[ad_1]

Samsung

A global deceleration in laptop sales is linked in a new report from market research firm Trendforce to rising vaccination rates and a corresponding decrease in remote work and distance learning. According to the results, demand for Chromebooks has fallen by more than 50% in a month since July. And laptop shipments for the rest of the year are expected to be affected by the COVID-19 pandemic and changing business demand.

Trendforce said interest in ChromeOS laptops over the past year has been driven primarily by distance learning. The analyst pointed to the increase in vaccination rates in North America, Europe and Japan during the second half of 2021, which recently slowed demand for Chromebooks.

After being a “primary driver” of overall laptop shipments in the first half of 2021, Chromebook shipments fell more than 50% for a month in the second half of the year. And because Chromebooks represent a “relatively high share” of HP and Samsung’s overall notebook shipments, OEM shipments are expected to fall 10-20% from the first half to the second half.

Still, all is not going downhill for Chromebooks: Trendforce still expects a total of 36 million devices shipped in 2021.

“The US FCC launched the Emergency Connectivity Fund, totaling $ 7.17 billion, in July to facilitate the purchase of equipment such as laptops, tablets and mobile devices. network connectivity through schools and libraries, ”Trendforce said. “This fund will likely support demand for Chromebooks for the next year.”

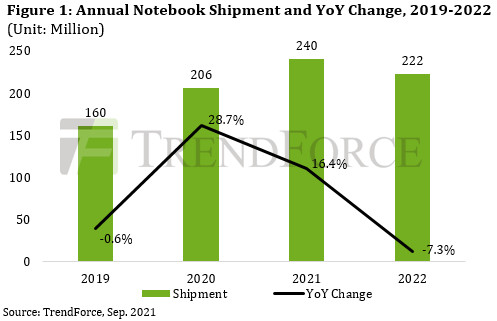

Laptop shipments are expected to reach 240 million this year.

Overall, Trendforce believes laptop shipments will see a 16.4% year-over-year increase in 2021 to a total of 240 million systems.

Q4 in question

At best, fourth quarter shipments will be comparable to third quarter numbers, Trendforce predicted. But one downside of the Q4 over the T3 is that the latter’s numbers were helped by laptop brands that rushed to ship Q4 shipments earlier in order to avoid port traffic. The return of workers to offices in North America and Europe is fueling demand, but the researcher is uncertain whether the trend for commercial laptops will be as strong in the fourth quarter as it is in the third.

If business demand continues to rise, Dell should be satisfied because it sees a higher market share from its commercial laptops than “any other brand,” according to Trendforce. The research company expects Dell’s commercial laptop shipments to increase 20% from the first half of the year to the second half.

Q4 laptop shipments are also expected to be boosted by upgrading people to take advantage of things like next-gen processors from Intel or Windows 11, which debuts next week (although, remember you don’t need to buy a new PC to upgrade to Windows 11). However, the final figures will also be affected by the world’s situation with the COVID-19 pandemic.

All the while, the laptop supply chain is still bogged down with a limited stock of components, including ICs for Wi-Fi modules, USB Type-C power supply, and power management. In addition, 14 and 15.6 inch displays using IPS panels and 1920 × 1080 resolution are also limited. The good news is that lower resolution TN panels in these sizes are starting to meet demand, while 11.6-inch panels are getting cheaper. Trendforce predicted that supply and demand for laptop panels would “break even” in the fourth quarter.

By 2022, vaccinations are expected to be even more widespread, and Trendforce estimates laptop shipments will decline 7-8%, year over year, to around 220 million units. Even though this trendline is pointing down, note that it is still an improvement over the 160 million units shipped in 2019 before the pandemic.

[ad_2]

Source link