[ad_1]

A healthy IT spending environment and strong demand for newer hardware and software offerings helped Cisco Systems (CSCO – Get Report) once again meet Wall Street's expectations.

After Wednesday's bell, Cisco announced revenue of $ 12.96 billion for the April quarter (fiscal third quarter) and non-GAAP EPS of $ 0.78, exceeding analysts' estimates consensus of 12.89 billion USD and 0.77 USD. The business figure has officially increased by 4% per year, up 6%, excluding revenue from the business of video provider software (Cisco) service providers (Cisco ), which was sold last October. EPS, which benefited from significant share repurchases, increased by 18%.

For the July quarter, Cisco expects revenue growth of 4.5% to 6.5%, excluding last year's SP video revenue (though recent acquisitions), as well as EPS of US $ 0.80 to US $ 0.82. This compares with a consensus estimate of a 3.4% official business growth, 5.1% growth excluding SP video sales and a BPA $ 0.81.

Cisco shares rose 2.8% to $ 53.88 after trading hours, and are now up 24% year-over-year. Here are some points to remember from his report on the results and his call.

1. Equipment sales were better than expected

Revenue from Cisco's infrastructure platforms, covering the company's key switching and routing product lines, as well as products such as servers and Wi-Fi systems, grew by 5% per year. year to reach $ 7.55 billion against a consensus of $ 7.46 billion.

CFO Kelly Kramer said of financial results that switch sales were strong, Cisco's Catalyst 9000 line is leading to a healthy upgrade cycle for its campus switch (office) business. It added that Cisco's wireless business (hardware and Wi-Fi software) had experienced "strong growth" and that its routing and "data center" activities (servers and storage) were growing.

Cisco Systems is a stake in Jim Cramer Action Alerts PLUS club member. Would you like to be alerted before Jim Cramer buys or sells CSCO? Learn more now

2. Orders from companies and governments remained strong, while carrier orders weakened

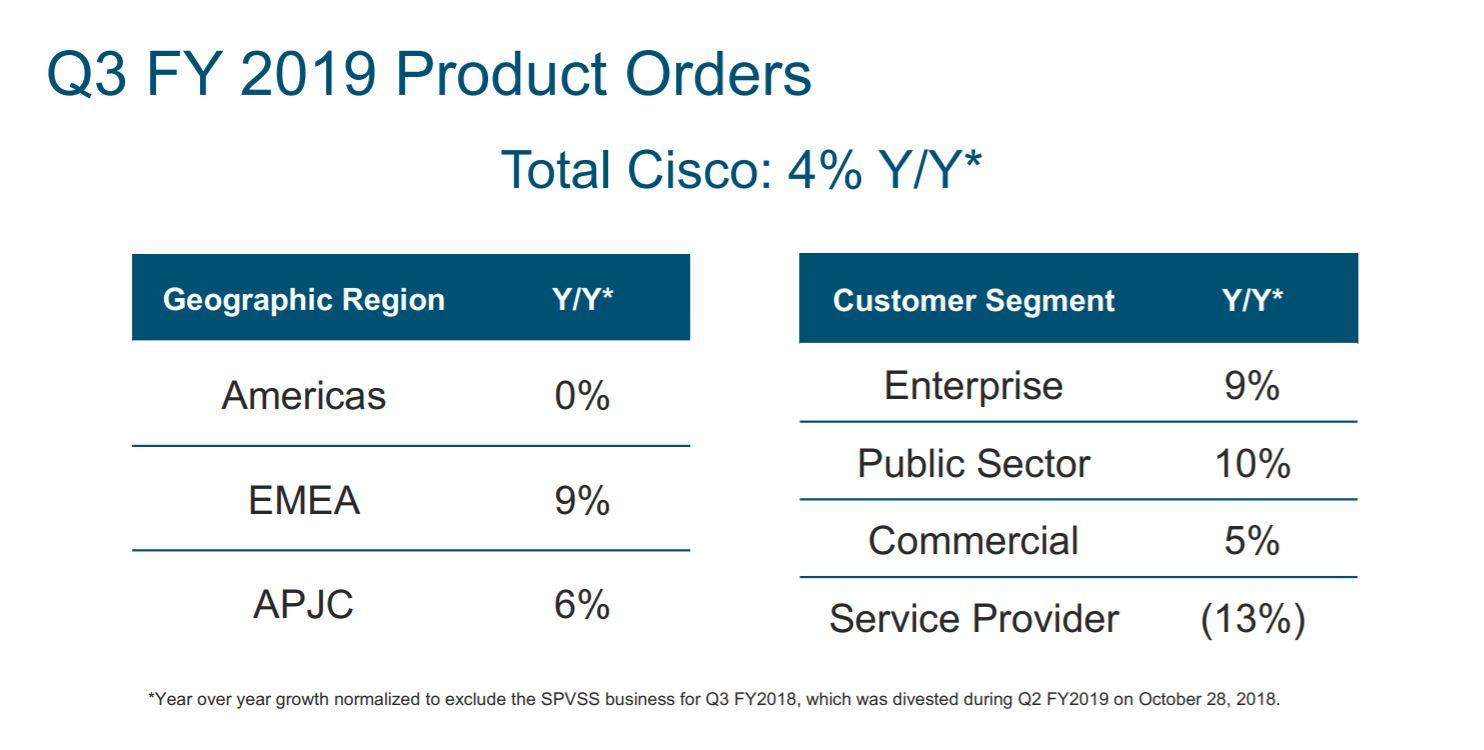

After an 8% annual increase in the October and January quarters, Cisco product orders grew 4% in the January quarter. Orders from businesses and the public sector increased by 9% and 10%, respectively, and "commercial" orders (small and medium-sized enterprises) increased by 5%. However, orders from service providers dropped 13%, after only 1% in January.

Asked about the weakness of service providers during the call, CEO Chuck Robbins said that service provider orders were traditionally very bulky and that they were tied to a limited number of large customers, and that low expenses in capital expenditures by carriers in the Americas weighed on demand. Later, when he was asked about the impact of the 5G on Cisco, he said the operators were focusing for the moment on "tuning the macro-radio of their networks" and that the investments in the core networks (which Cisco could benefit from) would be realized later as the 5G traffic grew.

Cisco Product Order Trends for the April quarter. Source: Cisco.

The Juniper Networks routing archiver (JNPR – Get Report) also finds low demand from operators. Juniper service provider revenues, which rely heavily on sales to US telecom operators, dropped 9% in the first quarter, and the service provider forecasts for the company's service providers would remain weak in the second quarter.

3. Security sales were still strong

Cisco's security product revenue increased 21 percent to $ 707 million, surpassing a consensus of $ 676 million. The acquisition of the authentication software publisher and service providers Duo Security last summer helped, but it seems that organic growth is also healthy.

During the call, Kramer called the security force the quarter a "very broad base," covering Cisco's network security offerings, advanced threat protection and cloud security. Many counterparts in computer security also reported good numbers.

4. Revenues from "applications" continue to grow, but at a more moderate pace

The Cisco Applications segment achieved a 1.43 billion dollar business turnover, up 9% but below a consensus of 1.5 billion USD. In part, on the one-year anniversary of the BroadSoft cloud communications software vendor, a $ 1.9 billion cloud computing software vendor, growth slowed report in January of 24%.

Kramer noted that 65 percent of Cisco-generated software products, whether they come from the apps industry or elsewhere, now come from subscriptions, up from 56 percent a year ago. Robbins said that the Cisco AppDynamics application performance monitoring software (acquired in 2017) was showing another quarter of strong growth, and when asked how the company is doing in the face of growing competition from Zoom Video Communications (ZM), a fast-growing business: insisted that the Webex conferencing software unit "continues to grow very robustly".

5. Cisco perceives "very minimal impact" in recent rate increases

In response to a question about the impact of the recent Trump administration's decision to increase customs duties on Chinese imports by 10 percent to $ 200 billion, Robbins said that Cisco was already working to adjust its supply chain. tariffs, and that the recent increase is taken into account in its forecasts. He added that the company sees "only a very minimal impact at this stage" tariffs.

6. Cisco continues to aggressively repurchase stocks

Three months after adding $ 15 billion to its share repurchase authorization, Cisco has announced that it has repurchased $ 6 billion worth of shares at an average price of $ 52.14. This follows the $ 5 billion share buyback during the January quarter at an average price of $ 45.09.

Cisco, which still has about $ 11 billion in net cash (cash less debt) and is expected to generate more than $ 15 billion in free cash flow in its next fiscal year, can quickly buy back shares if it wish it.

Cisco has recently been introduced by the internal technical analyst of Real Money Bruce Kamich. To know more about how you can enjoy from that and other stocks, Bruce recently analyzed, click here please.

[ad_2]

Source link