[ad_1]

Morgan Creek Capital Management CEO Mark Yusko responds to Senate blockade of cryptocurrency regulation as part of infrastructure.

Ethereum was the most traded cryptocurrency on the Coinbase exchange in the three months through June, as investors explored the world of decentralized finance.

| Teleprinter | Security | Last | Change | Change % |

|---|---|---|---|---|

| PIECE OF MONEY | COINBASE GLOBAL, INC. | 278.40 | +8.73 | + 3.24% |

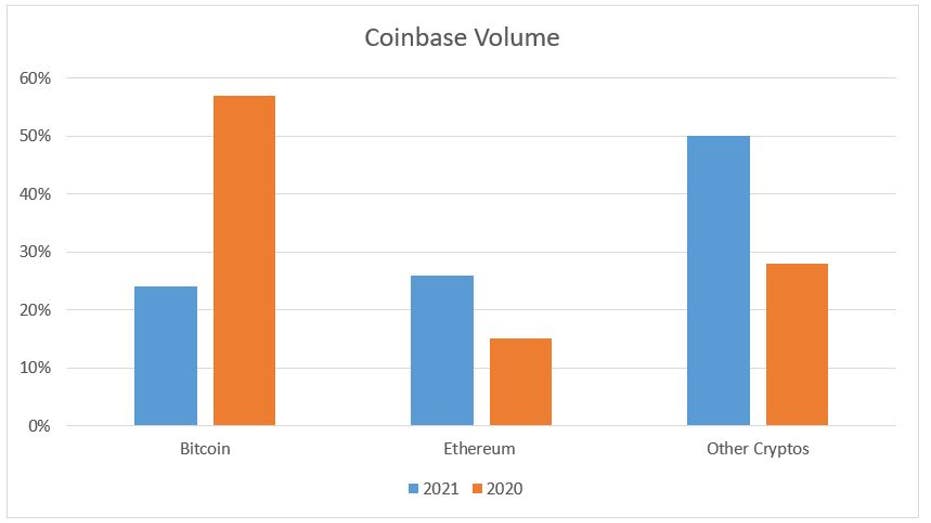

Ethereum, the second largest cryptocurrency by market cap, was responsible for 26% of the trading volume on Coinbase, compared to 24% for Bitcoin. A year ago, Bitcoin commanded 57% of the total volume on the platform compared to 15% for Ethereum.

Total transaction volume in the second quarter was $ 462 billion, up 1,550% from $ 28 billion a year ago.

“Bitcoin may be great wealth, but most of the innovations happening in the crypto space right now are happening on the Ethereum blockchain,” said Mati Greenspan, CEO of Quantum Economics, a Tel Aviv-based project aimed at to help people understand Financial Markets.

The Ethereum blockchain is used for both decentralized finance and non-fungible tokens, two applications that have recently taken the crypto world by storm.

Decentralized finance, or DeFi, does not rely on banks or other financial intermediaries to offer financial instruments, and instead uses blockchain, most often Ethereum.

A non-fungible token, or NFT, is a unit of data stored on the blockchain that says a digital asset is unique and cannot be replicated. This includes art, music, and other types of digital files.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Interest in DeFi and NFTs helped push Ethereum’s price up 344% this year to $ 3,240 per token, giving the cryptocurrency a market cap of $ 380 billion, according to CoinMarketCap.com.

The price of Bitcoin, meanwhile, has climbed 58% this year to reach $ 46,490 a coin. Its market capitalization was over $ 871 billion.

[ad_2]

Source link