[ad_1]

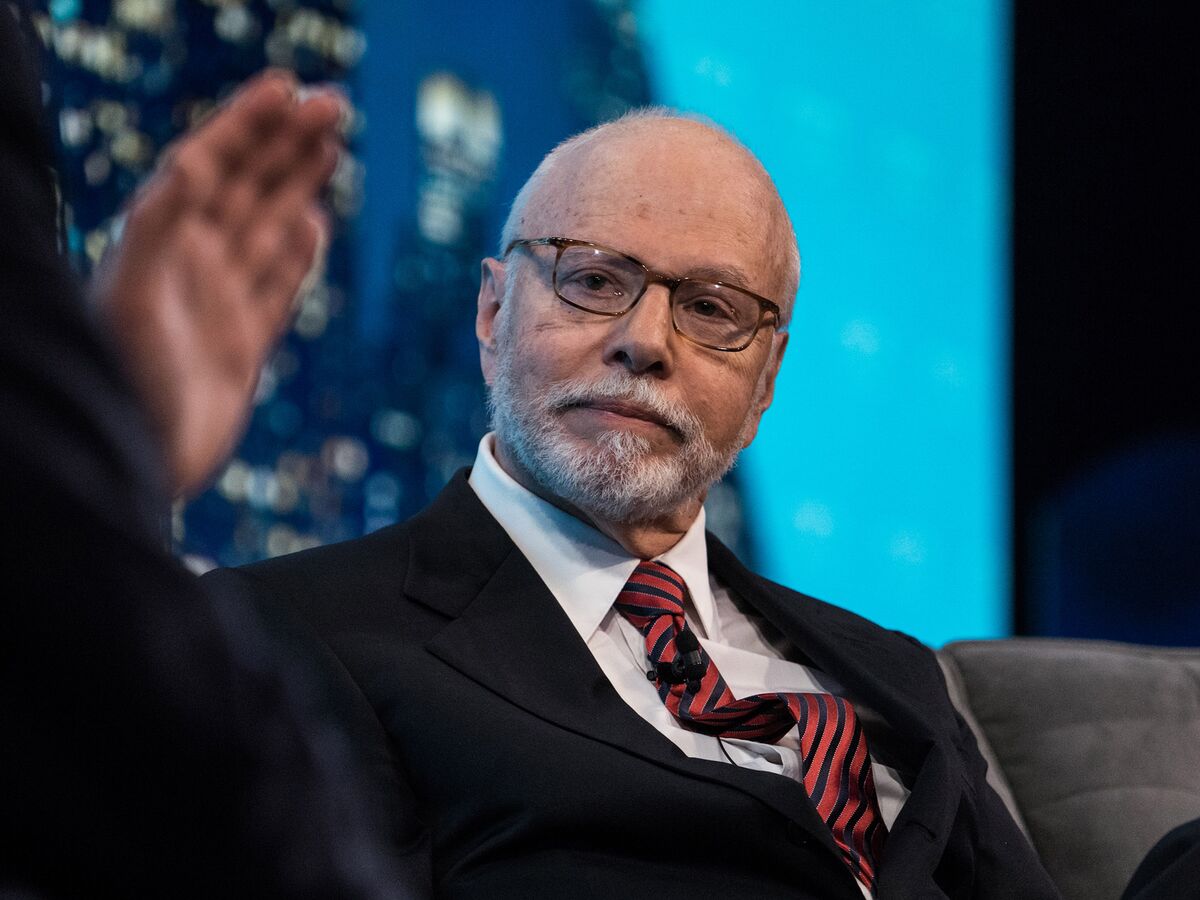

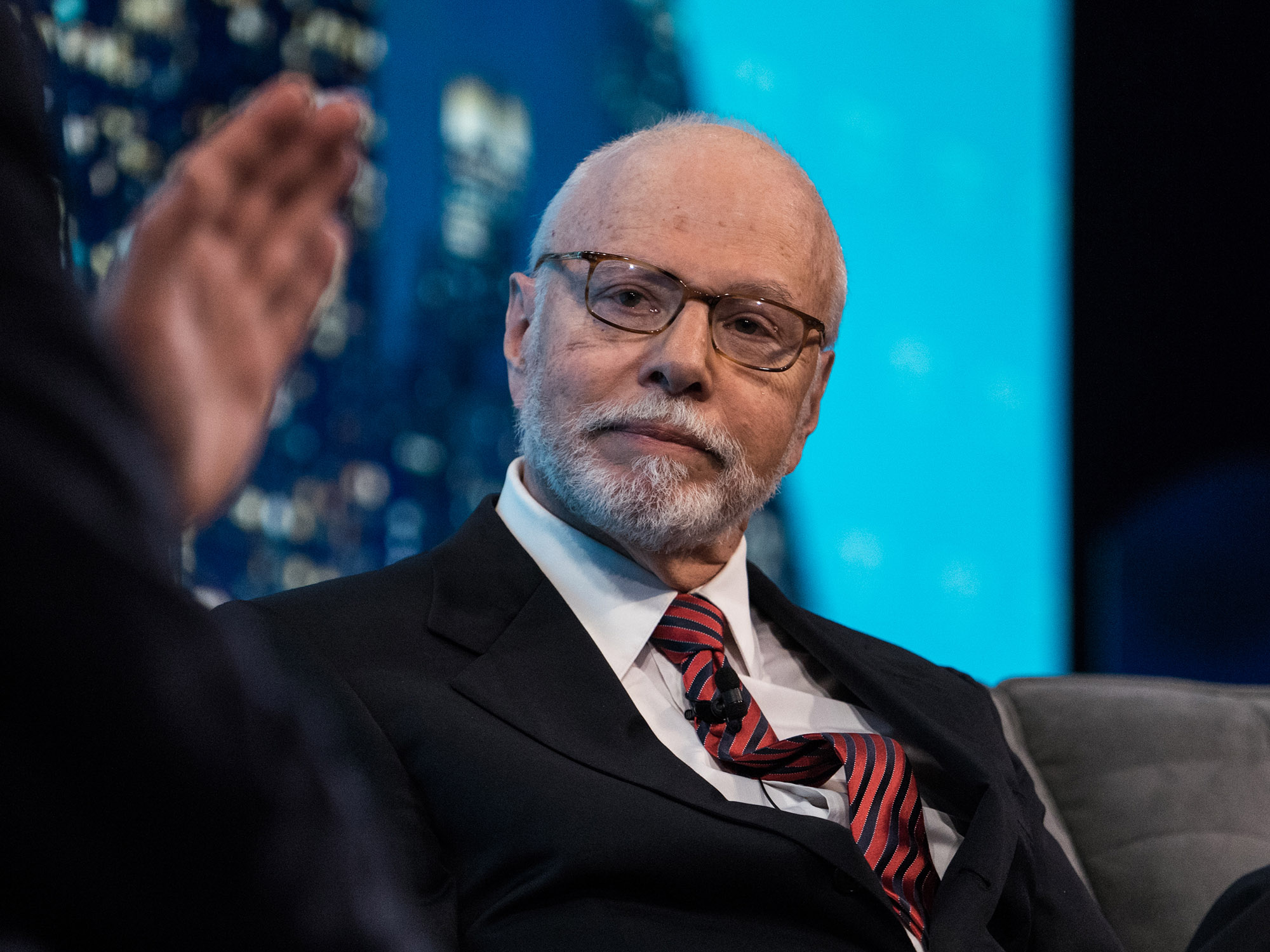

Paul singer

Photographer: Misha Friedman / Bloomberg

Photographer: Misha Friedman / Bloomberg

Elliott Management Corp., a hedge fund known for its activist shareholder campaigns, is meeting with bankers to raise more than $ 1 billion to fund a special purpose acquisition company, Dow Jones reported Sunday.

The process is at an early stage and plans could change, Dow Jones said, citing people familiar with the matter who have not been identified. Elliott, founded by billionaire Paul Singer, could use the proceeds to buy a company potentially worth billions in double digits, based on similarly sized targets that PSPCs have agreed to address, according to the report.

Once an obscure investment vehicle, PSPCs raised $ 83 billion on U.S. exchanges in 2020, representing about 46% of the total of all initial public offerings, according to data compiled by Bloomberg. This year, at least 117 PSPC have already raised more than $ 35 billion, ahead of another record year. PSPCs pool funds to fund merger and acquisition opportunities.

It’s unclear which industries Elliott might target, Dow Jones said.

Elliott, with over $ 45 billion in assets under management, has campaigned for change at some of the world’s largest and most prominent companies, including Twitter Inc., Softbank Group Corp., AT&T Inc., and others.

[ad_2]

Source link