[ad_1]

Vintage Coca-Cola ads, via Envisioning The American Dream.

A portfolio hedged around a Coca-Cola position

Last August, I wrote about the performance of a bullet proof wallet, or cover, built around a position on AT & T (T) in 2017 and in I presented a short story, which was finalized in February (each portfolio lasts six months). After that, I started presenting covered portfolios built around other alleged conservative actions, including Coca-Cola (KO), in November. Let's see how the wallet is completed after six months. First of all, remember how the portfolio was built and what it consists of.

Construction of the October KO Covered Portfolio

We used the hedged portfolio method to build a concentrated portfolio around Coca-Cola in October, starting with the following locations:

- You had $ 200,000 to invest.

- You were not willing to risk a levy of more than 14% over the next six months, so you wanted to be protected against any further decline.

- You wanted to invest in a handful of names, including Coca-Cola, in order to maximize the expected total return, net of hedging costs.

Here is a summary of the steps to follow if you want to do it manually.

Step 1: Estimating Potential Returns

The purpose of this step was to find names that could generate high total returns to be included alongside Coca-Cola. Our site, Portfolio Armor, calculates its own potential returns by analyzing the adjusted price history (which takes into account dividends) and the option market climate, but you might have derived from the Wall Street price targets or price targets given by Seeking Alpha contributors. Your initial universe could have been as big as Portfolio Armor (about 4,500 stocks and publicly traded products with options traded in the US), or something smaller, like the Dow 30.

Step 2: Calculation of Coverage Costs

Since you were going to hedge, the gross potential returns would have been less important to you than the potential returns net of hedging costs. To solve these problems, you would have had to determine the optimal, or least expensive, way to protect each name. We wrote about how to find optimal hedges here. For this example, you would have looked for the cost of coverage against drops of 14% or more. The weaker the decline you sought to protect, the more restricted the list of names you could have used.

Step 3: Name Ranking by Potential Net Return

For each of the names in your initial universe with positive return potential, you would have subtracted the cost of coverage calculated in step 2 to obtain a net return potential.

Step 4: Purchase and Cover

Here, you would have simply bought and covered a handful of names with the best return potential, net of hedging costs. The automated approach presented below included a precise adjustment step aimed at reducing liquidity and another to determine whether to hedge with put options or collars, but these four steps formed the basis .

The November Coca-Cola Covered Portfolio

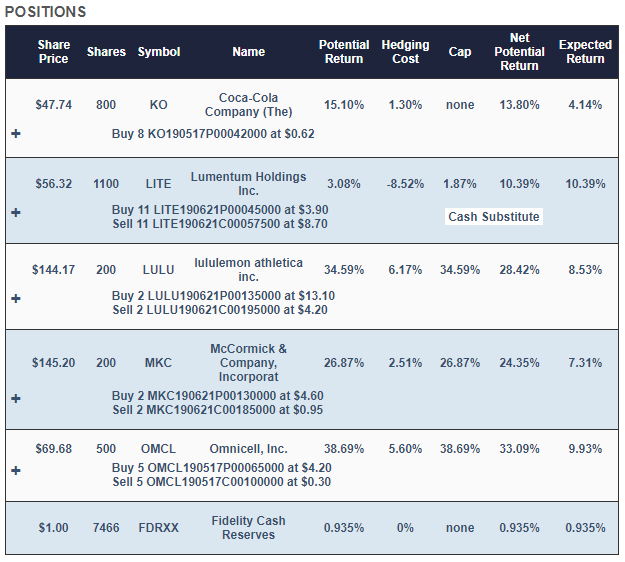

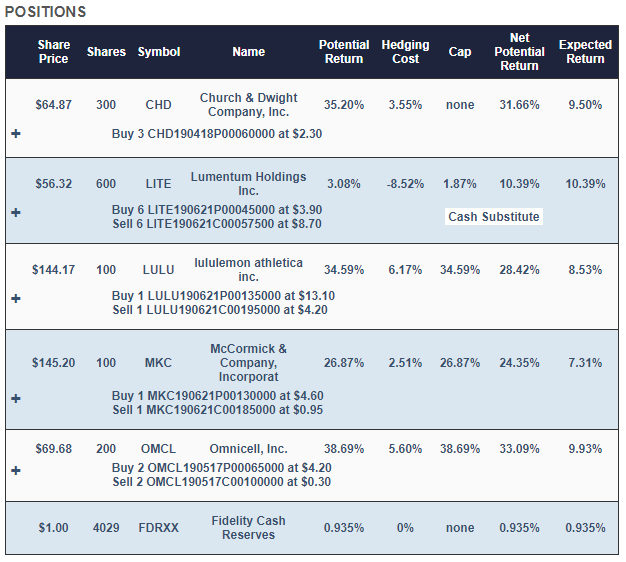

Using the process described above, here's what we presented Portfolio Armor's Portfolio Portfolio Tool:

Image via Portfolio Armor.

In addition to Coca-Cola, the site included Lululemon (LULU), McCormick (MKC) and Omnicell (OMCL) as major securities, based on their net potential yield of less than 14%. The site attempted to assign dollar amounts approximately equal to each of these names, but rounded the dollar amounts to ensure that it had rounded lots of each share.

In its development phase, it chose Lumentum Holdings (LITE) to absorb liquidity from the process of rounding up principal securities. Lumentum is covered with an optimal, or the least expensive, collars, with a cap on the current (annual) seven-day yield of Fidelity Government Cash Reserves (FDRXX). The hedge cost of this transaction is negative: the idea here is to get a better return than cash while lowering the cost of overall portfolio coverage and limiting your risk of loss in accordance with your tolerance at risk.

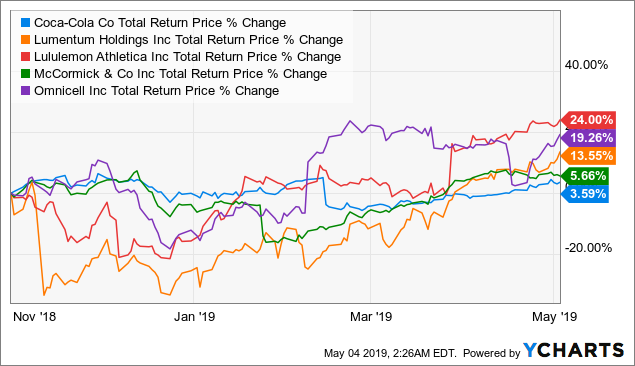

Underlying securities performance since

As a result, the underlying securities of the hedged portfolio have evolved since then with no hedging. Coca-Cola was the best performer.

Data by YCharts

Coca-Cola was the least successful name here, underperforming the names selected by Portfolio Armor. Assuming, for the sake of simplicity, that your portfolio is equally weighted and that you held each position from November 1 to May 1, your growth would have been 13.2%.

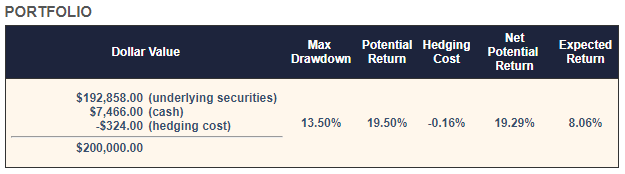

Portfolio Performance Covered Since

Here is how the covered portfolio is behaved.

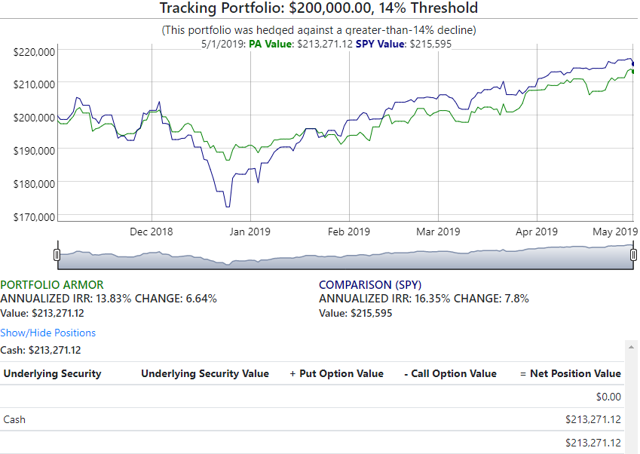

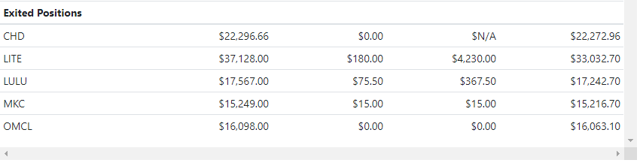

Graphic via Portfolio Armor.

The hedged portfolio ended up 6.64%, net of hedging and trading costs, while the SPDR S & P 500 ETF (SPY) was up 7.8% over the same period.

Competitive returns with less risk

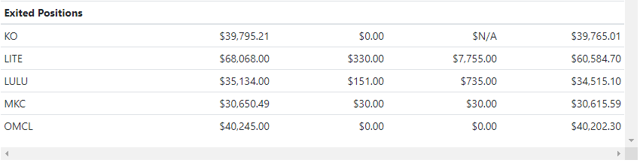

During the December nadir, this portfolio was down 6.74%, while that of SPY was down 13.81%, as shown in the graph below.

Graphic via Portfolio Armor.

And, as I mentioned above, the portfolio had a return close to that of SPY: 6.64% versus 7.8%. This is a competitive return, and the weaker December draw illustrated the lower risk in the portfolio.

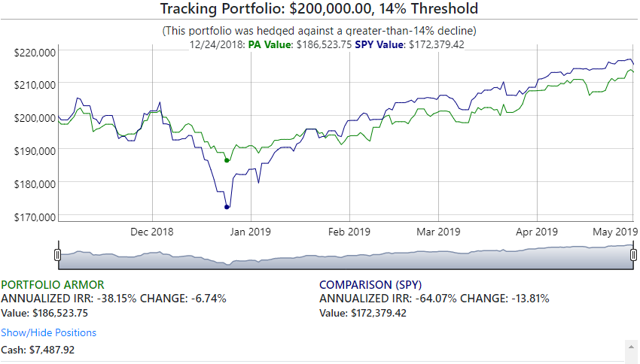

Better without soda

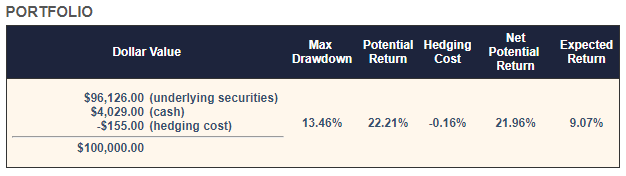

When I presented this portfolio in my November article, I mentioned that there is a difference between the portfolios I present in my Marketplace service and the fact that in these portfolios I let Portfolio Armor pick all the names rather than to give him one. I did it in this case, with knockout. How would this type of portfolio go without KO? It turns out that, on the same date, I presented a portfolio similar to my Marketplace subscribers, a $ 100,000 portfolio hedged against a drop of more than 14% and in which Portfolio Armor had chosen all the names . Instead of KO, the site chose Church & Dwight (CHD):

This soda-free wallet slightly outperformed SPY:

pack

It's a coincidence that I've created the Coca-Cola portfolio at the same time as the Coca-Cola one, because it illustrates the impact of stock selection well. In a concentrated portfolio, the difference of a position can affect the overall return. In both portfolios, however, the risk was strictly limited because of the hedge.

To be transparent and accountable, I publish a performance update of my Bulletproof Investing service every week. Here is the latest: Performance Update – Week 75.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link