[ad_1]

The financial markets have ignored the violence and chaos on Capitol Hill, with both the Dow DJIA,

and S&P 500 SPX,

hitting new highs on Wednesday and the Nikkei 225 setting another 30-year record on Thursday.

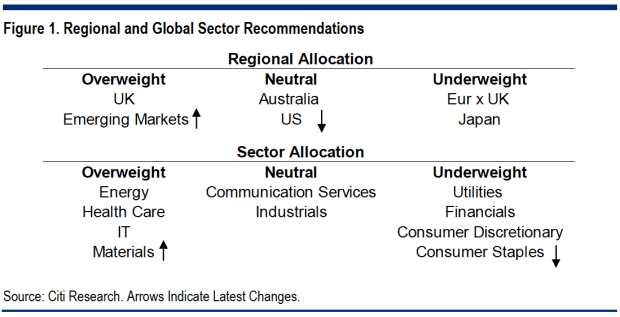

But investor optimism may be tempered as we continue into 2021, as Citi’s global strategy team said global equities will remain stable over the year, in our call of the day.

Investment bank strategists predicted an increase of just 2% in the benchmark MSCI All Countries World 892400,

over 2021, and have neutralized their inclination towards growth sectors in favor of a rotation towards value stocks.

Lowering the temperature due to their long-standing bias towards growth stocks, which has consistently maintained their rating in the overweight US market, is part of the rationale for downgrading the US market to neutral.

They also saw the US budget deficit as a threat to the dollar, which they expected to weaken this year, boosting emerging markets and commodity stocks.

But bond yields could be raised, aided by a recovery in the global economy, with Citi forecasting the 10-year U.S. Treasury yield (currently at 1%) to hit 1.25% in the coming months and 1.45% by the end of the year. They said it should help financial and energy companies, which are pillars of value.

The best returns are expected in the UK, where Citi predicts 7% growth for the FTSE 100 UKX,

and Australia, where they await the S & P / ASX 200 XJO,

increase by 6%. Emerging markets, notably China, Korea and Russia, are singled out by growth strategists.

Their “mildly bullish” view of global stocks depends on the success of COVID-19 vaccines in restarting the global economy. Citi economists forecast a 5% increase in global gross domestic product in 2021, following the 3.9% contraction in 2020.

These two factors are expected to boost the recovery in corporate earnings, with earnings per share in the worst-off sectors rebounding the most.

Citi strategists said much of their recovery forecast could already be reflected in the market, as the MSCI All Countries World Index trades at 20 times the consensus earnings per share – far higher than the long-term median of 15 times. By this measure, the United States is the most expensive of the major markets and the United Kingdom the cheapest.

Regarding sentiment, Citi said we are deep in euphoria for the US Panic / Euphoria Index, indicating that corrections may be ahead. Their suggestion? Buy the dip.

The buzz

President Donald Trump has admitted defeat in the US presidential election, saying there will be an “orderly transition” of power. His concession came after Congress certified the victory of Joe Biden and Kamala Harris, voting on the night after a violent pro-Trump mob stormed Capitol Hill on Wednesday.

Also: Why the stock market rallied even as a violent mob stormed the Capitol

Facebook FB tech giants,

and Twitter TWTR,

took steps to limit Trump’s ability to communicate with his supporters during the siege on Capitol Hill, temporarily locking his accounts amid the violence that left four people dead.

More: World leaders Boris Johnson, Justin Trudeau and more condemn ‘shocking’ and ‘scandalous’ scenes on Capitol Hill

Senior officials in the Trump administration have discussed the possibility of invoking the 25th Amendment to the Constitution, according to CBS. If invoked – for the first time in history – he would remove Trump from the presidency and make Vice President Mike Pence the Commander-in-Chief.

Read more: Re-dismiss? 25th amendment? Various ideas have floated around to end the Trump era now

U.S. officials are considering banning Americans from investing in Alibaba and Tencent, China’s two largest publicly traded companies. It would mark an expansion of the Trump administration’s advanced effort to blacklist investments in Chinese companies linked to the country’s military.

Sports betting actions like DraftKings DKNG,

Caesars CZR,

and MGM Resorts MGM,

jumped at the end of Wednesday after New York Gov. Andrew Cuomo changed his mind about legalizing the practice. Cuomo said New York has the potential to be the “largest sports betting market in the United States.”

The steps

YM00 stock futures,

ES00,

point slightly upwards, ready for a soft but positive opening to continue the records set by Wednesday’s rally. Asian markets NIK,

HSI,

SHCOMP,

checked while the European SXXP equities,

UKX,

DAX,

PX1,

are trading just above flat.

The market is reacting positively to the Democratic sweep ushered in by the two Senate second-round wins in Georgia, which improve the odds of more fiscal stimulus, as Vice President-elect Harris would vote to break the tie.

Read more: Democrats win second round election in Georgia, giving their party control of the US Senate

Table

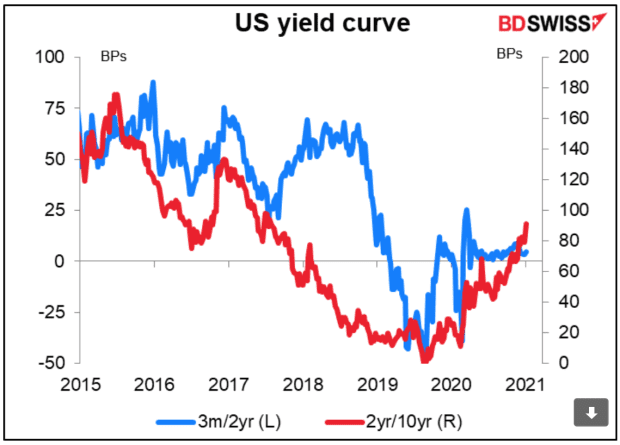

U.S. Treasury yields, shown in our Marshall Gittler’s chart of the day at BDSwiss, rose sharply as the two Senate second-round races in Georgia were called for the Democrats. 10-year returns TMUBMUSD10Y,

rose 8 basis points to 1.04%, the first time they have exceeded 1% since mid-March 2020.

The tweet

YouGov’s research found that one in five voters approved the capture of Capitol Hill, and a majority of Republicans blamed President-elect Biden for it.

Random readings

The new pub is trading during the lockdown after opening at a nursing home.

On the Llamas: A “very cold” llama found wandering off the highway in Massachusetts

Need to Know starts early and is updated until the opening bell, but register here to have it delivered to your inbox. The emailed version will be sent out at approximately 7:30 a.m. Eastern Time.

Want more for the day ahead? Sign up for Barron’s Daily, a morning investor briefing, featuring exclusive commentary from the editors at Barron’s and MarketWatch.

[ad_2]

Source link