[ad_1]

The rally comes amid a global energy crisis that is hitting China, the world’s largest producer and consumer of coal, particularly hard. And as gas prices skyrocket in Europe, there has been a resurgence in demand for fossil fuels that policymakers across the continent have long been trying to phase out.

Yet there is not enough coal for everyone. A German power producer recently shut down one of its power plants after running out of fuel.

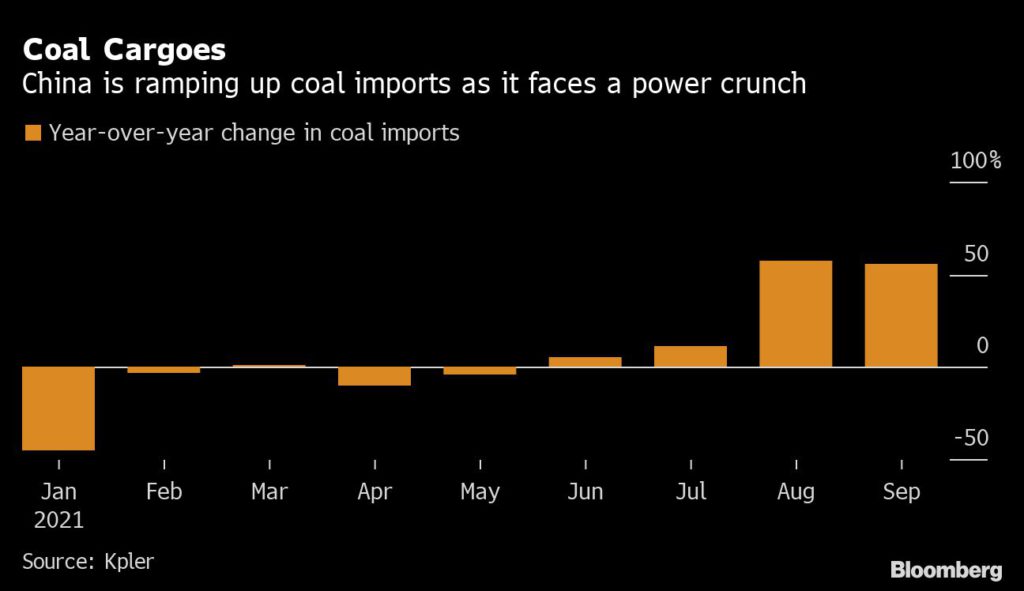

Earlier this week, Chinese Vice Premier Han Zheng ordered state-owned energy giants to guarantee fuel supplies for the winter at all costs. China consumes and extracts half of the world’s coal, and it is also the largest importer. The government has told the miners to continue digging even if they have exceeded their annual quota.

Thermal coal prices tracked by IHS Markit and Argus have increased since late 2020 as demand rebounded from the depths of the pandemic and alternative fuels like natural gas became more expensive. High-emission fuel is back in fashion just weeks before nations gather in Scotland for the COP26 climate change summit.

Supply issues also pushed up prices. China has struggled to ramp up production amid tighter safety checks following fatal crashes, while torrential rains, labor issues and transport bottlenecks have hampered exports from countries like Indonesia, Australia, Colombia and South Africa, among others.

The Newcastle coal benchmark could average $ 190 a tonne from October to December, Goldman Sachs Group Inc. said in a note in September.

The gains come as the world plans to move away from emission-intensive fuel in favor of renewable sources that will help meet net zero targets. Even China aims to start reducing its domestic consumption by 2026, and President Xi Jinping has pledged to stop building new coal-fired power plants abroad.

In the short term, demand in key countries is proving resilient. Thermal power generation in China was 14% higher in the year to August than in the previous two years. Demand in 2022 could be slightly higher than this year, potentially up 1%, said Shirley Zhang, coal analyst at Wood Mackenzie Ltd.

(By Dan Murtaugh, with assistance from Ann Koh and Stephen Stapczynski)

[ad_2]

Source link