[ad_1]

A few Tesla Inc. insiders have had a busy two days this week, including an investor who is close to CEO Elon Musk and again showing good timing in his transactions.

He’s the brother of Elon Musk, Kimbal Musk, a Tesla TSLA,

board member and entrepreneur, who sold $ 25.56 million in open market shares this week with all trades above $ 850, according to a filing.

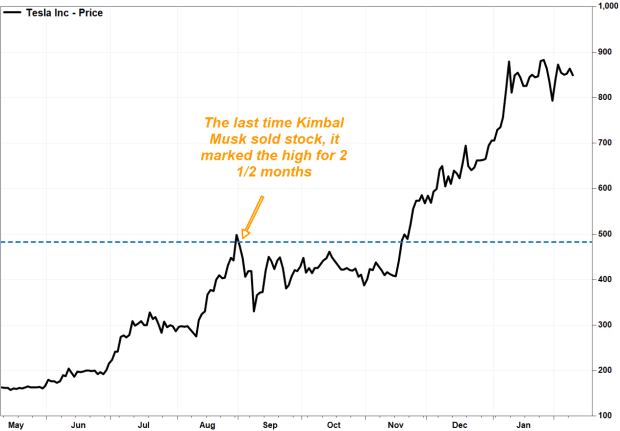

The last time Kimbal Musk sold shares in the electric vehicle maker, he also exercised options to buy the same amount, just at a much lower price. At the time, sales of Kimbal Musk appeared to be a high for action for more than 2.5 months.

FactSet, MarketWatch

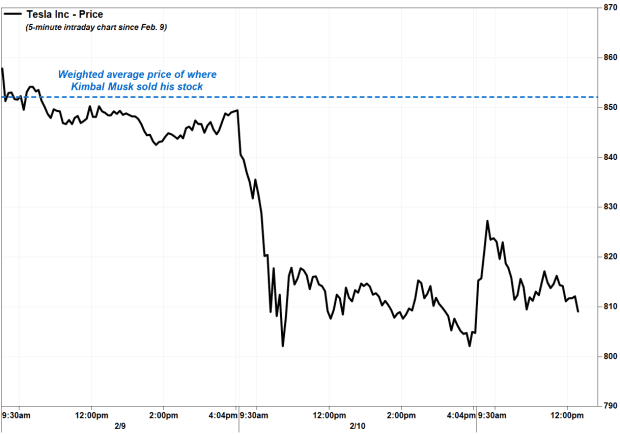

Kimbal Musk’s timing was also good this week. It sold its 30,000 shares on Feb.9 in a series of trades at a weighted average price of $ 852,117, according to a MarketWatch analysis of SEC data. The stock opened that day at $ 855.12 and traded in an intraday range of $ 859.80 to $ 841.75, before closing at $ 849.46.

Wednesday, the TSLA stock,

fell 5.3%, to an intraday high of just $ 844.82. It rose 1% Thursday at noon, but at $ 812.41 it was still well below where Kimbal Musk sold its stock.

Here are the jobs of Kimbal Musk:

• Sold: 7,971 shares at $ 850,277 (weighted average)

• Sold: 11,409 shares at $ 851,452

• Sold: 1,983 shares at $ 852,243

• Sold: 3,482 shares at $ 853,767

• Sale of 3,415 shares at $ 854,805

• Sold: 1,140 shares at $ 855,927

• Sold: 600 shares at $ 856,676

FactSet, MarketWatch

After the sale, Kimbal Musk still owned 599,740 Tesla common shares, or about 0.06% of the outstanding shares. His remaining stake is worth approximately $ 487.2 million in shares at current prices.

Tesla stock has risen 95% in the past three months, while the S&P 500 SPX index,

gained 9.6%.

Vanguard increases stake to become second largest shareholder

While Kimbal sold, the Vanguard Group revealed that it held 57.81 million shares, or 6.1% of the outstanding shares, according to an SEC filing Wednesday.

This now makes Vanguard the second largest shareholder, behind Elon Musk with around 18% and ahead of Capital Research & Management Co. with 5.5%, according to FactSet.

This means that Vanguard recently bought around 14.53 million Tesla shares, as the fund manager previously revealed that he owned 43.28 million shares, or 4.4% of the outstanding shares, as of September 30. . Prices paid for the shares were not disclosed.

Board member Antonio Gracias makes a pretty dime trading Tesla shares

In another SEC filing on Wednesday night, Tesla revealed that private equity investor Antonio Gracias, a long-time Tesla board member and close to Elon Musk, had acquired a total earlier this week. of 150,747 shares at a weighted average price of $ 58,149 per exercise of derivative securities. .

On February 9, the same day Kimbal Musk sold his shares, the record shows that Gracias sold 150,747 shares in a series of transactions. However, he didn’t do as well as Kimbal Musk, as he sold his shares at a weighted average price of $ 846,591.

Still, Gracias made $ 118.86 million on deals.

Here are the professions of Gracias:

• Vested: 97,000 shares at $ 52.38

• Vested: 53,747 shares at $ 68.56

• Sold: 1,930 shares at $ 842,596 (weighted average)

• Sold: 13,256 shares at $ 843.51

• Sold: 22,036 shares at $ 844,372

• Sold: 22,122 shares at $ 845,364

• Sold: 19,320 shares at $ 846,381

• Sold: 19,039 shares at $ 847.36

• Sold: 34,023 shares at $ 848,404

• Sold: 18,588 shares at $ 849.32

• Sold: 433 shares at $ 850,346

After the transaction, Gracias held 2,545 Tesla common shares.

–Steve Goldstein contributed to this report.

[ad_2]

Source link