[ad_1]

The tidal wave of money flowing from index funds and ETFs has always preoccupied the asset management industry. With minimal commissions and often higher returns, these fund vehicles now pose an existential threat to asset managers.

These concerns now range from career risk to market risk. Michael Burry, the hedge fund manager who became famous thanks to Michael Lewis's book The big court (and was then interpreted by Christian Bale in the film version), recently compared the index funds to toxic CDOs, he who made so much shortfall when the housing bubble burst. Burry says that flows in index funds distort the stock and bond markets and that when these flows reverse, "it will be ugly".

In 1991, the legendary hedge fund manager, Seth Klarman, called indexation a new style of Wall Street. "When that happens," he said, "the prices of the securities included in the popular indexes will almost certainly fall relative to those that were excluded.When the market trend will reverse, match the market will no longer look as attractive, affect the performance of indexers and further exacerbate the rush to exits. "

These comparisons are therefore nothing new among large traders. Nevertheless, individual investors need to be very careful when they read in the newspaper accounts of famous investors calling for a crash, especially when it comes to funds in which so many investors invest. people. But worries about a bubble in passive investments are exaggerated. Here's why:

No scam fees, no problem

It's strange that some people think it's kind of a bad thing for investors to transfer money into funds that:

- save money in fees

- are more tax efficient

- have lower turnover and trading costs

- beat the majority of actively managed funds in the long run

- are simpler and easier to understand than most investment strategies

It is also strange to call the idea that more investors are actively avoiding alpha research by thinking and acting in a long-term perspective. It's like worrying about McDonald's sales if we all had to eliminate junk food.

Would it not be more worrisome for investors to embark on the opposite scenario of high-cost, inefficient, and consistently below-average funds?

The tail does not move the dog

There is a lot of noise around mutual funds and ETFs. But, in fact, the property of the stock market goes far beyond these two vehicles. Vanguard's founder, John Bogle, provided a breakdown of the ownership of the index in his latest book:

Yes, US index funds have grown to a gigantic size. Their holdings of US equities doubled from 3.3% of their total market value in 2002 to 6.8% in 2009, and then doubled again to about 14% in 2018. Other mutual funds currently hold about 20% of the shares of companies, bringing the total mutual fund to nearly 35%, the largest holder of common shares in the country.

Index funds therefore represent less than 15% of share ownership of public companies. And, according to former Vanguard CEO Bill McNabb, the indexation on stocks and bonds globally represents less than 5% of global assets.

That said, it is not at all challenging to ask: why are people not more worried about active managers? Surely they are just as likely, if not more so, to torpedo the markets. No?

Vanguard and iShares have experienced massive growth over the past two decades, recording billions of dollars in inflows. But that does not mean that indexing is a totally new phenomenon. It has just been packaged in a cheaper package.

Professional money managers have been monitoring their benchmarks for decades. The result? These ETFs and ETFs are rapidly becoming benchmarks for active fund managers. In addition, very few actively managed funds move far away from these benchmarks, as this difference may result in underperformance. And that 's what makes you get fired in the asset management industry.

Career risk is perhaps one of the biggest market inefficiencies, rarely mentioned. And as career risk is a sustainable reality, indexing to the closet will be with us for a while.

Pensions and other large institutional investors add to the phenomenon. They have been creating their own index funds internally for years. We are just witnessing a change in the institutional practice of parallel indexing in favor of a buoyant market for ETFs and other index funds, as investors have weakened.

Is not it a good thing that investors are turning away from expensive index funds?

Active funds literally own the market

When you buy an index fund from the total stock market, you literally buy the stock market in proportion to the shares held by all active investors. If you summarize the collective holdings of active managers, you essentially get a capitalization-weighted index. Investors in index funds simply buy what active investors have presented to them.

In addition, we must remember that every penny paid in index funds does not go directly to the S & P 500 or a total market fund. Most of the money goes, but there are also index funds for small caps, mid caps, value, growth, sectors, themes and everything in between.

Most concerns about indexing come down to career risk in the asset management field. By withdrawing from the game through the direct purchase of index funds, there are now fewer suckers at the poker table for the pros to enjoy.

Is not it a good thing when most small investors have decided not to worry about competing with active professional managers who, in fact, are trading primarily between them?

The discovery of the prices is a derobade

Do not feel sorry for the active management community. It will never stop completely. It's far too lucrative and tempting for Type A personalities to prove themselves.

However, investors are concerned that, as index funds continue to gain market share, the price discovery mechanism may become fragile. It does not make sense. There are many price discoveries in the markets. In fact, you could probably say there are too many cases right now.

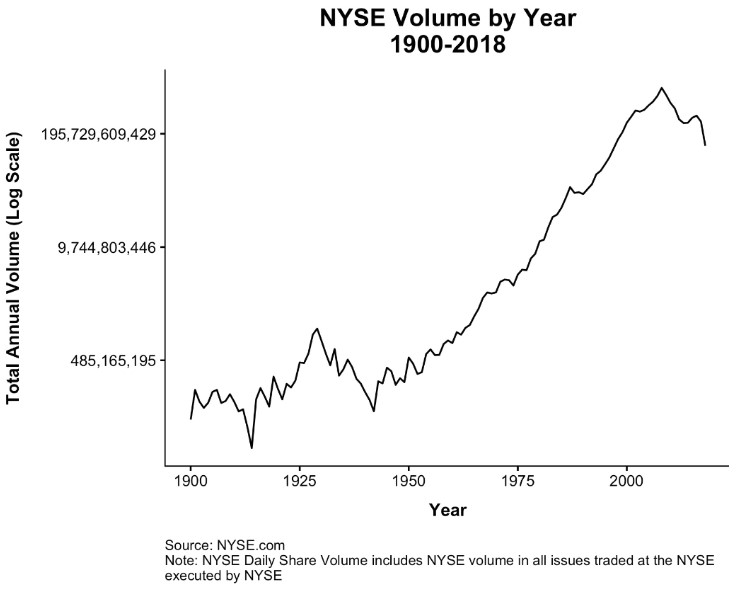

About fifty years ago, for example, the total volume of transactions on shares listed on the New York Stock Exchange rose to 3 million shares. Today, Apple has an average transaction volume of about 26 million shares a day. Facebook generates an average of more than 16 million shares a day. The largest Exchange ETF (SPY) averages close to 70 million exchanges per day.

Active managers will be always set prices, no matter how many there are. Charley Ellis wrote in his book The index revolution, this indexation represents less than 5% of transactions, the remaining 95% being made by active investors. This will always be the case regardless of the amount of money paid into the index funds.

Here is the volume of NYSE by year:

Mind you, I'm not complaining about the increase in volume. This is a good thing as it reduces transaction costs and decreases bid / ask spreads.

But what is the most worrying trend for individual investors – people who have decided to bargain less or people who have decided to negotiate more?

Yes, index funds are free riders, but what?

Cliff Asness wrote a few years ago for Bloomberg a wonderful article on the idea that index investors are free riders:

The use of price signals by those who have played no part in their determination is perhaps the most important characteristic of capitalism. The fact that most of us, and most of our dollars, do not have to choose stocks, or price the air conditioners, is a huge advantage, and taking advantage of it makes us intelligent capitalists and intelligent, not commissioners. "

Yes, index investors are free riders, but that is how most markets work. We do not go to the grocery store to bid on the prices of oranges against each other to strike a balance. The market does it for us.

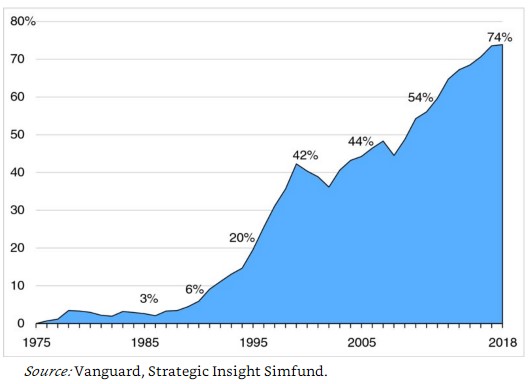

It should also be stressed that the success of indexing does not mean that any active management is inherently useless or bad. In fact, Vanguard remains a ton of money in active funds. Here is the breakdown of the assets in the index funds of the company (also taken from Bogle's book):

The trend is easy to detect, but the company still has more than $ 1 trillion in actively managed funds. They simply manage their active funds using strategies that use low turnover, long holding periods and below-average fees.

Would it not be a net benefit to the ultimate investor if the push for indexing forced the asset management industry to adapt?

Liquidity is not a problem for index funds

One of the big problems is knowing what happens if all those who have accumulated these funds in recent years decide to reverse the course and rush to the outputs at the same time. There will always be investors who panic when markets fall, regardless of the type of fund they invest in.

When an investor in an index fund sells, he technically sells his holdings in direct proportion to his weighting in the index. The impact on the market is therefore stifled. It's worth repeating: investors in index funds simply hold shares in the proportion that all active investors own shares.

In addition, index funds never increase your assets. They never receive a margin call. They do not place 30% of your holdings in Valeant Pharmaceuticals. And no index fund has ever closed to spend more time with his family.

Why, then, would index funds or ETFs be different from any other type of fund or any other security in this regard?

People love to add a story to the ups and downs of the markets. Index funds are the ideal scapegoat in a rising market for 10 years and have outperformed all other strategies. It will not last forever. But the next time the market recovers, it will have more to do with investors than index funds.

Do you know what made do not cause the Great Depression, or the stock market crash in Japan, or the crash of 1987, or the bear market of 1973-1974? Index funds. Index funds were not present either for the bubble of the South Sea of the 1700s.

You know what made cause these historical bubbles and accidents? Human nature.

Could the stock market become a bubble again? Of course. There will always be bubbles.

Are index funds perfect? No, they give you all the benefits of the stock market. And all the disadvantages. And indexes can not go anywhere for years, just like individual stocks. They can become too expensive and cheaper. They own good and bad stocks.

But it's not new. This is the stock market for you.

This passive talk about bubbles is silly. Wake me up when index funds control 90% of the stock market.

Ben Carlson, CFA, is Director of Institutional Asset Management at Ritholtz Wealth Management.

More stories to read absolutely Fortune:

– CEO of Deutsche Bank on the European Central Bank: "Negative rates ruin the financial system"

-September is historically the worst month for stocks. Will 2019 follow the pattern?

-Why next recession may look very different from 2008

-Here's what it would take to get to "win-win" with China on trade

– "Zombie" companies are on the rise and could pose a threat to the US economy.

Do not miss the daily Conditions sheet, Fortune's newsletter on offers and builders.

[ad_2]

Source link