[ad_1]

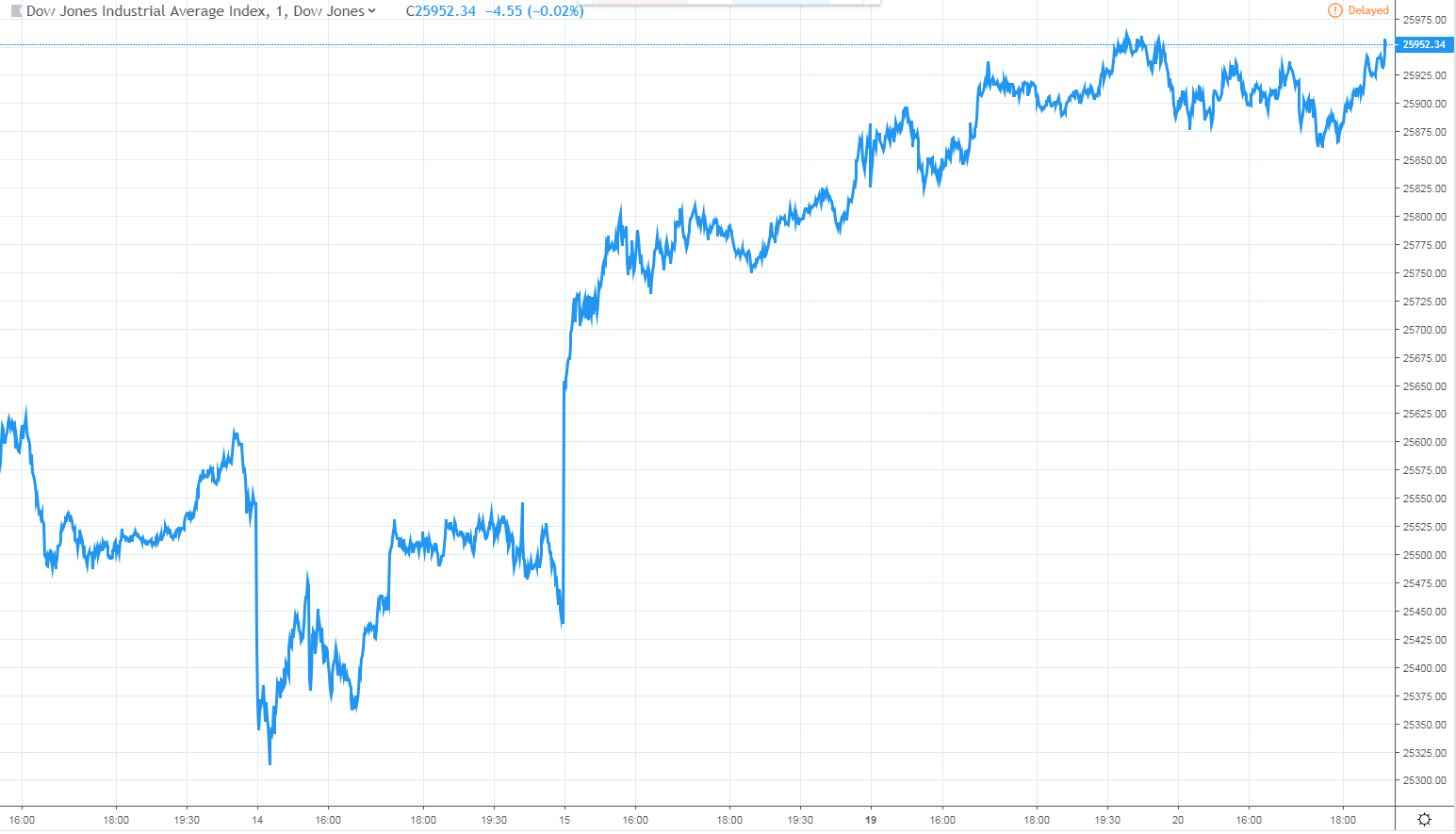

The Dow maintained its gains on Wednesday afternoon after the release of the minutes of the Federal Reserve meeting, which confirmed the central bank's intention to suspend its interest rate hikes.

DOW HOLDS GAINS, NASDAQ BECOMES RED

The Dow Jones Industrial Average rose 61 points, or 0.2%, to 25,952.32. The first-order index rose slightly early in the morning, reflecting a tepid pre-market session for Dow futures.

The broad S & P 500 index climbed 0.1% to 2,782.29, with the bulk of gains being concentrated in the primary industries. Inventories of raw materials increased by 1.4% on average, while energy shares rose by 0.5%. Inventories related to real estate, consumer staples and health care posted losses.

At the same time, the Nasdaq Composite Index reversed its gains, down 0.1% to 7,480.35.

The recovery in stock prices in eight weeks has reduced market volatility, according to the CBOE VIX. The most widely used measure of investor anxiety fell 3.3% on Wednesday to 14.39. This is the lowest level since October 4th. By comparison, the VIX has historically traded above 20.00 and peaked north of 36.00 before Christmas Eve.

US stocks had their best start to the year in three decades, but this chart suggests difficulties for the S & P 500.

FOMC MINUTES CONFIRMS THE RATE-RIKE BREAK

Federal Reserve Chairman Jerome Powell announced last month that interest rates will remain unchanged for the moment. | Source: Shutterstock.

At 14:00 ET, the Federal Reserve released the official transcript of its January policy meeting, during which officials decided to keep interest rates unchanged. Members of the Federal Open Market Committee (FOMC) took a conciliatory tone at their meeting last month by reinstating wording referring to "patience" in their approach to tightening. This change comes after the December decline in the number of rate increases planned for 2019.

"Participants emphasized that, for the moment, a patient approach to monetary policy was an appropriate step in managing the various risks and uncertainties of the outlook," says the minutes.

The transcript reflects excerpts from the official policy statement published on January 30:

"In the light of global economic and financial developments and moderate inflationary pressures, the Committee will be patient as it will determine what future adjustments to the target range of the federal funds rate may be appropriate to support these results," he said. the press release.

Futures traders understood that this meant that no further rate hikes would be expected this year. The futures prices of federal funds involve a greater likelihood of a rate cut before another upward adjustment.

Five representatives of the Federal Reserve are due to deliver a speech in the second half of the week. On Friday, the central bank will release its latest monetary policy report.

The FOMC will not meet again until next month. The March rate statement will be accompanied by a revised summary of economic projections covering GDP, unemployment and inflation.

The selected image is a courtesy of Shutterstock. Chart via TradingView.

[ad_2]

Source link