[ad_1]

Credit Suisse and Nomura have warned of large losses after an inflammatory sell-off of around $ 20 billion of Chinese and US stocks as their client Archegos Capital Management was forced into massive asset recovery .

Nomura could face a total wiping out of its second half of the year earnings, while Credit Suisse warned the sale could have a “very significant and material” impact on its first quarter results.

Shares of Japan’s largest investment bank fell 16% on Monday morning in Tokyo, wiping out more than $ 3.2 billion from its market cap, as Nomura warned of recent deals with an anonymous client and the risk of a “material loss” to its US subsidiary.

Japanese and Swiss banks have provided prime brokerage services to Archegos, which was founded by former hedge manager Bill Hwang, according to several people familiar with the matter. Blue-chip brokers lend cash and securities to hedge funds and process their transactions.

Credit Suisse said in a statement Monday: “A major US-based hedge fund defaulted on margin calls made last week by Credit Suisse and certain other banks. As a result of the fund’s inability to meet these margin commitments, Credit Suisse and a number of other banks are exiting these positions. “

“While it is currently premature to quantify the exact magnitude of the loss resulting from this exit, it could be very significant and material to our first quarter results.”

Nomura said in a statement that it is assessing the scale of the potential losses, noting that its estimated claim against the client is around $ 2 billion. The company said that figure was based on market prices at the close of U.S. negotiations on March 26 and could rise if asset prices continue to fall.

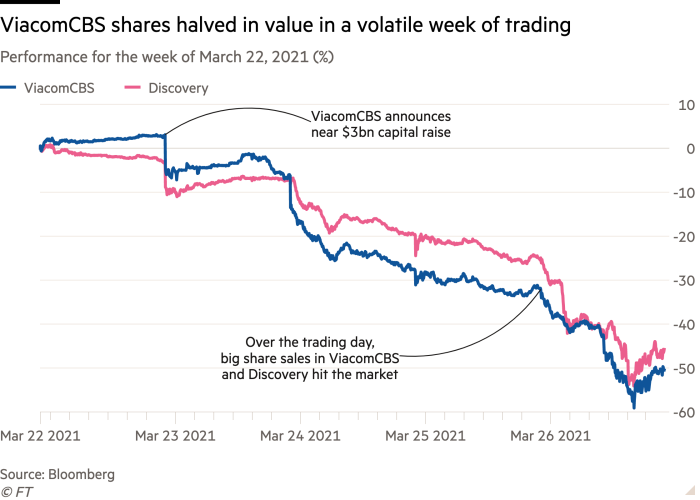

A private investment firm, Archegos was behind billions of dollars in stock sales that captivated Wall Street on Friday. The fund, which was heavily exposed to ViacomCBS and several Chinese tech stocks, was hit hard after shares of the US media group began falling on Tuesday and Wednesday. The declines prompted a margin call from one of Archegos’ main brokers, triggering similar demands for liquidity from other banks.

Hong Kong and Tokyo hedge funds said on Monday that traders around the world were ready for further block sales of shares associated with Archegos and other funds that may also be forced to unwind heavily leveraged positions, such as Teng Yue Partners, when trading opened in the United States on Monday. Teng Yue was not immediately available for comment.

Jefferies analyst Hideyasu Ban said a loss estimate of $ 2 billion recorded in the quarter ending March 31 would wipe out most of Nomura’s pre-tax profits for the second half of the fiscal year ending this year. week.

Other blue chip brokers who had provided leverage to Archegos said the problems at Nomura and Credit Suisse were related to being slower to offload blocks of shares in the market compared to their peers. , including Goldman Sachs and Morgan Stanley.

An executive at a Wall Street bank in Hong Kong said, “It’s unclear why Nomura sat on their hands and racked up these big losses.”

Another Tokyo-based banker said the extremely high level of leverage that Nomura appeared to have extended to Archegos was “baffling”.

Archegos is a family office that manages the wealth of Bill Hwang, a former “Tiger cub” student of Julian Robertson’s legendary Tiger Management hedge fund. It had around $ 10 billion in assets last week, according to prime brokers. New York-based Hwang previously ran hedge fund Tiger Asia, but returned liquidity to investors in 2012 when he admitted to making a wire transfer fraud involving Chinese bank stocks.

An executive from a global hedge fund in Hong Kong said, “It’s surprising that a China-oriented fund uses Nomura and is given so much leverage by a Japanese bank. It appears to have been at least four times what a long / short equity fund would normally get. “

Teng Yue Partners, led by fellow club Tao Tao Li, has also been linked with the sale that hit shares of US media groups and Chinese tech firm GSX Techedu last week, according to brokers and traders from foreground in Hong Kong.

Tokyo bankers familiar with the circumstances surrounding the massive sale of Archegos’ assets described the event as a possible “Lehman moment” that would force several lenders to acknowledge that the leverage extended to the fund created excessive risk.

Nomura and Credit Suisse are among at least five banks that have provided prime brokerage services to Archegos, alongside Goldman Sachs, Morgan Stanley and UBS, according to people familiar with the matter.

Some banks have banned all global trade with Hwang after settling illegal trading fees with US regulators in 2012 and were banned from trading in Hong Kong in 2014.

[ad_2]

Source link