[ad_1]

Daily Exchange Market Report March 26, 2019

Kathy Lien, Managing Director, Foreign Exchange Strategy for BK Asset Management

Softer data could not contain declines. US stocks rallied for the second day in a row, despite larger than expected declines of, and. The slowdown in the real estate market is not surprising, but the collapse of the Conference Board's Consumer Confidence Report runs counter to the improvement posted earlier this month and the stock pickup in February. has also prolonged its recovery, but we continue to believe that parity is down, especially after the latest round of US data. In addition to improving risk appetite, the greenback has also benefited from a rebound in US rate hikes. While the plan to not raise rates this year is positive for equities, the motivation is global uncertainty, which is negative for the currency. While the recovery could choke here, if it soared, sellers would enter 111. The trade balance should be released tomorrow and, while manufacturing activity continues to slow, the deficit has reached a record high the month previous, which suggests a recovery. . If today's economic reports have not hurt the dollar, Wednesday's trade report will probably not do it either.

The weakest currency was the, which fell below 1.1300 as it approached 1.1250. All other major currencies traded higher, allowing the EUR / USD to hold back the trend. The interest of this initiative is that no major economic report on the euro area has been published and that German yields have followed rising Treasury rates. During the European negotiating session, comments were made about TLTRO-3, including the possibility that details would be disclosed in June, but by then the EUR / USD was in the process of being discussed. to reach 1,1325 and did not decline before the opening of New York. Nevertheless, the economic problems of the euro area are well known and with a negative German, the pair has been hardest hit by the economic recovery.

Remains faithful to its recent findings that MPs are beginning to see the May agreement as a better alternative to the lack of agreement or absence of Brexit. However, the Democratic Unionist Party (DUP) compared May's plan to jail time and said he would prefer a one-year delay in support of his withdrawal agreement. Parliament took control of the Brexit process last night, depriving the government of its program for the first time in more than 100 years. The first step will be to hold Wednesday a series of indicative votes on alternatives to the May agreement. The pound sterling will therefore remain targeted and will be subject to wild intraday volatility.

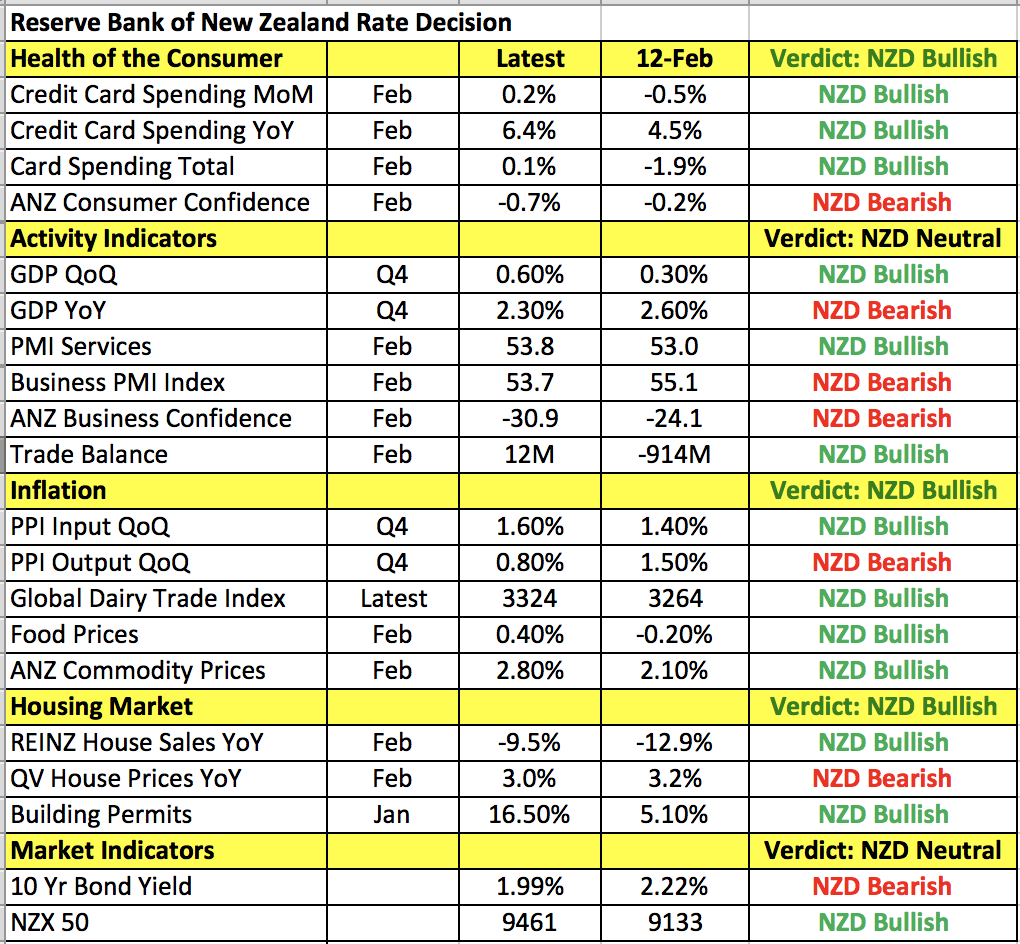

For the moment, investors will watch. A better-than-expected result showing that New Zealand had a trade surplus in February had very little impact on the currency. Meetings and traders are eager to see if recent economic improvements will be enough to maintain the RBNZ's neutrality. When the central bank met last month, it pushed back its rate hikes until early 2021, but the NZD skyrocketed after the RBNZ's governor stated that the chances of easing did not increase and that growth should resume. Since then, the confidence of manufacturers, businesses and consumers has slowed, but business activity, growth, prices and are on the rise. The shares have also reached a record level, which will help and feel.

Fusion Media or anyone involved in Fusion Media will not accept any liability for loss or damage arising from the use of information, including data, quotes, charts and buy / sell signals contained in this website. Please be fully aware of the risks and costs associated with financial market transactions. This is one of the most risky forms of investing possible.

[ad_2]

Source link