20%, 10%, 10%, 10% and 1% in perpetuity.

Source: Colorado Department of Revenue

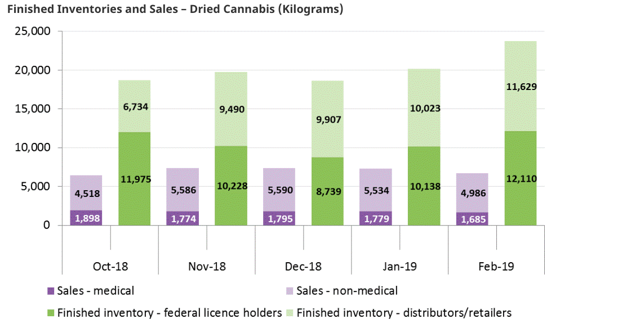

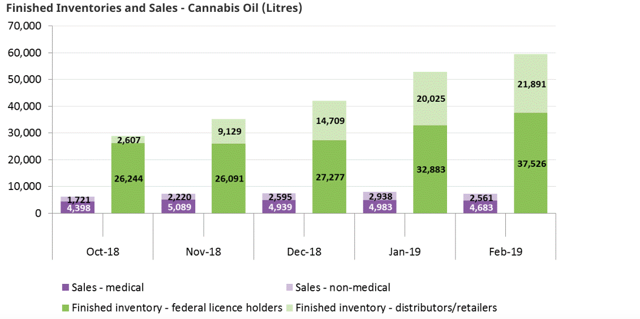

Where this approach may be imperfect, the lack of development in the Canadian recreational cannabis market leads to a very low starting point for this analysis. Consider that total sales estimated by Statistics Canada at only $ 115 million in the fourth quarter of 2018 were not a full quarter, as the legalization took place on October 17, 2019. Available data over 5 months show that approximately 27,700 kilograms were sold in the form of dried flowers or oils (assuming 1 gram / 8 ml of oil) and $ 8 per gram would indicate a turnover of approximately $ 221.6 million , which, annualized, equates to about 379 million dollars. Using this point as a starting point and using the annual growth rates of the Colorado case, the market value would represent only about $ 1.9 billion for 2025, which, as stated in Canopy Stock blowing bubbles and smoke ?, Would not support the $ 20 billion CCG market capitalization. The reason for low initial sales is mainly due to the lack of licensed producers' products and the types of products that are legal for the consumer (flowers and oils), which is far from enough to attract black market consumers.

The purpose of this article is to discuss the market forecasts provided by Deloitte, Brightfield Group, BDS Analytics, CIBC and New Frontier Data.

Industry forecasts

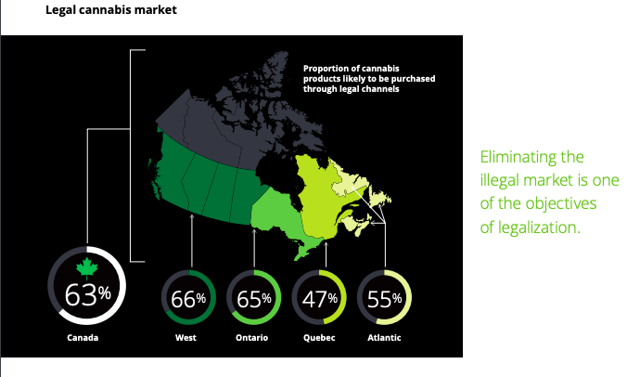

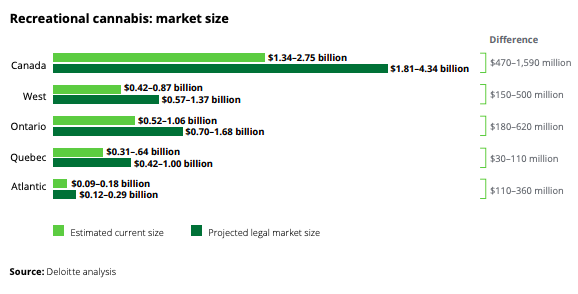

Deloitte, Brightfield Group, BDS Analytics, CIBC and New Frontier Data are all known for their market knowledge. Deloitte estimates that the size of the cannabis market in Canada, including medical, illegal and legal recreational products, represents sales of approximately $ 7.17 billion. Of this amount, $ 0.77 million is medical sales. The rest, which is obviously on the side of leisure and well above the majority (more than 90%), is currently served by the black market. However, they think that a turnaround in the script by the end of 2020 of up to $ 4.34 billion (68%) of sales will come from the legal leisure market.

Source: Deloitte Analytics

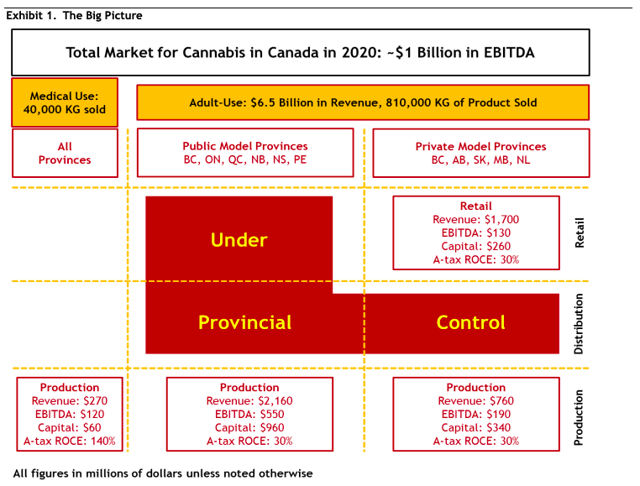

CIBC expects the Canadian recreation market to reach $ 6.5 billion in 2020, 810 kg sold ($ 8 per gram) and $ 1 billion in private sector EBITDA, with production representing over 85% of these amounts, the rest coming from the retail trade. – mainly in Western Canada.

Source: Cannabis Almost Showtime

In summary, here are the results of the various studies. We show the expected market value of the Canadian market for recreational cannabis by the various organizational studies, the implicit number of kilograms sold, assuming an average selling price of $ 8 / gram, the year in which the expected market value is achieved before that the market is stabilizing. Implicit annual growth to reach the market value established from the current level of $ 379 million in annual sales.

| Organization | Expected market value (in billions) | Kilograms sold at $ 8 / gram (in thousands) | Year | Implicit annual growth rate |

| Deloitte | $ 4.34 | 543 | 2020 | 1.045% |

| CIBC | $ 6.50 | 810 | 2020 | 1.615% |

| New Frontier Group | $ 9.20 | 1150 | 2025 | 70% |

| BDS analysis | $ 4.80 | 600 | 2024 | 66% |

| Brightfield Group | $ 5.00 | 625 | 2021 | 263% |

| Current market value | $ 0.38 | 47 | 2019 |

New Frontier Group is by far the most optimistic, forecasting $ 9.2 billion by 2025. However, its annualized growth rate is one of the lowest. CIBC and Deloitte are arguably the most aggressive forecasts at $ 4.34 billion and $ 6.5 billion, which would require annualized growth rates of 1,045% and 1,615%, respectively, over the course of the year. next year. BDS Analytics is the most conservative, forecasting only $ 4.8 million for 2024 and would require only a compound annual growth rate of 66%.

We will explore all of these different scenarios and their impacts on the CGC's assessment.

Hypotheses

Besides the revenue forecast, we use exactly the same assumptions in the article Is Canopy Stock Blowing Bubbles and Smoke ?. The following is a summary of the different assumptions used in the model:

Returned

- Kilograms sold in Canada will increase at the rates predicted by the above studies.

- CGC will serve 50% of the Canadian recreational cannabis market.

- Since it is very unlikely that Canadian producers will have full access to the US or European leisure markets in the near future due to the strict regulations applied in both countries, two of the most important, we will assume that CCG serves only the Canadian market. leisure market but will have access to the medical market worldwide.

- Similar growth parameters for the medical market as in the case of Colorado: 13%, 7%, then 1% in perpetuity.

- Medical cannabis and recreational cannabis sell for an average of $ 9.03 / g and $ 6.96 / g. It may not be reasonable to assume that these prices can be maintained as competition intensifies and recreational cannabis becomes a substitute for medical cannabis because of its lower price.

- Other income will represent 9% of total net income.

Cost of goods sold

- We use a cost of $ 2.78 / gram to estimate gross margins before fair value adjustments and assume a 5% decline rate over the next five years, which will be critical to success in their business model. because they are largely of. "The cost will remain unchanged after 5 years of sustainability.

- We ignore the effects of unrealized gains on changes in the fair value of biological assets.

SG & A

- We assume that this will correspond to the previous year to 50% of the turnover by 2020, and then gradually decline to 33%, 10%, and then 5% in perpetuity.

R & D

- R & D expenses will be set at 2% of the turnover.

General and administrative

- We assume that general and administrative expenses will account for 50% of revenues for 2020 and then decrease to 10% in perpetuity.

Acquisition costs

- We assume 7%, 5%, then 1% of the turnover in perpetuity.

Net working capital

- We assume that net working capital increases by a quarter of the income rate (since there are usually 4 crops per year). We subtract the cash from this estimate because the majority of balance sheet liquidity is reserved for acquisitions.

CAPEX

- Given that CGC has already spent $ 3.4 billion on the $ 5 billion injection of Constellation Brands (STZ) for the acquisition of Acreage in order to enter the US cannabis market, it would not be an exaggeration to believe that the 1.6 billion are spent before the end of 2019 in acquisitions. CAPEX will be equal to the amortization (10% of income) in perpetuity.

WACC

We perform valuations using a WACC range of between 7.0% and 8.5%, which is reasonable because their capital structure is primarily equity (D / E of only 16%).

Free cash flow growth at terminals

We expect long-term revenue growth of 1-2% (roughly similar to alcohol sales in Canada and the United States), which translates into long-term growth of approximately 2-4% of free cash flow. We provide estimates of valuation ranges similar to those of WACCs.

Valuation analysis

Below, we can see the valuation ranges when the different studies are integrated into our CGC valuation model.

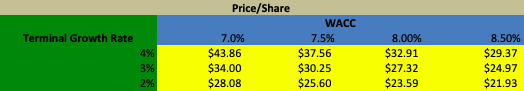

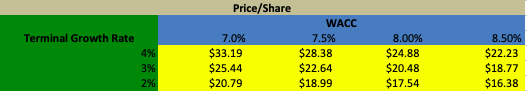

BDS analysis

Source: Author

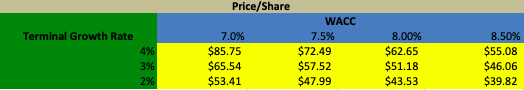

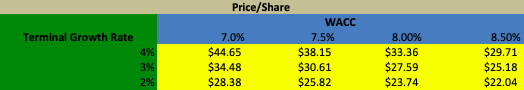

New Frontier Group

Source: Author

CIBC

Source: Author

Deloitte

Source: Author

Brightfield Group

Source: Author

As can be seen below, the model is highly sensitive to WACC and terminal free cash flow growth rates, as valuation ranges vary from $ 20 per share to the most conservative assumptions. , namely a WACC growth rate of 8.5% and 2%. the most aggressive, with a WACC of 7% and a growth rate of free cash flow of 4%. The valuation range is $ 45 / share in the case of New Frontier.

Conclusion

Admittedly, the model is very sensitive to the assumptions used by many financial models. What can be inferred is that even if the Canadian market for recreational cannabis grows to between $ 4.34 and $ 6.5 billion by 2025, that will not be enough to support the current situation of the GCC. Market capitalization of $ 20 billion. The Canadian market is expected to grow north by $ 9.0 billion annually by 2025 for the CGC to be fairly valued. This would mean that the market should grow at a CAGR of at least 70% per annum compared to the current annualized market value of about $ 379 million, which is well above the growth rates observed in Colorado since 2012, when recreational use was legalized. We must also bear in mind that the Colorado market participants were primarily small private companies and not large Crown corporations like Canada. Colorado's small and agile dispensaries could quickly increase orders and meet the growing demand. In Canada, provincial entities will not have the same flexibility to increase their purchases as efficiently as their southern neighbors.

The only way to justify the $ 60 per share is justified if, overall, more and more countries legalize cannabis for recreational purposes, which is very likely, but obtaining full access to these markets seem very unlikely in the near future, considering the regulations in force in most countries, notably the United States.

Disclosure: I am / we are short CGC. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link