[ad_1]

Photographer: Andrey Rudakov / Bloomberg

Photographer: Andrey Rudakov / Bloomberg

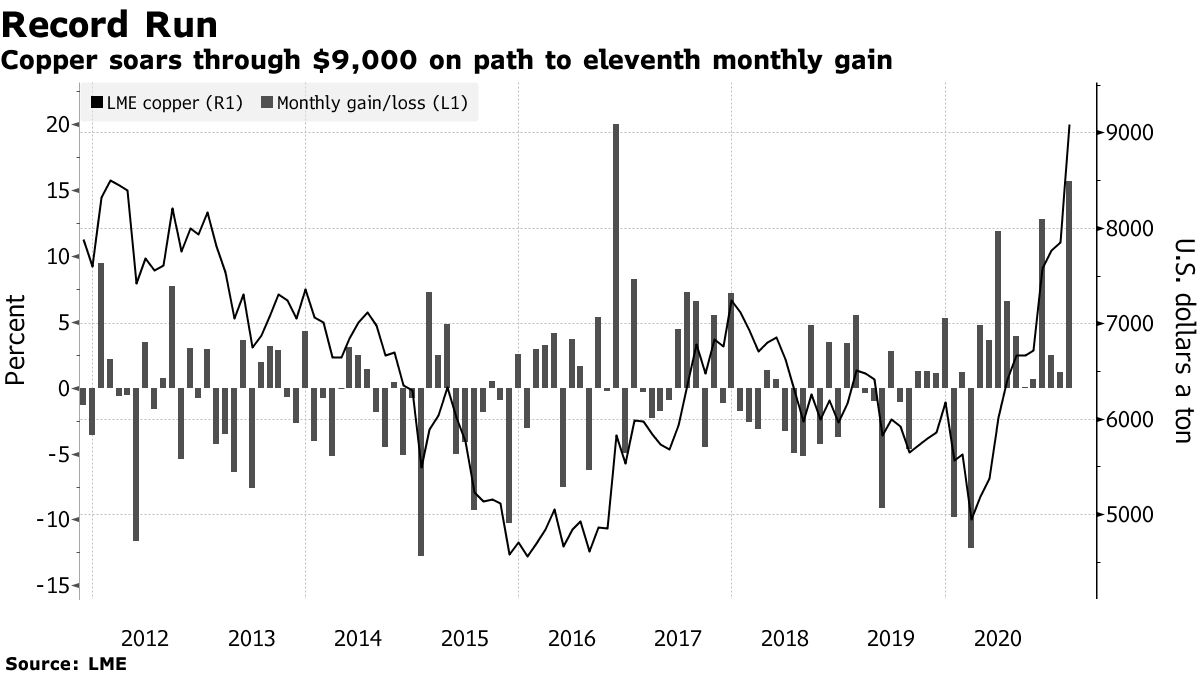

Copper rose above $ 9,000 a tonne for the first time nine years ago, one step closer to a record high in 2011, as investors bet supply tension will rise as the world will recover from the pandemic.

Copper is booming amid a large rally in commodities, from iron ore to nickel, while oil has gained more than 20% this year. The flagship industrial metal has doubled from a low in March, boosted by rapidly tightening physical markets, prospects for rebounding economic growth, and expectations that a period of years of low inflation in major economies could end.

Investors are also cramming into copper with betting that demand will increase in the coming years as governments launch unprecedented stimulus programs targeting renewable energy and electric vehicle infrastructure, which will require huge volumes of funding. copper.

“The list of bullish factors for copper is extremely long,” Max Layton, head of EMEA commodities research at Citigroup Inc, said by phone from London. “A lot of the more bullish developments are really going to play out. in the next few months, and therefore, we believe it will be sooner rather than later that it hits $ 10,000. “

In some areas of the physical copper market, supply conditions have been the strictest in years and may be under even greater pressure as China’s top-consuming smelters face squeezed profit margins to transform raw ore into refined metal. A leading supplier is considering reduction in production, a potential blow for buyers.

Soaring prices spur miners, push up stock prices, and raise the prospect of greater returns for shareholders. Jiangxi Copper Co., China’s top producer, gained up to 20% in Hong Kong at the highest level since 2012, while US producer Freeport-McMoRan Inc. closed at the highest level since 2014 on Friday.

Threat of inflation

With inflation expectations already rising around the world, the strong rally in commodities, including copper, may soon start to seep into the price of end-use goods, raising costs for governments with large projects. infrastructure spending.

The risk of faster inflation has caused bonds to sell off globally, with the benchmark 10-year US Treasury yield reaching its highest level in about a year on Monday. The spread between 5-year and 30-year yields reached the largest since October 2014, breaking another all-time high on signs of strength in reflation trade.

Falling real yields in bond markets could trigger further inflows into copper, create an inflation feedback loop and intensify the clamor for durable assets as prices rise.

Goldman Sachs Group Inc. has strengthened its copper’s bullish stance last week, claiming that China’s return after the week-long hiatus triggered another price hike. The market faces the largest deficit in a decade this year, with a high risk of a shortage in the coming months, according to the bank.

There are already signs of emerging tension on the London Metal Exchange, as spot contracts trade at a premium over futures contracts. This pattern, known as the demotion, was a feature of the market during a record boom in Chinese demand last year, and suggests that spot demand is once again outstripping supply as foreign exchange stocks fall. weak.

Three-month copper traded 1.2% higher on the LME at 11:39 a.m. in London after hitting $ 9,269.50, the highest since 2011. The metal is on track for an 11th monthly gain consecutive unprecedented. The current record price of $ 10,190 was reached in February 2011.

In China, the SHFE contract has reached the daily limit. Other metals rose, with LME nickel reaching $ 20,110 per tonne and tin the highest since 2011.

– With help from Mark Burton, Phoebe Sedgman, Winnie Zhu, Matt Turner, Sunil Jagtiani and Ranjeetha Pakiam

[ad_2]

Source link