[ad_1]

China’s V-shaped economic rebound after the Covid-19 pandemic is slowing, sending a warning to the rest of the world about the sustainability of their own recoveries.

The changing outlook was highlighted on Friday when the People’s Bank of China reduce the amount of cash that most banks must hold in reserve in order to stimulate lending. While the PBOC said the move was not a stimulus stimulus, the magnitude of the 50 basis point reduction in the reserve requirement ratio of most banks came as a surprise.

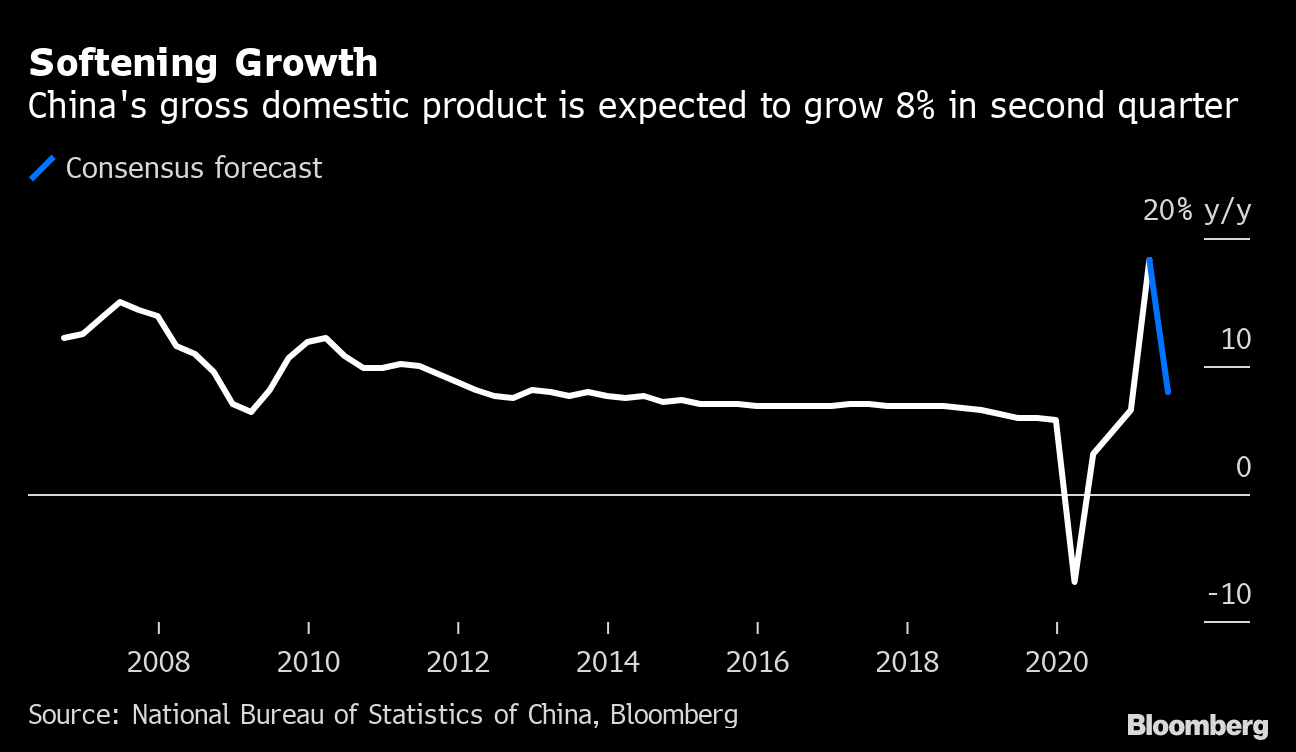

Data on Thursday is expected to show growth slowed in the second quarter to 8% from the record-breaking 18.3% gain in the first quarter, according to a Bloomberg poll of economists. Key figures for retail sales, industrial production and capital investment are also expected to moderate.

The PBOC’s swift move to lower banks’ RRRs is one way to ensure the recovery stabilizes from here, rather than stumbles.

Softening growth

China’s gross domestic product expected to grow 8% in second quarter

Source: National Bureau of Statistics of China, Bloomberg

The economy has always been expected to come down from the highs it reached in its initial rebound and last year’s weak base effect to wear off. But economists say the softening came sooner than expected and could now reverberate around the world.

“There is no doubt that the impact of a Chinese slowdown on the world economy will be greater than it was five years ago,” said Rob Subbaraman, head of research on Global markets at Nomura Holdings Inc. the release status of Covid-19 could also influence market expectations that if the Chinese economy cools now, others will soon follow. “

The slowing recovery also reinforces the view that factory inflation has probably peaked and commodity prices could moderate further.

“China’s slowing growth is expected to lead to short-term disinflationary pressures globally, especially on demand for industrial metals and capital goods,” said Wei Yao, chief economist for Asia. Pacific at Societe Generale SA.

The changing outlook reflects the advanced stage of recovery in China as growth stabilizes, according to Bloomberg Economics.

What Bloomberg Economics Says …

“Looking through the data distortions, the recovery matures, it doesn’t stumble. Activity and trade data for June will likely paint a similar picture – slower expansion, but still solid. “

– The team of economists from Asia

For the full report, Click here.

Nationally, the big puzzle continues to be why retail sales are still low given the virus remains under control. Sales are likely to slow again in June, according to Bloomberg Economics, as sentiment was weighed by controls aimed at containing sporadic outbreaks of the virus.

Even with the PBOC’s support for small and medium-sized enterprises, there is no sign of a general reversal of the disciplined stimulus approach taken by authorities since the onset of the crisis.

The RRR cut was in part aimed at “managing expectations” ahead of economic data in the second quarter of this week, said Bruce Pang, head of macro and strategic research at China Renaissance Securities Hong Kong.

“It also offers more room for maneuver for the future, as the momentum of the economic recovery has surely slowed down.”

– With the help of Enda Curran, Yujing Liu and Bihan Chen

[ad_2]

Source link