[ad_1]

(Bloomberg) – Tencent Holdings Ltd. was ordered to relinquish exclusive music streaming rights and pay half a million yuan in fines, becoming the latest Chinese internet giant to be brought under control by regulators.

An official investigation revealed that Tencent’s 2016 acquisition of China Music Corp. violated the regulations in part because of a lack of reporting to authorities, according to a statement released Saturday by the antitrust watchdog. The State Administration for Market Regulation demanded that Tencent and its subsidiaries relinquish exclusive music rights within 30 days and imposed a fine of 500,000 yuan ($ 77,145).

This agreement helped create Tencent Music Entertainment Group, which was formed after the merger of QQ Music and China Music Corp.

The government agency also called on social media and gaming giant Pony Ma and its affiliates to stop demanding music copyright holders to give it better treatment than its competitors through practices such as making high advance payments. Companies must submit their remediation plans within 10 days to the watchdog and continue to report on their implementation of changes annually for the next three years.

Tencent will establish rectification plans with its affiliates, including Tencent Music Entertainment, within the allotted time frame and “faithfully” execute the SAMR order to ensure all requirements are met, the company said in a statement on his official WeChat account.

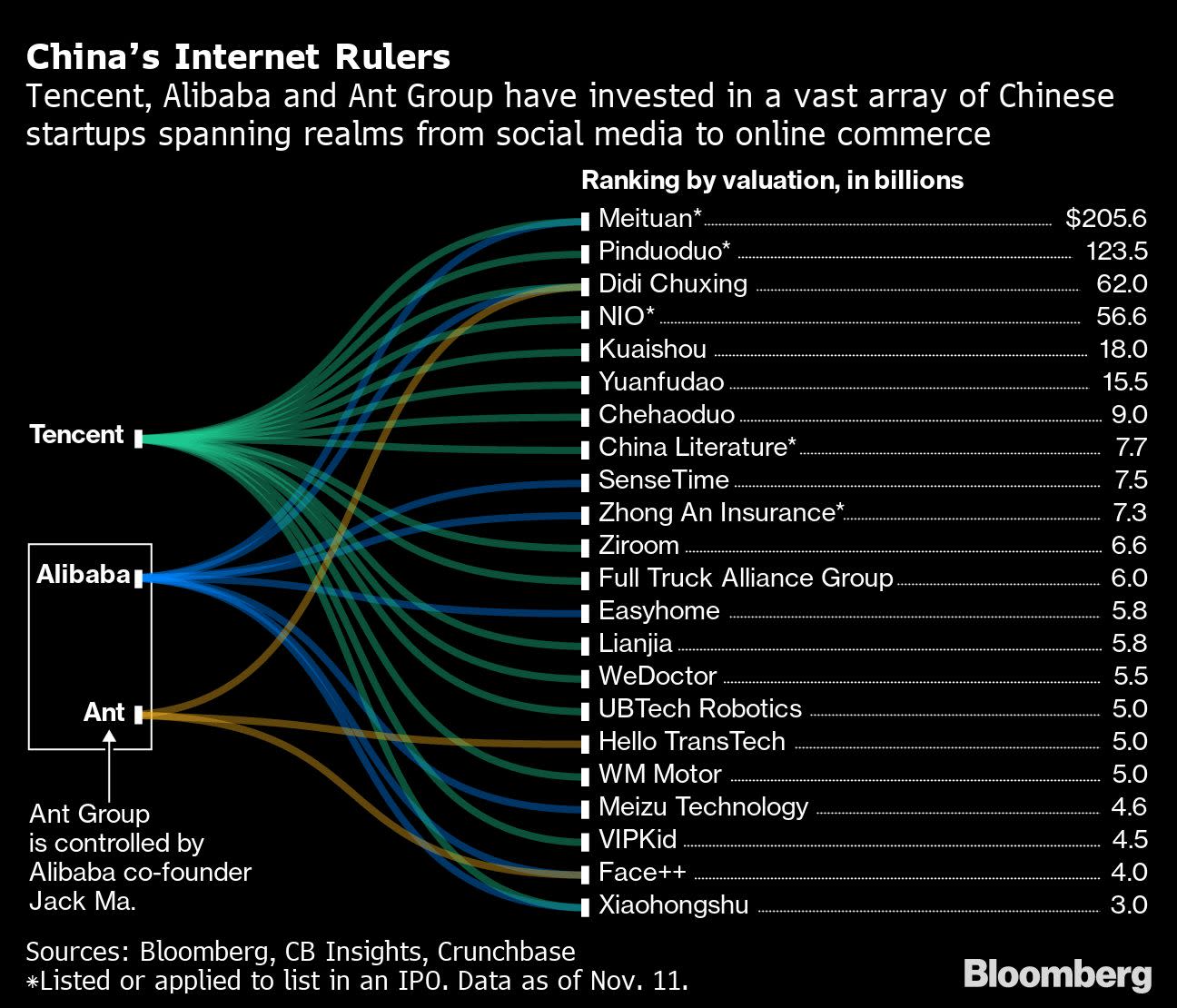

The penalty imposed on Tencent marks the most direct blow to Asia’s most valuable company from Beijing’s growing campaign against its tech giants. Another internet giant, Alibaba Group Holding Ltd., was fined a record $ 2.8 billion in April for antitrust violations, while its subsidiary Ant Group Co. had to drop a public offering. initial and restructure into a financial holding company. Tencent-backed companies have also come under scrutiny: Food delivery leader Meituan faces an anti-monopoly investigation while Didi Global Inc., operator of the country’s largest ridesharing service, faces an anti-monopoly investigation. was ordered this month to leave Chinese app stores by cyberspace regulators.

Beijing has sought to reduce the growing influence of powerful Chinese internet companies on all aspects of Chinese life, from online shopping to chatting and carpools. This campaign is now spreading to the realm of data security, with President Xi Jinping’s government exploring a number of models and actions to open up its information stores. Separately, financial regulators are planning rule changes that would allow them to prevent a Chinese company from listing overseas even if the stock selling unit is incorporated outside of China, people said. close to the file.

In response, the tech giants have pledged to comply with regulations and refrain from anti-competitive behavior, while dramatically increasing spending to drive growth. Tencent said in May that it would spend more of its extra profits this year on cloud services, games and video content, joining Alibaba and Meituan in telegraphing sharp increases in investment. The Shenzhen-based company also unveiled plans to invest 50 billion yuan in its so-called social values initiative to fund philanthropic efforts in areas such as education, rural revitalization, and carbon neutrality that are taking place. firmly align with Xi’s priorities.

Chinese antitrust authorities had previously investigated Tencent’s dealings with the world’s three biggest record companies, but the investigation has been suspended, people familiar with the matter said in February. Tencent Music has noticed tighter antitrust controls and has cooperated with regulators, executives said in May.

Tencent Music has long held a prominent place in Chinese music thanks to exclusive rights to many of the catalogs of Universal Music Group, Sony Music Entertainment and Warner Music Group Corp., which it then sublicenses to platforms. smaller forms, including those operated by NetEase Inc., Alibaba, and Xiaomi Corp. This dominance was weakened when NetEase struck deals to directly license songs from Universal and Sony.

In the past seven months, the watchdog has already imposed token fines – amounting to at least 4.5 million yuan, excluding penalties for subsidiaries – on the company for failing to apply for the approval of a number of past investments and acquisitions.

The company, co-founded by China’s second-richest person over twenty years ago, has previously been accused by rivals including TikTok owner ByteDance Ltd. of alleged monopolies by blocking their content on its super WeChat app, the chat and payment service used by over a billion people. In February, ByteDance filed a lawsuit accusing the largest company of violating antitrust laws by blocking content from Douyin, the Chinese twin of its globally popular short app, on WeChat and QQ.

Tencent’s fast-growing fintech companies are also given a separate review. Leading Chinese financial regulators believe Tencent deserves increased scrutiny following the crackdown on Ant, people with knowledge of their thinking told Bloomberg in March. The company was one of 13 companies that were ordered in late April by watchdogs, including the central bank and the banking regulator, to restrict their financial operations, placing many restrictions already imposed on Ant.

Executives sought to allay investor concerns, saying Tencent remains very focused on risk management and has “limited” itself to the size of its financial products for non-payment.

“When we look at the internal review, and when we look at what other things need to be done to make sure we’re in line with the minds of the regulators, it’s actually relatively manageable,” President Martin Lau said during the company’s first quarter earnings conference call.

More stories like this are available at bloomberg.com

Subscribe now to stay ahead of the game with the most trusted source of business information.

© 2021 Bloomberg LP

[ad_2]

Source link