[ad_1]

Cathie Wood’s five actively managed ETFs all more than doubled last year, easily beating the respectable 16% gain in the S&P 500. As CEO of ARK Invest, Wood has gained international recognition for his unwavering bullish outlook on You’re here, but she also made a lot of other winning choices.

On the heels of the successful passage of a $ 1.9 trillion COVID-19 relief program, President Joe Biden’s $ 3 trillion infrastructure bill aims to reform social programs, create jobs , build a green electricity grid, expand Internet access, etc. Woods Ark Autonomous Technology & Robotics FNB (NEW: ARKQ) is full of businesses poised to take advantage of an economic rebound, including caterpillar (NYSE: CAT), Deere & Company (NYSE: DE), and Komatsu (OTC: KMTUY). With that, we asked some of our contributors if they thought these three industrials were buys. Here is what they said.

Image source: Getty Images.

The takeover of Caterpillar has finally arrived

Daniel Foelber (Caterpillar): Photos of Biden campaigning in the Midwest, surrounded by legacy Caterpillar equipment and a “Build Back Better” banner, set the stage for the world’s largest construction machinery maker to get to work. Caterpillar is a cyclical business that tends to explode and slow down in step with the economy as a whole. To its credit, Caterpillar has done an impressive job diversifying its sales around the world. In fact, more than half of its sales are now generated outside of North America – which has helped its performance throughout the pandemic. Caterpillar continues to expand its manufacturing capabilities and product offerings in China, which is currently one of its fastest growing regions.

Caterpillar is best known for its construction equipment, which has a clear role to play in rebuilding the economy. But the company’s energy and transportation segment has experienced significant growth in recent years and is benefiting from rising oil prices. Due to its strong balance sheet, Caterpillar was able to purchase Weir GroupCaterpillar’s oil and gas division at an opportune time last year – which fits perfectly into Caterpillar’s drilling and drilling services product portfolio.

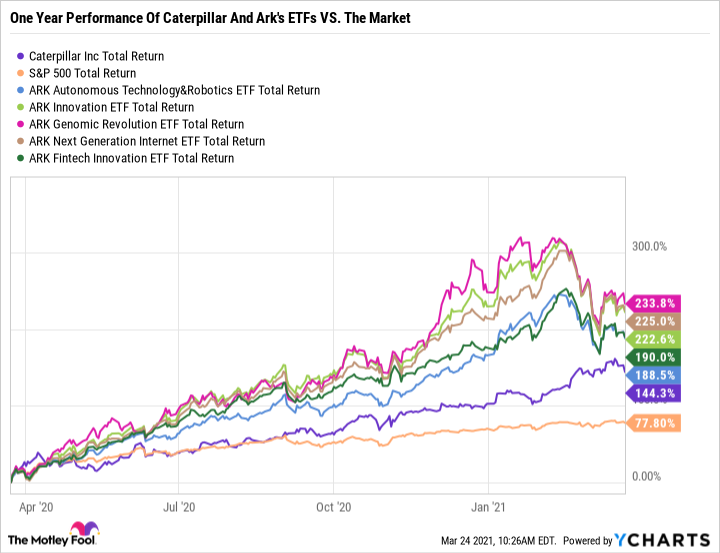

CAT Total Return Level Data by YCharts

Even without the infrastructure bill, Caterpillar predicts 2021 will be a year of growth as dealer inventories begin to rise and the company prepares for a recovery in the business cycle. Interrupted by the American-Chinese trade war and then the COVID-19 pandemic, Caterpillar has not experienced a sustained boom for nearly 10 years. With more than 25 years of consecutive annual dividend increases, Caterpillar has proven its resilience in tough market cycles. Caterpillar shares are near an all-time high as Wall Street clings to what could be record earnings and profits in the years to come. Cathie Wood seems to share this positive outlook. With a dividend yield of 1.9% and plenty of growth prospects, the Caterpillar stock is one to watch. Given that its shares have risen by over 140% in the past year (and Caterpillar has yet to hit the big numbers that everyone thinks it will), it may be best to take a wait-and-see approach to ensure Caterpillar can justify its high valuation. .

John Deere is also an infrastructure game

Lee Samaha (Deere): Although the company is best known for its iconic farm machinery, Deere is also a global leader in road and forestry construction equipment. In the pre-pandemic year of 2019, its construction and forestry segment was responsible for about half of operating profit as its agriculture and turf segment.

Deere’s road construction business received a boost following the $ 5.2 billion acquisition of Germany’s Wirtgen in 2017. The deal added solutions for milling, processing, paving, compaction and rehabilitation of Wirtgen to the existing strength of Deere in excavators and earthmoving equipment. As a result, Deere is now a major recipient of infrastructure spending for road construction and maintenance.

Deere management already expects its construction and forestry sales to increase 17% to 23%, from $ 8.9 billion in fiscal 2020 to between 10.5 and $ 11 billion in 2021 thanks to the reopening of the global economy.

At the same time, its farm equipment sales are expected to increase thanks to improved crop prices, the equipment replacement cycle and popular Deere smart farming solutions. All in all, 2021 will be a great year for the company and an infrastructure bill will be the icing on the cake.

Building a better America with help from the land of the rising sun

Scott Levine (Komatsu): No, you are not experiencing deja vu. The current discussion around the infrastructure bill probably sounds familiar, as it is a topic politicians on both sides of the aisle bring up frequently, whether during a campaign or when in office. Former President Donald Trump, for example, espoused enthusiasm for infrastructure spending early in his presidency. While Trump’s plans were unsuccessful, Biden’s recent success with the $ 1.9 trillion stimulus bill hints that another legislative victory may be possible.

This is perhaps one of the reasons why Komatsu occupies such an important position in the ETF Ark Autonomous Technology & Robotics. As of March 25, shares of the Japanese-headquartered construction equipment maker were the fund’s 10th largest stake, accounting for around 3.3%. If the infrastructure legislation gets to Biden’s office and receives his signature, Komatsu’s equipment will undoubtedly be in high demand. From excavators to bulldozers to dump trucks, Komatsu’s equipment will be an important part in the potential modernization of our bridges, highways and other infrastructure.

The second largest construction equipment manufacturer (behind Caterpillar) in terms of global sales, Komatsu has already seen demand for its equipment improve throughout 2020. While North American demand for its construction and mining equipment in the During the first two months of fiscal 2020, April May, had fallen by 34% each month compared to 2019, demand increased steadily over the following months. In November and December, for example, demand fell only 4% and 1%, respectively, year over year. (The company does not disaggregate data for the US market.) Management and shareholders undoubtedly pay special attention to improving market demand. In 2019, North America accounted for the largest market, 26%, of sales of construction, mining and utility equipment. For the context, the following two markets, Japan and Europe, respectively represented 14% and 10% of similar sales.

For investors who both want to follow Cathie Wood’s lead and intend to find an infrastructure-related stock, Komatsu stocks are in the trash. The stock is currently trading at 8.3 times cash flow from operations, down from its five-year average multiple of 11.9. Likewise, the title looks cheap in terms of price / sales ratio. Although Komatsu is trading at 1.5 times its sales – slightly above its five-year average ratio of 1.2 – it still looks cheap compared to the S&P 500’s P / S ratio of 2.8.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a premium Motley Fool consulting service. We are motley! Challenging an investment thesis – even one of our own – helps us all to think critically about investing and make decisions that help us become smarter, happier, and richer.

[ad_2]

Source link