[ad_1]

National Development and Reform Commission (NDRC) revealed its intention to immediately eliminate the mining bitcoin and crypto sector in its guidelines for the adjustments of the industrial structure published on April 1.

The list of sectors that will be encouraged, restricted and eliminated will be the subject of a public consultation period until May 7, according to the SCMP report, and as such, the mining facilities in China will likely be able to function in the next two or three months.

If, after the public consultation phase, the NDRC and the Chinese government followed up on the current closure of the bitcoin extraction and crypto-extraction sector, this would mean the end of the area of interest. most dominant bitcoin extraction.

Why it could be good for Bitcoin and Crypto

The possible imposition of a ban on cryptographic mining could lead to the decentralization of mining into the global mining market and encourage miners based in China to settle in foreign countries.

"The exploitation of bitcoins will no longer be dominated by China, but decentralized," Michael Zhong, an analyst with the Beijing-based cryptocurrency research firm, told SCMP, underlining that Chinese miners in Yunnan and Sichuan should go.

For many years, the major mining groups based in China, such as BTC.com and Antpool, some of which are operated by Bitmain, dominated the hash power of the Bitcoin network.

As a Validation Validation Chain (PoW) protocol, the Bitcoin network needs the computing power needed to verify transactions and broadcast data to the Bitcoin blockchain network.

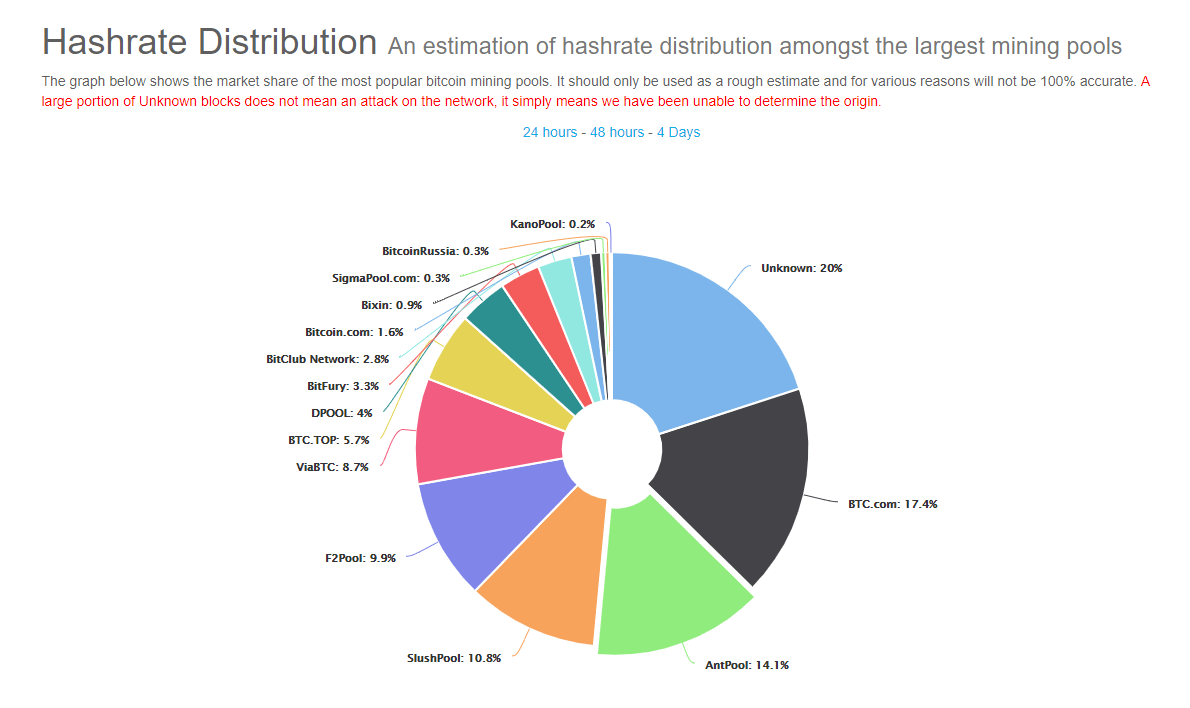

As of April 9, BTC.com and Antpool alone hold more than 31.5% of the Bitcoin network's hash power, which are both subsidiaries of Bitmain.

Bitcoin network hash power distribution (source, blockchain.com)

However, it is difficult to determine exactly what percentage of the Bitcoin hash power comes from China, as the pools represent a large group of miners, possibly spread around the world.

Therefore, even though groups like Antpool and BTC.com mainly based in China hold a significant share of the Bitcoin hashing rate market, it is premature to state conclusively that 31.5% of the hash power Bitcoin comes from China.

In addition, most mining companies, including Bitmain, have offices outside of Beijing and, if forced to leave China, would likely be able to continue their operations in foreign markets.

In addition to the top three pools, SlushPool, BitFury and many others are all based outside of China.

Mati Greenspan, Senior Market Analyst at eToro, also noted that China's possible ban on crypto-mining could have a positive impact on the bitcoin price trend.

he m said:

If this ban eventually occurs, it is more likely that BTC prices will rise and lower prices. The loss of cheap Chinese electricity would increase the costs of extraction, which is a net positive price. This would also serve to kill the FUD that bitcoin mining is centralized.

Why is China adopting this approach?

Kenetic Chief Executive Jehan Chu said that, just as China has been able to control what is known as China's big firewall, the government will probably want to "restart" the security sector. cryptocurrency as he sees fit.

Chu said:

"NDRC's action is broadly in line with China's desire to control different layers of the rapidly growing cryptography industry and does not mean a major policy change yet. I think that China simply wants to "restart" the crypto industry into an entity that it monitors, the same approach that it had adopted with the Internet. "

It remains to be seen whether China plans to offer a tightly regulated cryptocurrency market in the future, or whether its priority is simply to ban all sectors related to the asset class.

[ad_2]

Source link