[ad_1]

POINTS FOR DISCUSSION OF RAW OIL AND GOLD:

- Crude oil prices rise as Trump threatens Iran, OPEC is considering production cuts

- Gold price retreats US $ 1,300 / oz to test support for 9-month trend

- Fed Chairman's Address, Powell, Could Impact Commodity Prices

Crude oil prices jumped higher at the beginning of the trading week after US President Trump threatened Iran via Twitter, warning Tehran officials that they want a fight, it will be the "end" of the Islamic Republic. Tensions between the two countries have increased since the US government tightened sanctions on Iranian oil exports after it withdrew from an Obama-era nuclear disarmament deal.

Prices were probably helped upward, as OPEC members led by the Saudi Arabia meeting in Jeddah expressed a desire to extend the agreement to cut the production of oil. 39, here the end of the year. Russia – the largest non-OPEC member producer participating in the program – could however have other ideas. His energy minister, Alexander Novak, reportedly talked about easing the restrictions, which will expire next month if they are not renewed.

GROSS OIL, GOLD PRICES CAN SUFFER IN POWER OF FED PRESIDENCY

The higher movement may have trouble following because the risk appetite falters. Scheduled comments from Fed Chairman Jerome Powell title an otherwise quiet offer on the economic calendar Monday. He is likely to reiterate the US central bank's preference for a wait-and-see approach, wiping out the hopes of traders to calm down to support sentiment in the face of slowing global growth and rising political uncertainties.

Cycle-sensitive oil prices are likely to experience lower pressures than inventories in this scenario. Gold prices could also fall, prolonging a series of four-day losses, as fears of rate cuts fade boost yields in US dollars and Treasury bonds. This bodes ill for an anti-fiat and non-interest-bearing reference asset. The markets are currently evaluating the probability of a reduction before the end of the year to 73.5%.

Have we understood our forecasts for crude oil and gold? Get them here discover!

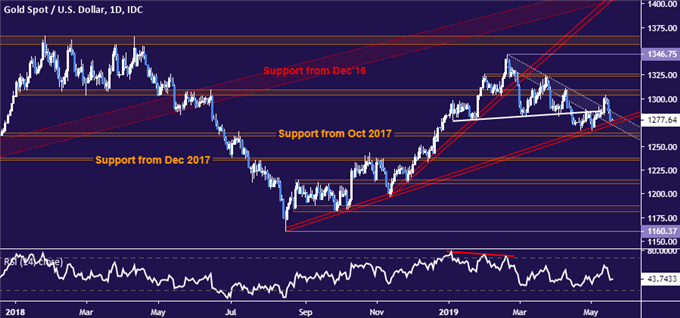

TECHNICAL ANALYSIS GOLD

Gold prices then dropped to test their support for an uptrend line leading them up since mid-August 2018, now at 1273.01. This is reinforced by the inflection area from 1260.80 to 63.76. Exceeding this threshold then exposes the area 1235.11-38.00. The short-term resistance is in the 1303.70-09.12 region, followed by a minor hurdle in the 1323.40-26.30 price range along the path leading to the February peak at 1346.75.

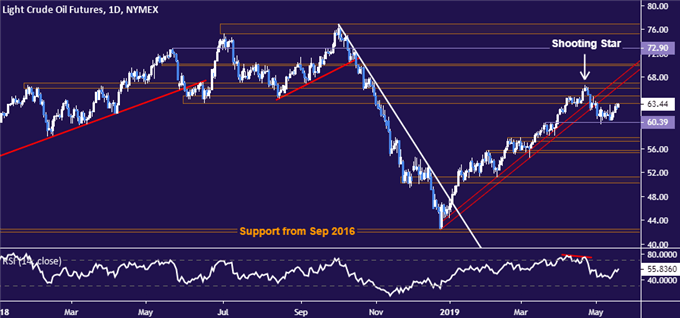

TECHNICAL ANALYSIS OF GROSS OIL

Crude oil prices exert pressure on the outer layer of a dense resistance block ranging from 63.59 to 67.03. If the buyers manage to overcome the upper limit of this obstacle, a test of the figure of $ 70 / bbl can follow. Immediate support is at 60.39, with a reversal below that confirmed each day at closing, paving the way for a challenge from 57.24-88.

COMMERCIAL RESOURCES ON GOODS

— Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

[ad_2]

Source link