[ad_1]

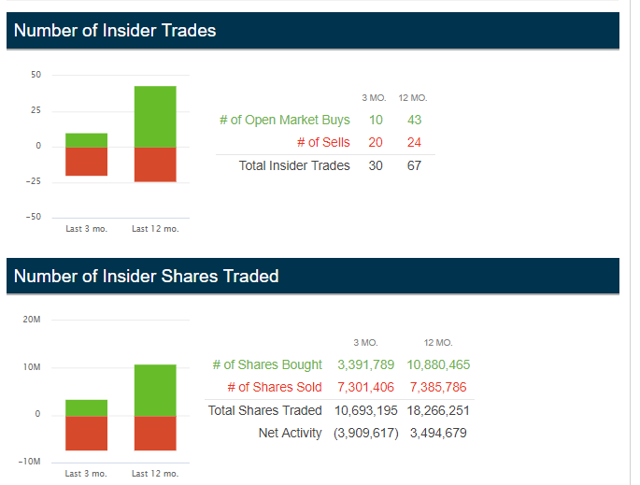

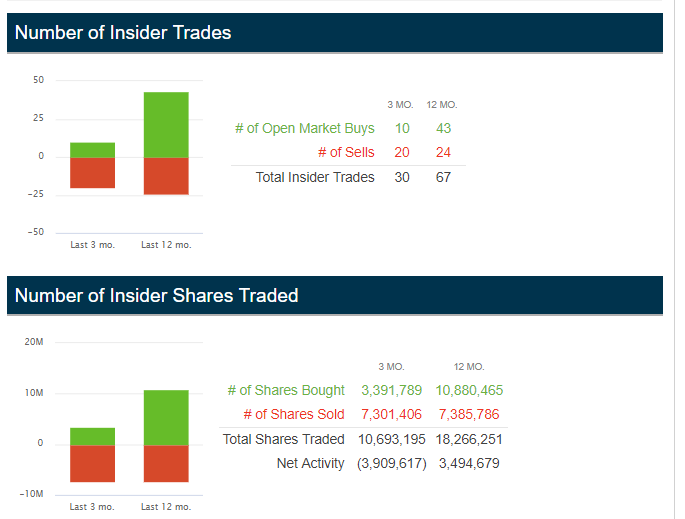

Many are made up of purchases and sales of insiders and major shareholders. Sometimes these purchases and sales do not give a complete picture. In the case of Chesapeake Energy (CHK), the company recently merged with WildHorse Resource Development (WRD).

Some new large shareholders may have portfolio rebalancing and tax considerations as a result of the merger. As a result, sales do not give a complete picture of the situation. Plus shares acquired as part of a merger are not part of the records normally required of insiders.

Unless there is a definitive announcement, an exit strategy may take some time before it will manifest itself through periodic sales of shares. First sales may or may not represent the beginning of an exit strategy. The main ongoing activity of shareholders and insiders deserves to be monitored. However, this activity (even an apparent exit strategy) may not represent a bearish statement on the title. Instead, it may simply mean that the major shareholder wants to go ahead or has other obligations to adhere to.

Source: NASDAQ website, April 6, 2019

Sometimes the alarm sounds the minute later and the major purchases of major shareholders. When reviewing these sales, it should be noted that the number of shares initially allocated to NGP Energy Capital Management has increased significantly. In addition, while NGP Energy Capital Management represents by far the largest share of equity sales in the last quarter, it still retains more than 300 million shares. This number of shares should reassure shareholders that this major shareholder has a significant stake in the company and encourages him to put pressure on the company to achieve good results in the future.

Similarly, insiders bought shares as part of their various incentive programs. The sales above are most likely to cover taxes and other high priority items. Clearly, insiders become larger shareholders. The current sales group seems rather routine given the merger with WildHorse Resource Development and previous purchases in the unopened market. Nothing in the aforementioned activity would constitute a vote of censure for the future of this company.

Financial optimism

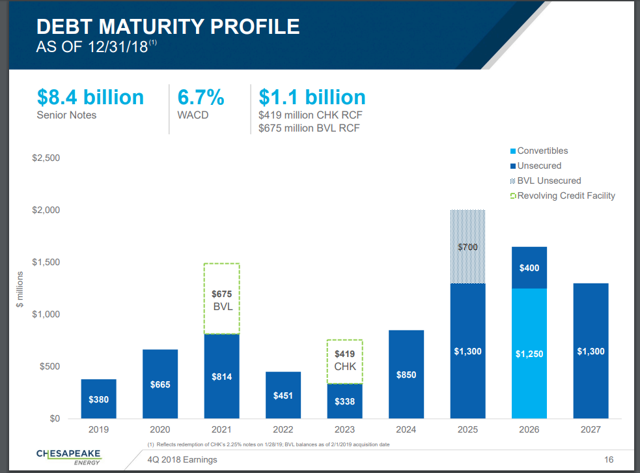

For the first time in a long time, Chesapeake Energy has a way out of the debt stranglehold that threatens the future of society.

Source: Chesapeake Energy, fourth quarter 2018, presentation of revenue slide show

Management has significantly reduced its debt through the sale of Utica shale leases and related production. But much of this debt reduction will come back in the first quarter, as the debt resulting from the WildHorse Resource Development acquisition is assimilated. The slide above already shows the WildHorse Resource Development Senior Notes and the revolving credit facility. The acquisition offer also included a cash portion that required financing. The total debt contracted will probably be "in the same proportions" as the debt eliminated by the product of Utica shale.

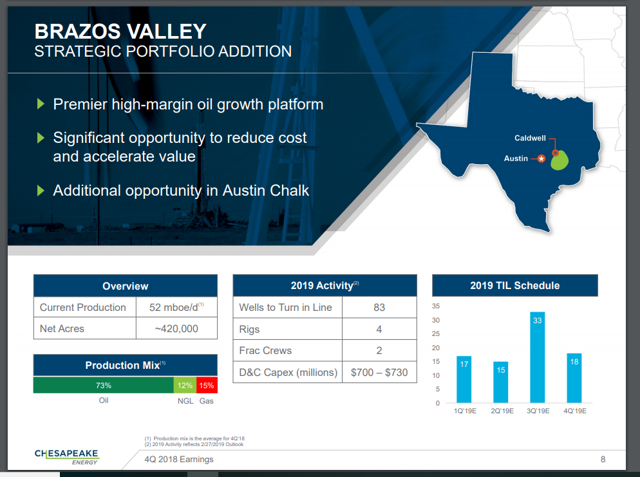

The big change is that most of the gas production sold has been replaced by much of Eagle Ford's oil production. The economic aspects related to the acquisitions seemed very interesting, as well as a quick payback period. A fast payback period is usually a quick generation of cash flow. Chesapeake Energy has needed a lot more cash for some time. This acquisition could be the key to a faster increase in cash flow.

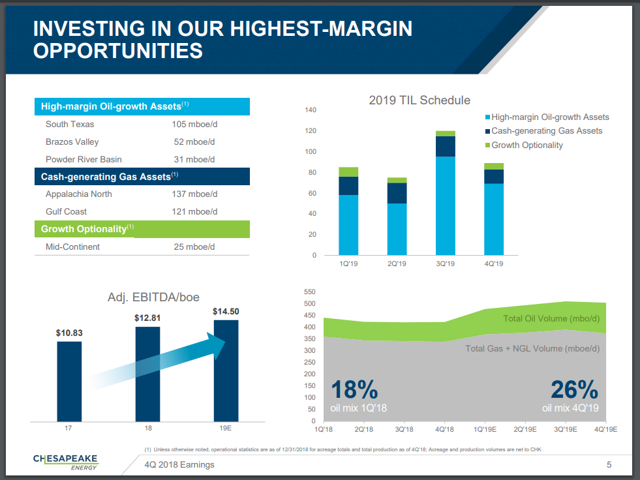

Mix of production products

The acquisition was also intended to re-launch the process of moving from a predominantly gas-based production mix to a more valuable liquid-based production mix. Again, the goal was to increase profitability and cash flow.

Source: Chesapeake Energy, fourth quarter 2018, presentation of revenue slide show

The mere fact of selling Utica's shale assets while retaining the portion of the portfolio containing a large amount of liquids had already increased the percentage of oil produced. A second boost took place during the current fiscal year, when Brazos Valley's assets were acquired.

Chesapeake Energy was already familiar with these assets because it has a history of operating in Eagle Ford. The acquisition may not be considered strictly "complementary", although the asset is sufficiently close to the other assets of Chesapeake so that management can calculate some synergies as well as some improvements to what the management of WildHorse Resource Development was doing already.

As a result, the transition to more oil has resulted in an immediate cash flow boost, as oil and associated liquids generally have more value and profitability than natural gas. Better still, Chesapeake paid most of the acquisition using common shares of the company. As a result, the acquisition should be accretive and also reduce some key debt ratios immediately.

Meanwhile, the company has platforms located mainly on liquids-rich properties. This transition in recent years has focused on increasing the profitability and cash flow of businesses. The Eagle Ford Basin oil platform can be very profitable with very fast payback times. The latest boost in oil prices would only strengthen these benefits.

Eagle Ford Benefits

The Eagle Ford has often taken less importance than the Permian Basin, much more public. But the Eagle Ford does not have any problems to take away at the moment. In addition, the Eagle Ford is not subject to the widespread reduction in the price of the Permian. All these contrary Permian winds reduce the higher costs that characterize the Permian operators.

The result is that Chesapeake Energy can increase Eagle Ford production as quickly or as slowly as management wants and benefit from better prices than Permian producers.

Meanwhile, periodic improvements to the operation and design of the wells that sweep the industry will only continue to reduce operating costs and the payback period. Long-term profitability is expected to increase. This acquisition might seem very economical in a few years, as improvements in the industry continue.

L & # 39; s future

Chesapeake's new energy will probably still have about $ 10 billion in long-term debt at the end of the first quarter. This will certainly be higher than in the fourth quarter of 2018. However, management now has a way to quickly increase its cash flow. The rise in oil prices should amplify this progress and give this company the opportunity to free itself of its debt or to increase its oil production more quickly.

There will likely still be a sale of some gas assets to pay off debt faster if management can get the desired price for these assets. The latest merger gives the company more financial resources to withstand the write-offs that typically accompany Chesapeake sales.

An investment grade rating for the company now seems likely in the next three years as long as oil prices do not resist a catastrophic collapse. A year or two of high oil prices would go a long way toward restoring the financial health of this company.

Source: Seeking Alpha Website, April 7, 2019

The stock has been rising since the price hit its lowest in late December. This gathering should continue. The enterprise value of the company is about $ 16 billion (taking into account the debt contracted at the time of the merger). This is probably just over five times the projected cash flow for the year.

The finances are still a bit speculative. Cash flow should barely fall within the reasonably accepted loan standards this year. If cash flow exceeded this target, this stock could skyrocket, becoming a cherished market. The market likes business stories that come back from their death. The management of Chesapeake Energy has this type of story for this exercise.

If oil prices fall unexpectedly, management now has the necessary financing to withstand a decline. As oil prices rise, expect this stock to be a dealer's paradise. A doubling of current prices over the next year would be a reasonable assumption. This market, however, tends to pack with a good story. The stock chartists could have a considerable advantage over the fundamentalists with this common stock. Meanwhile, rising oil prices provide a minimal downside risk.

Warning: I am not an investment advisor, and this article is not meant to be a recommendation to buy or sell shares. Investors are advised to consult all documents and press releases of the company to determine whether it meets their own investment criteria.

I'm analyzing oil and gas companies such as Chesapeake Energy and related companies belonging to my service, Oil & Gas Value Research, where I'm looking for undervalued names in the oil and gas sector. I break everything you need to know about these companies: balance sheet, competitive position and development prospects. This article is an example of what I do. But for members of Oil & Gas Value Research, they get it first and they get analysis on companies that are not published on the free website. Interested? Sign up here for a free two-week trial.

Disclosure: I am / we have been CHK for a long time. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: I can buy more or sell CHK according to market conditions

[ad_2]

Source link