[ad_1]

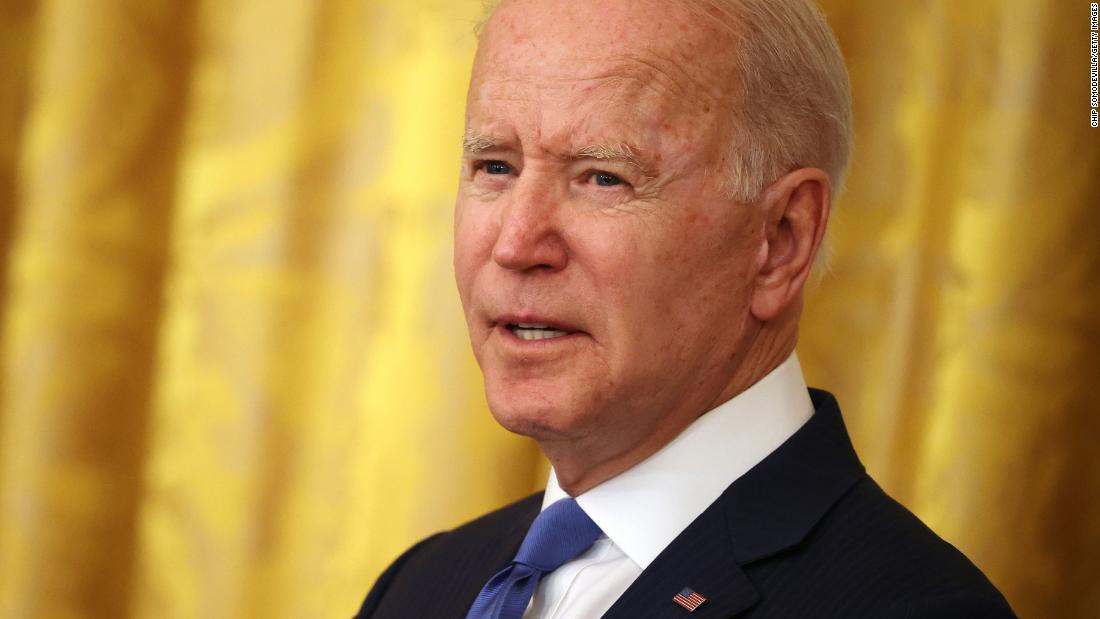

“It can allow a hard-working parent to say to their child, ‘Honey, we understand, you can get your new braces now. We can find you a tutor to help you in the math class that you are having problems with. with. We can provide you with the sports equipment you need to sign up for your first team that you will play with, ”Biden said from the White House.

“For each child under the age of 6, a parent will receive $ 3,600 per year. For each child aged 6 to 17, he will receive $ 3,000 per year. For example, a middle-class family with two young children should expect to receive $ 7,200 per year. year to help raise their children, ”Biden said.

Biden continued, “They’ll get the first half of that $ 3,600 starting today. Today. Today. And he’ll be paid $ 600 a month by July and December. And then they will receive the remainder of the payment next spring, around tax day. “

Starting Thursday, according to the White House, American families should expect to receive payments on the 15th of each month – providing them with additional funds – until the end of 2021, with tax relief upon production of their statements next year. The vast majority of families – around 39 million households, covering 88% of the children – will automatically get the credit because they filed 2019 or 2020 returns claiming the credit. Families filing electronically should see payments on their accounts Thursday that say “CHILD CTC”, while families filing by mail should expect checks in “several days,” according to the administration.

The White House predicts the payments will be “transformative” for families, resulting in “the biggest one-year drop in child poverty in US history,” the official said.

In his remarks highlighting the credit on Thursday, Biden “will highlight the adjustments that have been made to the CLC so that families who need help the most get the full amount of this tax cut, as well as the return on investment. that it provides to our nation. children. “

“For the first time in our country’s history, working American families are receiving monthly tax breaks to help pay for essentials like doctor’s visits, school supplies and groceries,” the secretary said. to Treasury Janet Yellen in a statement Wednesday evening. “This major tax break for the middle class and this step in reducing child poverty is a remarkable economic victory for America – and also a moral victory.”

The full enhanced credit will be available to heads of households earning $ 112,500 and joint filers earning up to $ 150,000 per year, after which it will begin to disappear.

For many families, the credit then tops out at $ 2,000 per child and begins to wane for single parents earning over $ 200,000 or married couples with incomes over $ 400,000.

The president will also use part of his remarks on Thursday to “stress the importance of adopting the U.S. plan for families as part of his comprehensive Build Back Better program to ensure this tax cut continues for families. workers for years to come, ”the official said. CNN Wednesday.

This is a breaking story and will be updated.

[ad_2]

Source link