[ad_1]

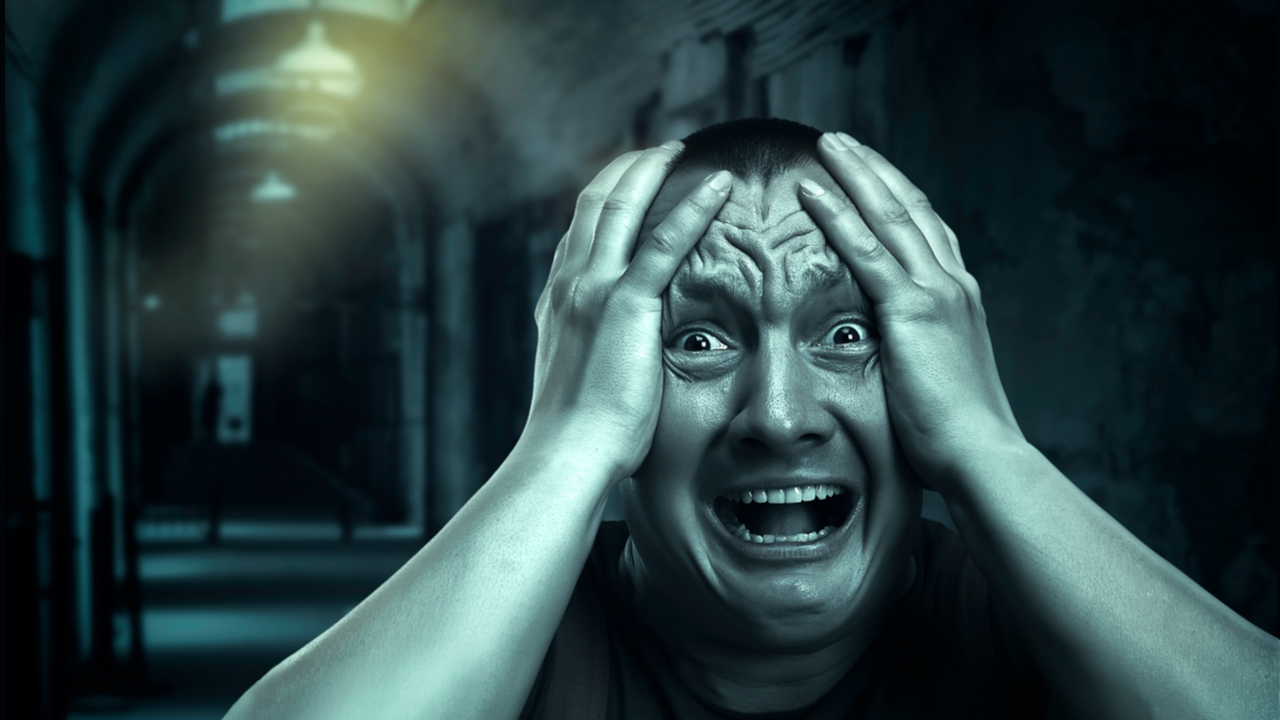

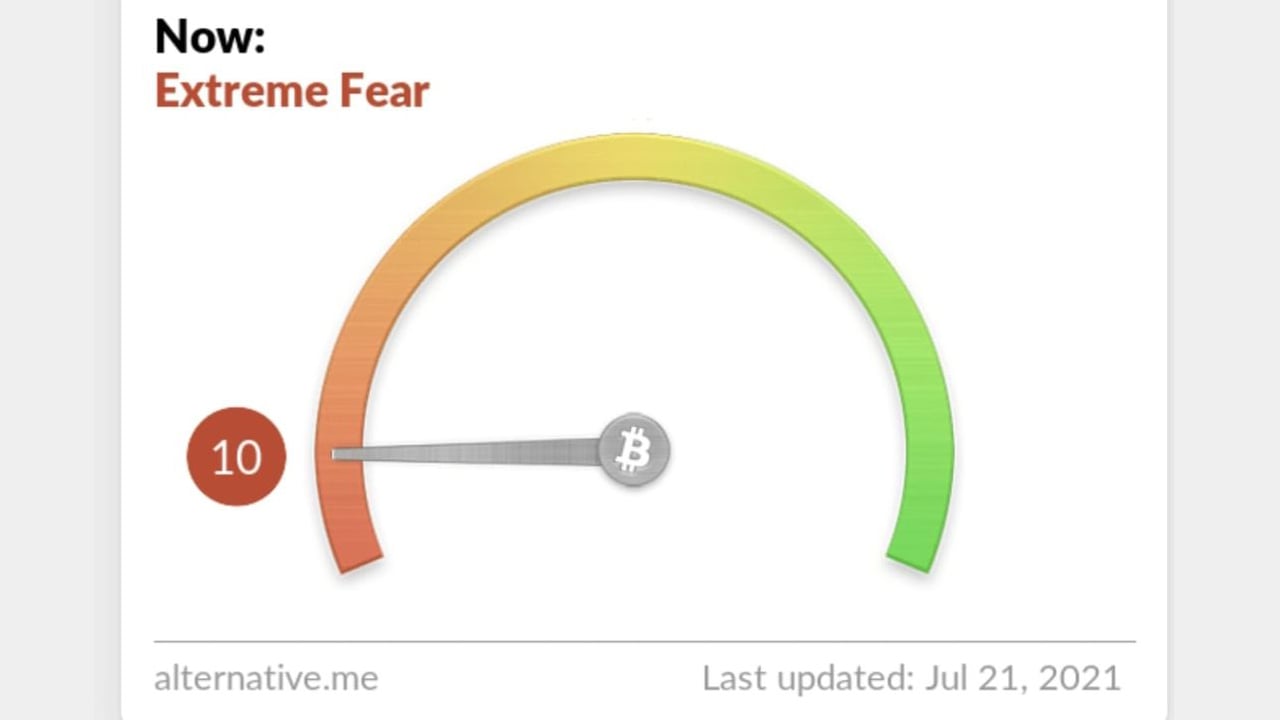

On Wednesday, after falling below the $ 30,000 region, the price of bitcoin rebounded more than 8% from Tuesday’s low. Meanwhile, the sentiment measure recorded by the Crypto Fear and Greed Index (CFGI) is extremely low, indicating “extreme fear” in the market. While this is a scary term, now is usually the best time to get assets at a lower price. However, technical data from Tradingview shows that bitcoin is still in the “sell” range, while oscillators in the bitcoin market are more “neutral”.

CFGI Sentiment Metric Reaches ‘Extreme Fear’

The price of bitcoin (BTC) hit a low of $ 29,300 on July 20, 2021, and since then the price has managed to climb back above the $ 32,000 grip. Despite the rebound, there is a lot of uncertainty in the crypto space when it comes to short-term bitcoin price predictions.

Some believe the price may dip into the $ 20,000 zone again and others believe that a rebound is in the cards and the next trajectory will be well above the all-time high of $ 64,000. Most traders who think this rebound could be happening believe that bitcoin’s price movements today are eerily similar to the prices BTC saw in 2013. At that time, BTC plunged to $ 50 per coin. after soaring well above the $ 200 grip in mid-May 2013.

The price of Bitcoin then jumped nearly 2,400% from the summer 2013 low and hit the first all-time high in US dollar crypto assets in four digits. After BTC fell to $ 29,300 on Tuesday, the Crypto Fear and Greed Index (CFGI) hit a low of ten on the charts. The score of ten is not the lowest point recorded by the CFGI metric, but it is very low compared to most days. The last time the CFGI metric recorded a ten was in mid-June and the end of May as well. Since the end of May, the CFGI metric has not been this low for over a year, as the last time the CFGI hit a ten or less was during the market rout of March 12, 2020, also known as “Black Thursday”.

While the feeling of extreme fear may seem miserable, traders believe this is one of the best entry points to enter any market. A market filled with panicked and “extreme fear” sellers will certainly see cheaper assets than a market filled with “extreme greed,” which is the higher end of the CFGI spectrum. Essentially, the CFGI analyzes “emotions and feelings from different sources and aggregates them into one number,” the website details.

Oscillators and moving averages tell a similar story

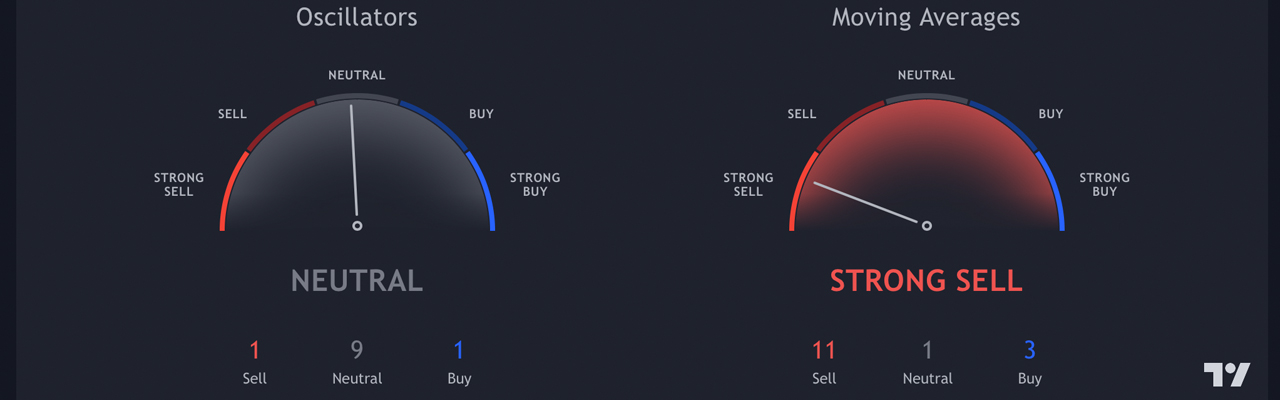

Unlike CFGI, Tradingview’s BTC / USD techniques show a similar story, but some of the indicators can be seen as different perspectives. A one-day summary of BTC / USD techniques from Tradingview shows a scale towards the “sell” range.

Moving averages (MA) are different and Tradingview’s MA techniques indicate the “strong sell” range. At the same time, the BTC / USD oscillators are a bit hotter and indicate a “neutral” range. For example, the relative strength index (RSI 14) indicates “neutral” and stochastic (14, 3, 3) also indicates that things are “neutral”.

All moving average indicators suggest the “sell” range while the simple moving average (SMA 10) and exponential moving average (EMA 10) are in the “buy” range. When it comes to BTC / USD oscillators, the only ‘buy’ signal is the momentum indicator, but the moving average convergence divergence (MACD), a trend that follows momentum, is recorded as a ‘sell’. Wednesday.

Delta Exchange CEO Says “$ 30,000 Has Been Reliable Support Since May”

Meanwhile, despite Tuesday morning’s plunge, bitcoin (BTC) continues to hold a support zone. In a note sent to Bitcoin.com News, Delta Exchange CEO Pankaj Balani explains that current support, at least so far, has been reliable.

“Bitcoin has gone down since the start of this month,” Balani said. “Volatility has compressed considerably with a lower range. Bitcoin is trading in a significant support area of $ 29- $ 31,000 USDT. $ 30,000 has proven to be very reliable support since May. A break from this level is likely to lead to a significant increase in volatility and a final capitulation of crypto assets. That said, BTC is still in the $ 30,000 to $ 40,000 rectangle until a definitive outage occurs, ”the Delta Exchange executive added.

What do you think of Bitcoin’s CFGI metric that exploits “extreme fear” and technical data from today’s Tradingview statistics? Do you agree with Pankaj Balani’s reliable support commentary? Let us know what you think of this topic in the comments section below.

Image credits: Shutterstock, Pixabay, Wiki Commons

Warning: This article is for informational purposes only. This is not a direct offer or the solicitation of an offer to buy or sell, nor a recommendation or endorsement of any product, service or business. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or allegedly caused by or in connection with the use of or reliance on any content, good or service mentioned in this article.

[ad_2]

Source link