[ad_1]

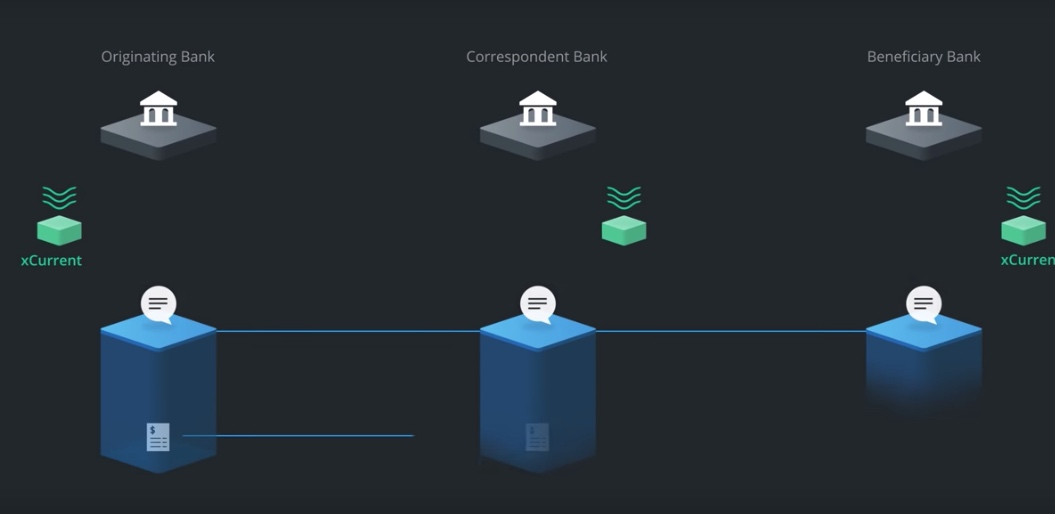

Version 4.0 allows financial institutions to connect to xRapid, the cross-border payment solution they use XRP.

Ripple started implementing a new version of xCurrent for many important customers including American Express and Santander

The new version 4.0 offers financial giants the opportunity to connect to xRapid, the solution of cross-border payments Ripple that uses XRP to provide more speed and liquidity. But will companies really use it?

Ripple started updating its customers with the new version in September, and a spokesman for the company said CoinDesk that until now no one has chosen to use the new software integration with xRapid

In addition, Banco Santander's communications officer stated that, for the time being, the company was sticking to xCurrent for your mobile payment application One Pay FX.

Santander only uses xCurrent, not xRapid or XRP. And the bank has not improved so far. Santander does not need this update today to offer all the benefits of One Pay FX.

Ripple officially launched xRapid in October 2018. He revealed that MercuryFX, Cuallix and Catalyst Corporate Credit Union use the software for commercial payments. Vice President of Products Asheesh Birla said it already helps them reduce costs and improve turnaround times.

Comments received from our customers use the xRapid experience, which reduces costs, but also reduces setup time.

Ripple has also been badociated with cryptographic exchanges Bittrex, Coins.ph and Bitsowho will use xRapid stimulate cross-border payments between the United States and the Philippines, and between the United States and Mexico.

Expectations

In June, the Director General of Ripple, Brad Garlinghouse said that he expects "dozens" of banks to implement xRapid from here the end of 2019.

I think that, while improving the utility of the XRP program, we will continue to see this ecosystem grow and be healthier. I said publicly at the end of this year that I am fully convinced that the big banks will use xRapid as a liquidity tool by the end of the year. I hope we will see an order of magnitude by the end of next year: dozens.

Also in June, Western Union announced that his pilot xRapid this did not allow the company to save time and money. In response, Ripple He said the results show that small financial institutions and start-ups are more likely to initially realize significant savings with technology.

Source: DailyHodl

Translation from DiarioBitcoin

Web image of Ripple

related

Source link