[ad_1]

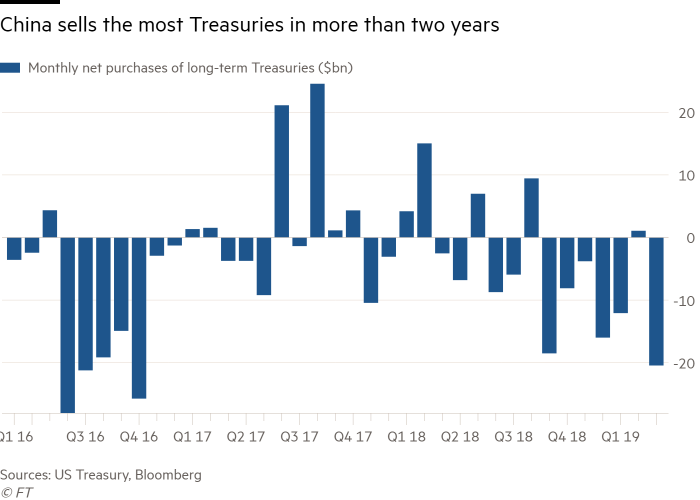

In March, China sold the largest number of Treasury securities in more than two years in March, fearing that the country will position itself as the main foreign creditor of the US government in the ongoing trade dispute between the two countries.

China sold $ 20.5 billion worth of US government bonds during the month, according to data released Wednesday by the US Treasury. The data cover transactions on Treasury bonds maturing in excess of one year by foreign official institutions such as central banks and private investors. The other major foreign holders, notably Japan and the United Kingdom, were also net sellers.

Analysts noted that the period covered by the data was prior to the last break in trade negotiations between the United States and China and the subsequent increase in tariffs on Chinese imports by the government. Trump.

With the exception of a small net purchase last month, China now sells Treasury securities every month since September. In the United States, there are fears that China will increase its sales of treasury securities by trying to disrupt the market and put upward pressure on US interest rates, which will increase the costs of debt. 39, loan from the US government.

"In almost every meeting with my clients, I am asked if this tool will be used," said Torsten Slok, chief economist at Deutsche Bank. "The very size of [China’s] reservations and that even becomes a topic of conversation means that the market should take it seriously. "

On Monday, Chinese officials announced that they would increase tariffs on an additional $ 60 billion worth of US goods, following a sharp escalation of the trade war triggered by President Donald Trump.

Last Friday, Trump's administration increased tariffs on Chinese imports by $ 200 billion to 25 percent after US and Chinese negotiators failed to reach agreement on future trade relations between the two countries. The White House has since decided to levy additional rights on an additional $ 300 billion of Chinese imports in response to the latest reprisals from Beijing.

But several investors and analysts have rejected the threat that China would resort to such drastic measures to sell its assets to the US Treasury.

China is the largest foreign holder of Treasury securities, with a total of $ 1.12 billion, which means that any increase in returns it could generate would also result in losses on its own portfolio.

The size of the Chinese Treasury's assets testifies to the trade imbalance with the United States. One of the reasons why China buys Treasury securities is the money it exports to the United States. According to analysts, China usually sells Treasury securities when it needs to support its own currency, selling dollars.

"This will be a long-term phenomenon in which they will need to support their currency and ease their financial conditions," said Andrew Brenner, head of international fixed income at National Alliance Securities.

March's sales stood out in part because the currency remained stable against the dollar throughout the month. In addition, sales had little effect on the performance of 10-year US Treasury yields on US interest rates, which fell 31 basis points to 2.41%.

"Normally, the answer to this situation is very similar – it's the exchange rate," Slok said. "This time, the number is more surprising. There are many open questions.

[ad_2]

Source link