[ad_1]

The market capitalization of the main cryptocurrency has recovered 10 billion US dollars lost the day before, after a series of positive announcements from institutional investors attending Consensus Invest.

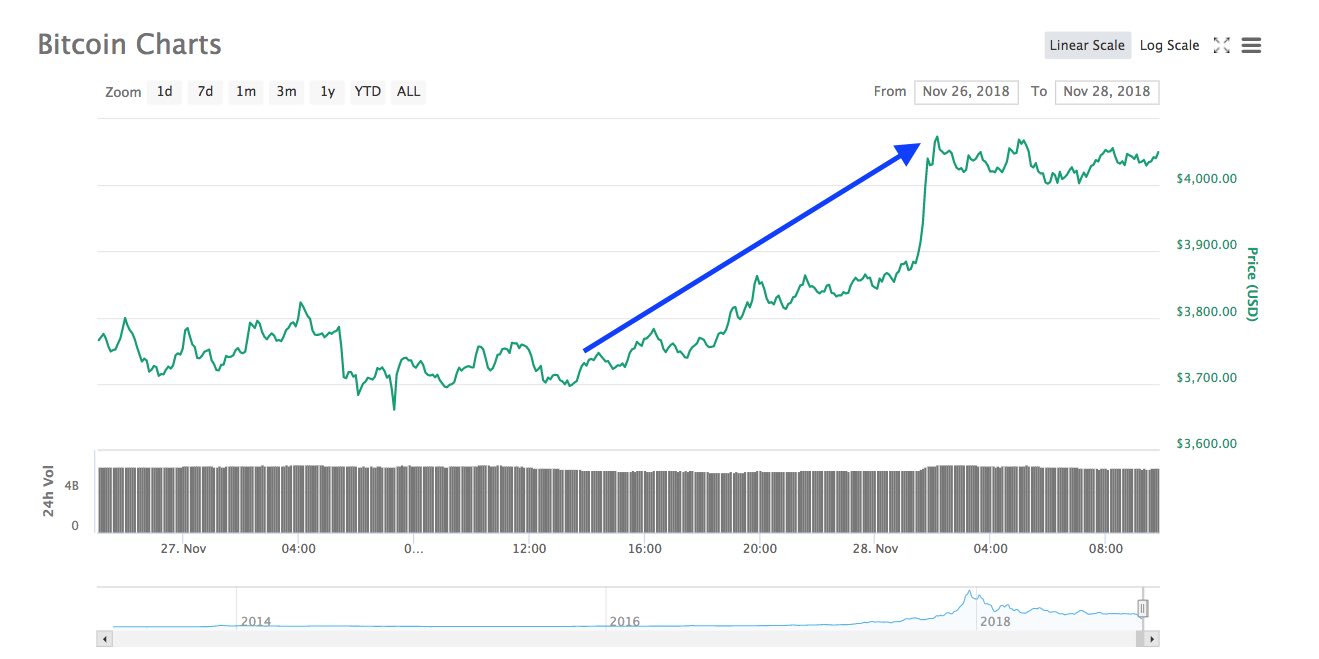

After a series of negative days for crypto-currencies, both Bitcoin as the others went up. In the case of Bitcoin managed to break the $ 4,000 barrier, which (even psychologically) encourages the market.

It is possible that this decision is motivated by the comments of Gabor Gurbacs, Director of Digital Asset Strategy at VanEck / MVIS. He announced in Consensus Invest that VanEck has partnered with Nasdaq to "market a crypto 2.0 regulated market".

When it's 8 o'clock in the morning in New York, Bitcoin had a substantial increase of 10.78% over yesterday. Its price is now $ 4,129.54. There have been transactions over the last 24 hours for more than $ 6.4 billion, indicating a fairly busy market. A lot of the transactions are between the pair Bitcoin / Tether. The capitalization market of Bitcoin it rose by nearly $ 10 billion between Tuesday and Wednesday and now stands at over $ 72 billion.

For its part XRP he had an increase of 9.92%, Ethereum 10.81%, Bitcoin Cash 7.11% Stellar 14.22%, EOS 7.50%, litecoin 12.49%, Monero 15.23% and Cardano 10.89%.

94 of the top 100 currencies are up, most with double digits. The market capitalization of the entire cryptosystem, which fell below $ 120 billion yesterday, is now growing to over $ 134 billion.

Experts say

Some badysts argue that the fact that Bitcoin breaking the $ 4,000 barrier may be a good sign for the market, but others suggest that it's best to wait for another barrier to be crossed: the $ 4,500 barrier because she would give up resistance. In any case, it is worth noting that what is happening now is related to the dynamics of the market itself and not to an external factor.

Sources of figures: MarchésDiaryBitcoin and CoinMarketCap

Report of DiarioBitcoin

Image of CoinMarketCap

related

Source link