[ad_1]

Short sellers posted returns of more than 9% of their bets against the flagship fund of investment management firm Cathie Wood in September, as the fund suffered its worst monthly outflows on record, the data showed.

S3 Partners, a financial analysis firm, said as of Oct. 5, short sellers had made $ 407 million in net mark-to-market profits year-to-date, a return of about 21%. Their $ 237 million profit last month was equivalent to a 9.2% return in September alone.

In total, investors withdrew $ 905 million from the Ark Innovation ETF (ARKK), which contributed to a 13% drop in assets under management, from $ 22 billion at the end of August to $ 19 billion at the end of September, according to data from TrackInsight.

The performance marks a significant departure from ARKK’s fortune in 2020, when it attracted net inflows of $ 9.56 billion and rewarded investors with returns of over 150%.

Net flows turned positive again in October and the fund has seen net inflows of around $ 5.7 billion since the start of the year, according to TrackInsight, but long-term investors have had to contend with a decline in the fund market price of 14% during the year. to October 4. This compares to a positive return of around 13% for the Invesco QQQ ETF, which tracks the Nasdaq 100.

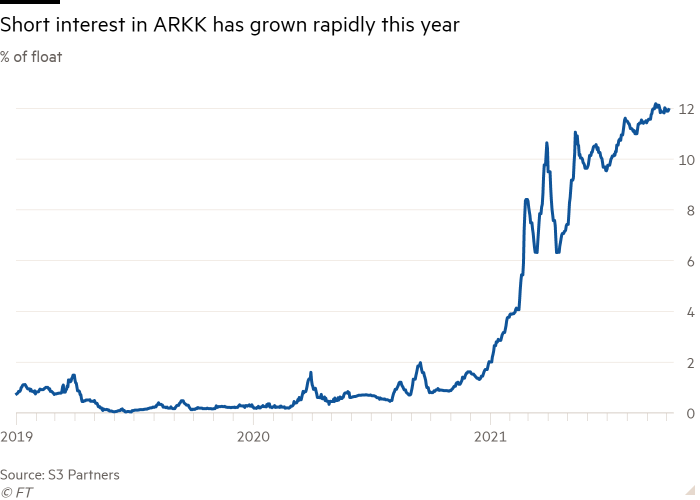

Industry participants expect tougher times to come. Data from S3 indicates that short-term interest in the ETF remains at record highs of around 12 percent.

“If this level of short-term interest persists, we are likely to see a dramatic increase in redemptions,” said Dan Izzo, Managing Director of ETF Market Maker GHCO.

Short sellers speculate that the price of a security is likely to fall and seek to profit from this by paying a fee to borrow stocks, sell them, and then buy them back at a reduced price before returning them. High short interest is a sign of pessimism among professional investors. If this then spreads to retail investors, short sales and redemptions are likely to be correlated, with a lag in time.

Some participants pointed to other signs of concern about Wood’s fund in the large gap between the average cost of borrowing components and the cost of borrowing the ETF itself.

IHS Markit, a data provider, said the average cost of borrowing for ARKK constituents was around 200 basis points, equivalent to $ 2 for every $ 100 of stock borrowed. However, ARKK units currently have annualized borrowing costs above 600 basis points.

“If the cost of borrowing an ETF temporarily increases, it is likely due to a short-term position taken by a market maker, for example, while a high long-term cost of borrowing relative to securities. Underlyings indicates that this is It is much more likely that investors are speculating on the fall in the price of the ETF, ”said Matt Brennan, head of investment management at AJ Bell, an online investment platform and a securities broker.

ARKK’s cost of borrowing has been at a consistently high premium over the average cost of borrowing for its constituents since May.

“Such a gap is extremely rare,” said Vincent Mortier, deputy director of investments at Amundi Asset Management. “What this tells you is that there is real short-term interest in this ETF.

Elisabeth Kashner, director of global fund analysis at data provider FactSet, expressed a similar view: “The most obvious interpretation of short-term interest is that people are betting against Cathie Wood. . . ARKK’s cost of borrowing is subject to the same market forces as anything else.

Ark Invest did not respond to requests for comment. However, in August, when news broke that Michael Burry, made famous in the film The big court, had made substantial bets against ARKK, Wood took on twitter to defend his strategy by saying that he did not understand the “innovation space”.

Despite Wood’s conviction, investor ardor has cooled since the start of the year. “The magnitude of short positions [here] shows that people think the ETF is too expensive, ”said Izzo.

Interested in ETFs?

Visit our ETF Hub for investor insights and insights, market updates and analysis, and easy-to-use tools to help you select the right ETFs.

[ad_2]

Source link