[ad_1]

(Source: imgflip)

Due to reader demands, I decided to split into two parts my weekly series "Best Dividend stocks to buy this week".

One will be the weekly watch list item (the best dividend stocks to buy in a slowing economy). The other will be the update of the Deep Value Dividend Growth Portfolio (which beats the market by 4.1% after 11 weeks).

To also make these more digestible, I divide the introduction of the weekly series into a revised introductory and reference article on the 3 rules of using the margin in a safe and cost-effective manner ( which will no longer be included in these upcoming articles).

I also monitor updates to my new Bunker dividend growth portfolio (aristocrats and 100% undervalued dividend kings) every time this portfolio is changed.

Introduction to the high value dividend growth portfolio

I have spent 23 years trying to find an investment strategy that can consistently generate attractive returns that will allow me to achieve my dream of financial independence.

Although there are many wise investment strategies after five years as a professional analyst / investment writer, I have determined that for me (and for many of my readers) , three approaches worked better.

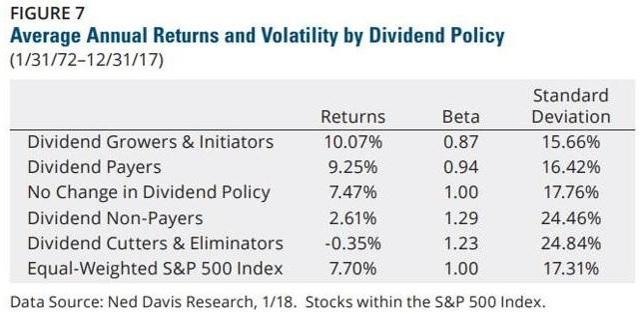

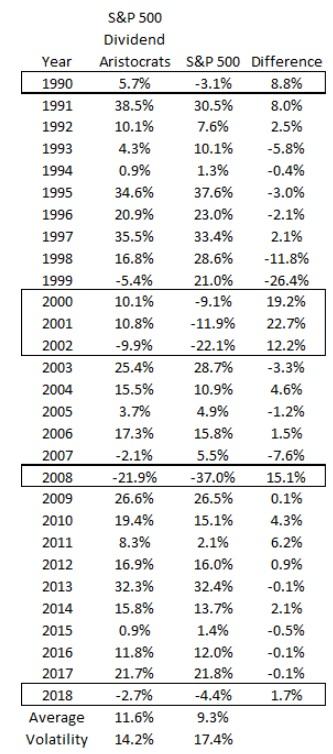

First, I focus on dividend-paying stocks because, historically, they have tended to outperform the market significantly, both in absolute terms and as a function of risk (total return / volatility).

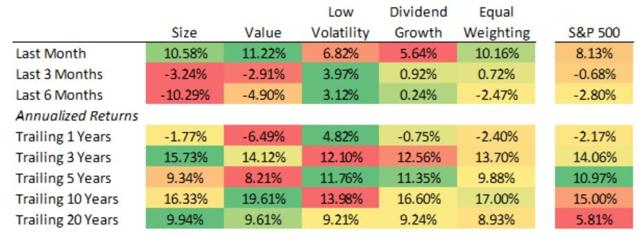

Second, I add a value-oriented approach ("be greedy when others are scared") because, just like dividend growth, value is a proven alpha factor that generally beats the market in the long run.

(Source: Ploutos Research) – record data until January 2019

Finally, I target low-risk dividend stocks, especially those that sleep well at night or SWAN's blue swips (such as aristocrats and dividend kings) because they have demonstrated a remarkable ability to generate secure and rising revenues. constant, as well as unparalleled performance on the market. total long-term returns.

(Source: Research Ploutos)

This is because equities are generally held during a bull market but less downward during declines. In other words, low risk dividend growth stocks manage to outperform not by "hitting the grand slam" but by "avoiding scratching".

What evidence do I have of such a low-risk, value-driven dividend growth approach can beat the market over time?

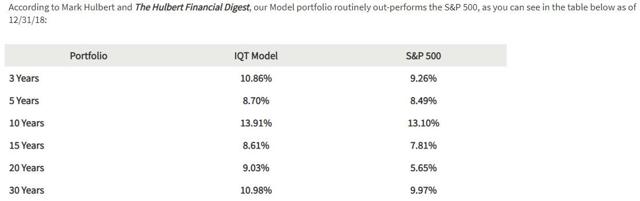

(Source: Investment Quality Trends)

Because the asset management company / newsletter publisher, Investment Quality Trends uses since 1966 a pure valuation approach focused solely on first-class dividends (based on six quality criteria) and has managed to consistently exceed market of about 10% with a lower volatility of 10%. .

An annual outperformance of 1% for 30 years does not seem like much, but only 7% of mutual fund managers can even match the S & P 500 over 15 years. By beating the market by 1% in 30 years, IQT is one of the elite managers / professional fund analysts.

I apply the same system to companies such as start-ups, as well as REITs, YieldCos and MLPs, which, because of the 25 years of continuous dividend requirement imposed by IQT, exclude this type investment of their recommendations.

Overall, my investment strategy can be summarized as follows:

- Only buy deeply undervalued blue chips (off my watch list) during a downturn in the markets.

- Save 50% of weekly cash (invested in treasury bills or long-term treasury bond ETFs) and wait for withdrawals / corrections / bear markets.

- When withdrawing (on average one every six months since World War II), deploy 50% of the cash (bond sales) in stages.

- If the withdrawal becomes a correction, deploy 50% of the remaining funds (in stages).

- If the correction becomes a bear market, roll out the remaining 50%.

With this approach, I will be able to avoid holding cash for years (with market downturns being common) and still buy high-quality, undervalued dividend growth stocks at very attractive valuations.

I also plan to dedicate monthly 50% of my real savings to the growth opportunities of the highest undervalued dividends, the remaining 50% providing liquidity allowing market withdrawals (more information about this in a moment).

I use the same total return-adjusted return model used by Brookfield Asset Management (BAM), and they have an excellent CAGR total return track record of 12-15% (in fact, it is their official goal as a company and exceed this goal).

There are four carefully prepared lists designed to focus on:

- Quality companies

- Safe dividends (these are all low-risk stocks)

- Good long-term growth potential

- Good safety margin (attractive ratings)

The portfolio also uses size ceilings for risk management purposes (in the event of a break in a thesis)

- sectoral ceiling: 25%

- ceiling of the industry (like tobacco): 15%

- individual capital: 5%

It is currently a paper portfolio that I manage on Morningstar and Simply Safe dividends in order to not only provide detailed portfolio statistics, but also total return over time. The rules for the portfolio are:

- Every month, I buy for a value of $ 500 (rounded to the nearest whole share) of all existing portfolio positions that remain on the list of active purchases (fair value or better).

- Every week, I buy for $ 500 worth of new stocks that appear on the watchlist "Top 5 Largest High Yield Companies, Aristocrats / Kings" (stocks alternate alternately). But only if the long-term total return potential is 13 +%, which is the official portfolio cut-off.

- If opportunistic buying opportunities appear (like a 5% crash and more than a day due to a loss of revenue), I can then increase the purchase of the next month.

- Dividends are reinvested.

- The shares are sold only if the thesis is broken or if a stock is overvalued by 25% (then sold half) or overvalued by 50% (total sale), and the capital is reinvested in new active recommendations.

Again, this is purely a tracking portfolio (template). I do not really put money there until the end of 2019 or the beginning of 2020, once I have eliminated all the margins of my wallet and started saving money. (in the form of very short-term or long-term bonds, depending on the state of the economy).

The reason I monitor this portfolio is to determine whether the best use of my savings in the future is to combine an average of 50% of the cost in dollars and 50% of opportunistic purchases during a recession, or a concentration 100% on recessions only.

The end of 2018 (the worst correction in 10 years) was an ideal time to buy quality dividend growth stocks at very attractive prices. The first DVDGP returns were sensational (low profit in December and up 10% in January from the 8% rise in the S & P 500 index in January), mainly due to the start of the portfolio then valuations were at their lowest level in years. But many investors also want to use their cash flow consistently. Our monthly method is to simulate and test the amount of alpha generated by this investment system in a rising market (exceeding 500% S & P 500 index from February to date) .

In the end, DVDGP represents the culmination of my 23 years of experience and is designed to be a growth portfolio of safe income that almost everyone can use. In other words, if I were managing a pension / endowment fund, here is what the equity portion of this portfolio would look like. Thus, it is also safe for most readers, because most of its assets are "widows and orphans", including many aristocrats and kings dividenders.

How can you use DVDGP? Primarily for investment ideas, and not necessarily to follow it (it owns 76 companies and most people prefer a more concentrated portfolio). As an analyst for Simply Safe Dividends (which conducts research on more than 200 companies a year), I am creating a smart beta ETF with DVDGP. Whoever produces twice the S & P 500, has a faster dividend growth and should be able to outperform it with a large margin over time (or at least my total return model says that's why I'm testing it ).

If the strategy works as well as expected, I could work with Brad Thomas and Chuck Carnevale to make it a closed-end fund. This would allow investors to take advantage of the portfolio while avoiding the problems that fund managers encounter with redemptions, forcing them to sell when markets are falling while they should be buying instead.

Consider DVDGP as a quality selection tool and a leading watch list of dividend stocks that I consider worth having for most investors. Then use it to help you build your own watch lists and then buy them when they reach a fair value or better.

4 opportunistic purchases last week

I added $ 500 to the following companies.

- Enbridge (ENB) – existing position

- Thor Industries (THO) – existing position

- General Dynamics (GD) – Existing Position

- Lowe's (LOW) – Existing Post

Enbridge was purchased after a 6% decline after announcing a one year delay in the Line 3 replacement project, representing approximately 50% of its growth backlog. However, since the Minnesota Public Utility Commission granted the certificate of necessity (and unanimously rejected the demands of the ecologist to reconsider), and that the company has obtained a servitude of 20 years with all the tribes involved on which the pipeline should be built, any delay has a low risk of permanent cancellation of the project.

Rather, it is a situation of "guaranteed approval arriving a little later than expected", according to which the analysts (and myself) do not think to have an impact on the expected increase of the dividend by 10%. the company in 2020 or medium-term growth forecasts of 5% to 7%.

Thor Industries plunged up to 11% the day it announced results that disappointed Wall Street and offered moderate advice, as its CEO said

While dealers continue to rationalize their inventory levels after seasonal order patterns and unusually high wholesale shipments in the first nine months of fiscal 2018, the company has taken steps to adjust its levels of inventory. production accordingly. A number of Thor production facilities have reduced their unit production rates, while others have moved to a four-day production week. "

Thor is a naturally cyclical company, operating in an expensive consumer discretionary sector that results in high volatility in sales and cash flow. The valuation method I use takes this into account and I am not afraid to take cheap stock when the market is worried about the future drop in sales.

Lowe's was added after making his debut in the top 5 dividend list on which DVDGP is based (it reached # 3). Whenever an action enters its top 5 respective tracking list, we add more.

General Dynamics entered the adjusted list of "Top 5 Dividend Aristocrats" after increasing its dividend by 9.7% (27th consecutive annual increase), and the stock had a poor week.

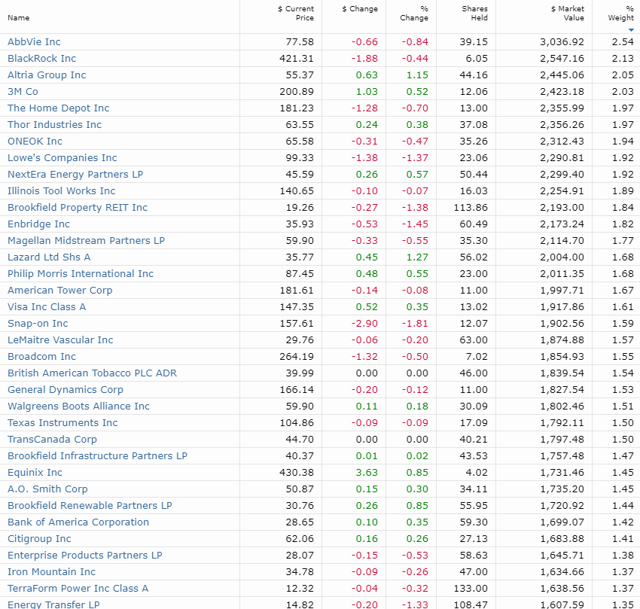

The Deep Value Dividend Growth Portfolio – 77 Total Investments

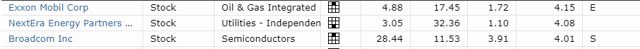

(Source: Morningstar) – Data at the close of March 8, CWEN is no longer held by the portfolio as I sold it before the dividend was reduced by 40%.

High yield stocks (yield of 4% and above)

(Source: Morningstar) – data as of March 8

(Source: Morningstar)

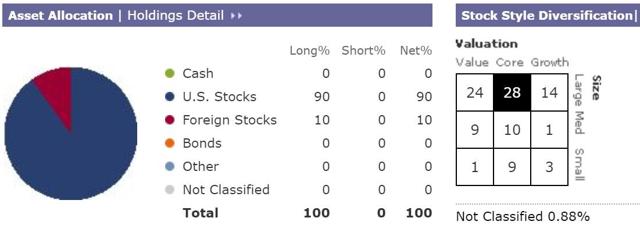

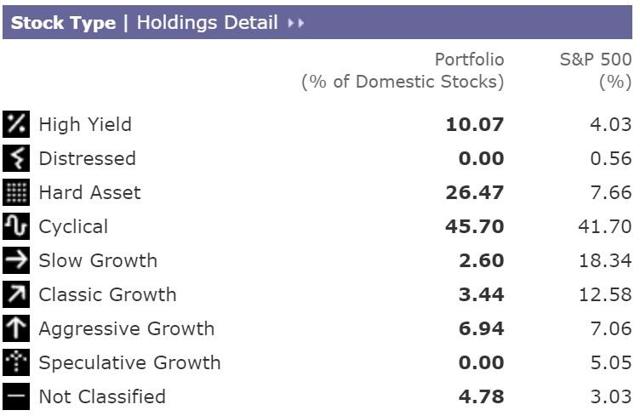

We focus primarily on US large-cap dividend stocks, with the objective of this portfolio being only to hold low-risk SWAN shares. Low risk is defined as a low risk of dividend reduction during a recession. Note that in fact, many of our large-cap blue-chips are making significant sales abroad, so we are largely exposed to the global growth markets.

(Source: Morningstar)

Due to the preference for undervalued stocks, we are overweight high yield companies, durable assets and cyclical companies.

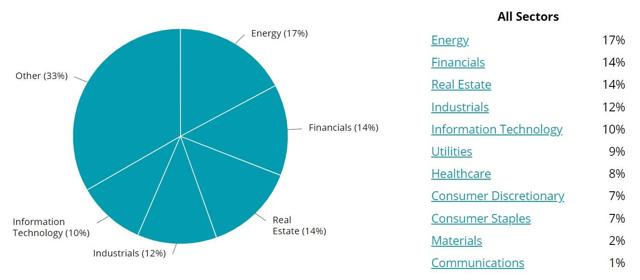

Sector concentration (25% of sector ceilings, 15% of sector ceilings and 5% of company ceilings in place)

(Source: Simply Safe dividends)

I impose ceilings on companies to ensure good risk management. As good as business is, it's never a good idea to let your portfolio become too risky. Since most of our energy stocks are mid-market companies or MLPs, I will limit this sector to 20% in order to limit exposure to this sector to 15%.

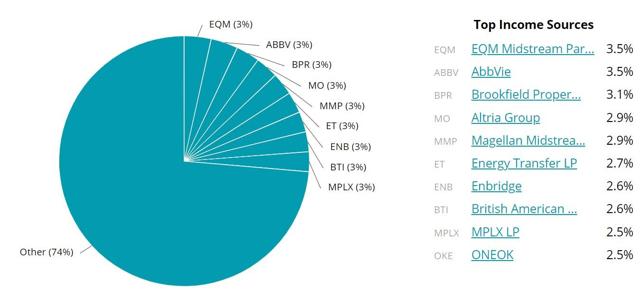

Concentration of income

(Source: Simply Safe dividends)

Portfolio income should focus on the most profitable stocks, at least until it becomes more diversified over time. Generally, you want to limit the income of a position to 5% or less. We have now achieved this goal in DVDGP.

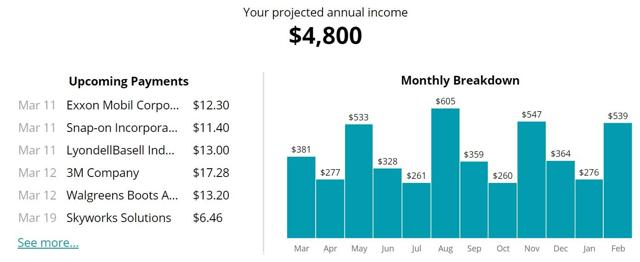

Annual dividends

(Source: Simply Safe dividends)

Although we may never fully realize the dream of paying dividends on a daily basis, we are currently paid weekly. And the monthly income stream will smooth out over time.

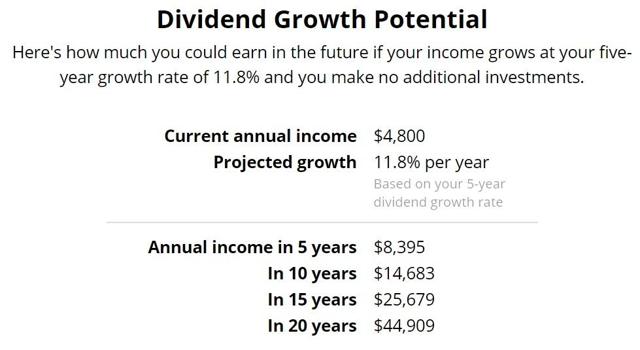

(Source: Simply Safe dividends)

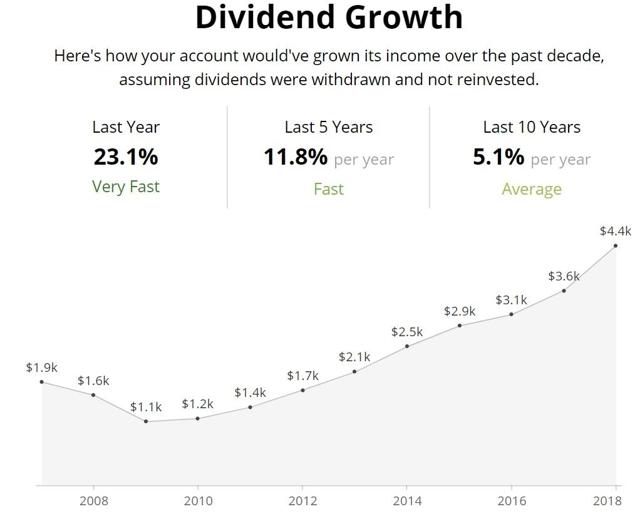

Note that the 10-year dividend growth figures are artificially low because my tracking software does not average anything that did not exist since those periods. Some of these stocks have been floated over the past five years, and as a result, the one- to five-year growth rates are the most accurate. These figures are purely organic and do not assume any reinvestment of dividends.

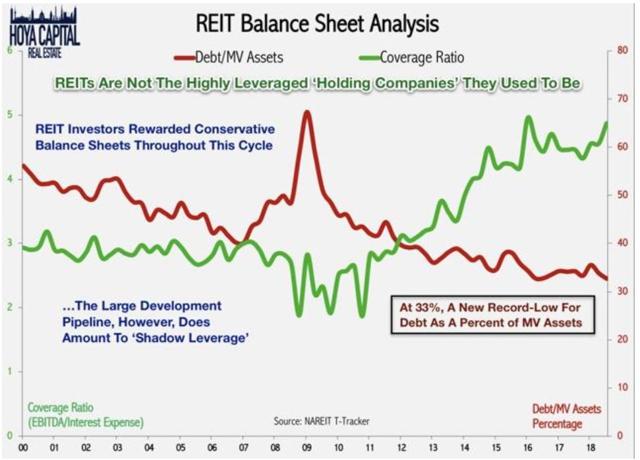

Declines in dividends during the financial crisis are due to REITs (such as Kimco and Simon), which reduced their dividend (as 78 REITs did during the Great Recession), as well as our strong exposure to mega-banks . Fortunately, since then, the REIT sector has been deleveraged and has the strongest balance sheet in its history.

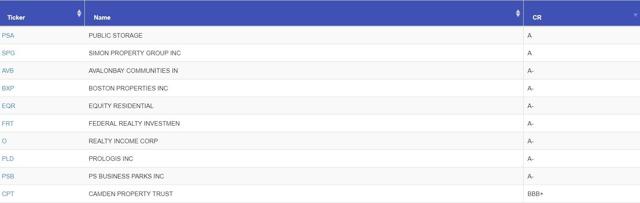

(Source: Hoya Capital Real Estate)

This means that during the next recession, most REITs will have do not have reduced their payments, especially Kimco, which has a credit rating of BBB + and will get an upgrade to A- in 2019 or 2020. Simon is one of two REITs having an "A" credit rating .

Main credit ratings of REITs (S & P)

(Source: F.A.S.T.Graphs)

Likewise, I am convinced that every bank we own (C, JPM, BAC, GS, HOMB, ABCB) will keep its dividends during future recessions (even if they risk being frozen).

There is no official dividend growth objective, although I would like to at least maintain a long-term dividend growth (1 year or 10 years), which is above the rate historic growth of 6.4% of the market. The jump in the year-over-year dividend growth rate is attributable to some of our semiconductor stocks, many of which have increased their dividends by more than 100% in the last 12 months.

(Source: Simply Safe dividends)

While maintaining dividend growth of 11.8% for 20 years is likely beyond the portfolio's potential, according to Morningstar, the projected growth rate of EPS (and therefore likely dividend) is approximately 12% for all five coming years.

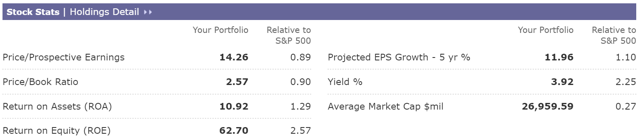

Fundamental Portfolio Statistics: (total return potentials are from current levels)

- Cost of return: 4.3%

- Yield: 4.0%

- Expected dividend growth over 5 years: 12.0%

- Expected total return over 5 years (no change in valuation): 16.0%

- Portfolio valuation (Morningstar DCF models): 12% undervalued

- Expected increase in valuation over 5 years: 2.7% CAGR (20% error margin)

- Expected valuation over 10 years: CAGR of 1.3% (margin of error of 20%)

- Adjusted total return potential of valuation: from 17.3% to 18.7% (historical market yield of 9.1%) – 20% margin of error

- Total return adjusted for the expected margin of error: 13.8% to 22.4%

- Portfolio beta: 1.03 (3% more volatile than the S & P 500 index)

(Source: Morningstar)

The quality of these companies is reflected in the asset and equity returns of this portfolio, well above average (good substitutes for long-term quality management and good corporate culture), as well as growth rate of projected profits faster.

DVDGP is also much more undervalued, offers a much higher yield and should generate much higher dividend growth than the broader market. This is due to the fact that US companies are putting more emphasis on buybacks as opposed to dividend increases for most non-dividend paying companies.

Another additional benefit is that the average market capitalization is smaller, which is an additional alpha factor (smaller stocks tend to outperform). It should be noted that the focus is primarily on blue chips, which means that the average market capitalization will likely increase over time (while remaining well below the market average of $ 100 billion).

Portfolio performance

- CAGR total return since inception (December 12, 2018): 10.3%

- CAGR Total Return S & P 500: 6.2%

- Outperformance of the market: 4.1%

- Long-term outperformance objective: 2 +%

- Since the beginning of the year: 8.5% against the S & P 500 10.1%

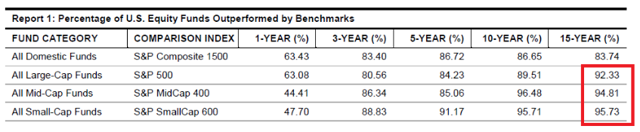

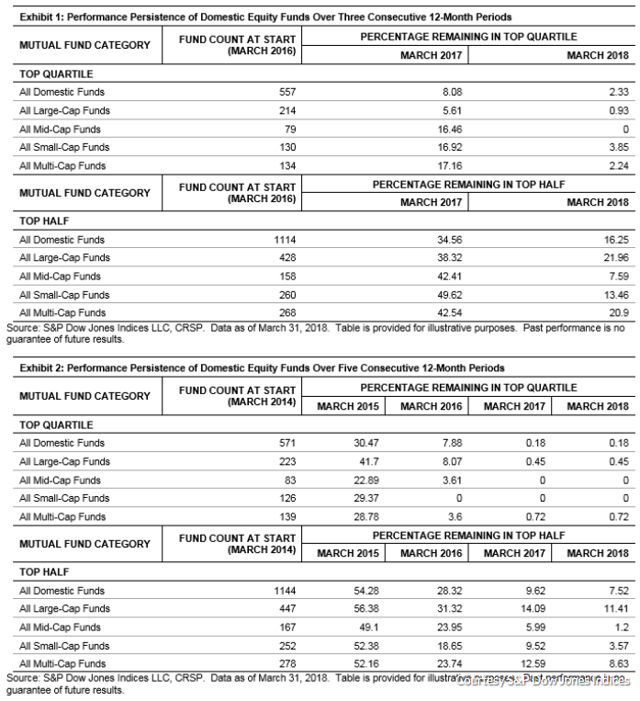

(Source: American Enterprise Institute)

Beat your goal is extremely difficult, even for professional fund managers. Indeed, the "hedge funds" see the new flows of money multiply, which makes it more difficult to recreate this success the following year.

(Source: S & P)

In addition, during the market downturn, retail investors withdraw funds, forcing professional fund managers to be forced sellers instead of acquiring fantastic valuations. Thus, only 0.45% of mutual funds remain in the top quartile of performers for five consecutive years.

That's why DVDGP is a no-margin portfolio, which uses stable cash inflows (simulating regular and high savings) to make opportunistic purchases. There is no guarantee that the strategy will beat the market over time, but avoiding the biggest traps of active fund managers means we have a very good chance.

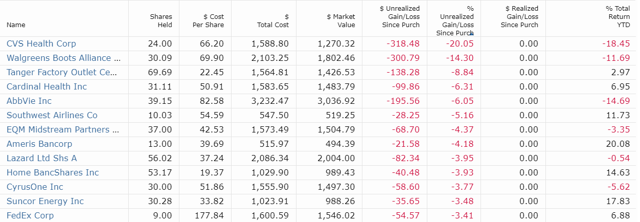

Worst performers

(Source: Morningstar) data as of March 8

The good news is that because of our monthly additions to all stocks that remain active buying recommendations, the more stocks fall in the short term, the lower our cost base will be.

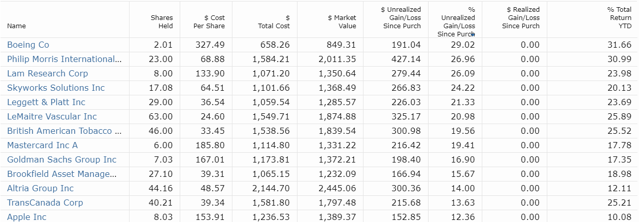

Best performers

(Source: Morningstar) data as of March 8

The disadvantage of our approach to average dollar costs is that we are also raising our cost base for the first winners. That is why I am testing the DCA approach to see if it can continue to generate alpha outside of sharp market declines.

However, since we only buy companies with good or excellent valuations, we should be able to generate very high returns. In fact, winners tend to continue to win, which allows them to keep the portfolio well balanced and avoid over-growing with companies that are irrelevant and that can cause very long underperformance.

This is why monthly DCA purchases are mainly based on the target returns of the DVDGP Bear Market Buying List.

Conclusion: So far, the highly diversified value-based approach works well

I am not surprised that the portfolio has moved away from its outperformance of more than 10% before the market began to fall. This huge alpha was due to the penetration of economically sensitive and cyclical sectors, such as energy, finance and industry, just before they stormed. a speed higher than the market.

The slowing of economic fundamentals is causing these same sectors to retreat, resulting in the kind of reversion of the alpha that I expected. However, I am still satisfied with the strategy, including adding opportunistically each month via an accelerated DCA approach.

When my margin will be gone by the end of 2019 (it would have risen to a high of $ 139K at the end of November, at $ 73.9K), I will be using DVDGP Watchlists to use 50% of my monthly savings, while keeping the other half. to deploy during corrections and down markets.

I find that this approach is a good compromise between putting your money to work right away (the time spent on the market is more important than the market timing) while respecting the fact that, in times of extreme pessimism and fear, even high-quality blue chips trade at obscene valuations.

Disclosure: I am / we are long ENB, KIM, BPY, BLK, ITW, TXN, AOS, AAPL, ABBV, BEP, MMM, LEG, WBA, EPD, MMP, AND, GS, XOM, MPLX, V, MA, BEEP, TERP, IRM, HD, SWKS, PM, OKE, C, AMT, BAM, LRCX, JPM, BAC, AMGP, LYB, BTI, TU, SPG, AMTD, BA, CONE, LOW, BMY, AMP, QTS, AY, EQIX, SWK, EPRT, GD, D, LAZ, QCOM, CVS, VOD, APD, AMP, HOMB, SYF, OMP, NBLX, EQM, SU, ABCB, LUV, PEGI. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link