[ad_1]

Note: All figures are in US dollars unless otherwise indicated.

Sweet and caffeinated redemption

Coca-Cola (NYSE: KO) released results this week that exceeded expectations, much to the delight of investors. The financial results were impressive, with net incomes rising 5% in the first quarter of 2019 and organic revenues rising 6%.

One of the most interesting conclusions of the conference call and forecasts is that Coca-Cola is expected to release Coca-Cola coffee on more than 25 world markets by the end of the year. Coca-Cola is not completely foreign to the coffee sector, we will be interested in it. In the past, there have been some failures around the Coke coffee businesses and this time the company is going to want to redeem itself. In this article, we examine why this coffee business could be an ideal solution for the company, which has gone wrong in previous coffee companies and its positive impact in the future.

The Keurig debacle

In 2014, Coca-Cola acquired approximately 10% of Green Mountain Coffee Roasters and participated in the launch of Keurig's new cold drink platform, Keurig Kold. "As part of the initial partnership agreement between the two companies, announced in February 2014, Coca-Cola acquired a stake that ultimately reached approximately 16% of Keurig's capital.In December 2015, Keurig entered into a merger agreement with JAB Holding Company JAB acquired Keurig ". Source: The Keurig KOLD platform will be abandoned

Eventually, due to several problems, including the cost of the machine and pods, soda tendencies and machine-related hardware issues, Keurig Kold was shut down in 2016. The price of the machine was over 300 USD, which was considerably higher compared to competing machines. In addition, the Coca Cola pods offered for sale were of low value in determining the true cost of a Coca-Cola beverage at retail price. As noted above, Keurig was eventually sold to JAB, in which Coca-Cola generated a gain of about $ 25 million. Although it was a good profit, it was an operational mistake to enter this market. Source: Coca-Cola Press Release

Costa Coffee Investment

Coca-Cola made another significant investment in coffee by buying Costa Coffee for $ 5.1 billion.

Source: Whitbread

The acquisition of Costa Coffe and the strategy for the future were discussed in the press release on the results of the first quarter of 2019. "During the quarter, the Company finalized the acquisition of Costa Ltd., which gives at Coca-Cola a significant entry point into hot beverages and a global market. In the second quarter, the company will begin to leverage Costa's scalable platform for all formats and channels with the launch of its ready-to-drink products. "

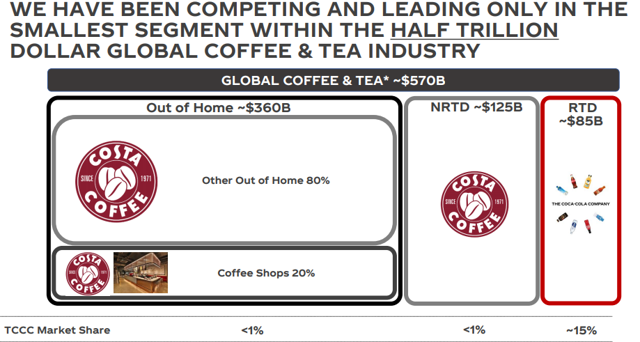

The Costa transaction is important for Coca-Cola. The company clearly feels that the market can still develop and gain market share over its competitors.

Source: Investor Presentation – Costa Ltd. Acquisition Project.

Costa has nearly 4,000 points of sale and operates in more than 30 countries thanks to its impressive scale immediately. As discussed below, the new Coca Cola coffee and energy drinks can complement the Costa Coffee by giving consumers the choice while avoiding the Coca Cola family of products. The fact that the brand is already established should lessen the complexities surrounding the launch of a new brand, both from a financial point of view and from a brand recognition point of view. When calling the results, the company said it wanted to market Costa ready to drink by the end of the second quarter. Geographically, Coca-Cola will do so in markets where Costa Coffee is already present.

And after?

At the call for results, Coca-Cola CEO and Director, James Quincey, introduced the new launch of Coca-Cola coffee. We have learned from these pilot projects and expect to be launched in more than 25 markets around the world by the end of the year. "The strategy is to take another opportunity to taste another Coca-Cola product. Cola does not hurt other Coca-Cola products, and Coca-Cola believes it can, and the company is targeting emerging markets to achieve that goal. "But in emerging economies, only a quarter of what they drink is a commercial drink. So, there is still a lot, in a way, to create opportunities and connect brands and benefits on certain occasions. So there are opportunities to expand the categories and exploit the vagueness. " Source: press release relating to the results of the first quarter of 2019.

Source: Coca-Cola website

By offering both the Coca-Cola coffee beverage and Costa coffee, the company has the opportunity to penetrate a segment of the market on which it has not yet excelled. With the general downward trend of sweet drinks, coffee offers are a perfect fit for Coca -Coca to diversify and effectively cover some of its core product offerings.

Risks to consider

There is a clear risk that the coffee strategy will not be implemented as planned and that markets will not be fully captured. By having two coffee-type products in addition to the new Cokes energy drink, there is a risk of market saturation. This would ultimately have an impact on sales and revenues and would prompt Coca-Cola to re-evaluate its hot beverage strategy.

It should not be exaggerated that the coke market is in decline, as evidenced by soda ash sales in the developed market. In addition, it is clear that soda consumption is steadily declining in North American markets, based on consumer preferences and general health guidelines. In addition, rising taxes on soft drinks could continue to weigh on the profits of Coca-Cola's core business, which could impact its coffee strategy if additional funds or resources are needed to focus on other priorities of the company.

To take away

Coca-Cola needs to build on its brand awareness and scale to carry out its coffee strategy. The company does not want the Keurig Kold transaction to be repeated from an operational point of view. Management is clearly optimistic that Coca-Cola is likely to thrive in the hot beverage market. If the strategy is executed appropriately, it will ultimately strengthen the already high power of beverages and increase shareholder value.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: This article is for information purposes only. Please do your own research and due diligence and consult a financial advisor and / or tax advisor if necessary before making an investment decision.

[ad_2]

Source link