[ad_1]

As a Seeking Alpha reader, you may have heard many articles about the oil revolution in the United States, and you are aware of the explosion in oil and natural gas production that is a direct result of the progress in oil and gas production. shale fracturing and horizontal drilling. We do not intend to write much if not more on this subject than to say it, our independent studies strongly suggest that all this is really true. America is really about to become the world's largest producer of oil and petroleum. America is poised to become one of the world's largest exporters of oil (light and crude crude oil) and natural gas via LNG.

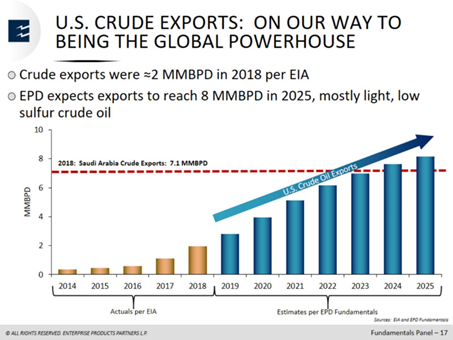

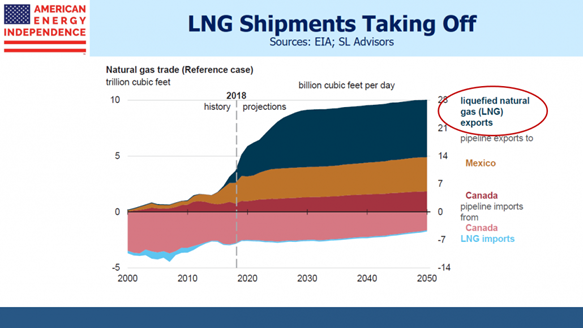

Here are two charts that show that US oil exports are about to quadruple and that LNG exports are about to increase by 500% or more in the coming years. It's exhausting to see these kinds of data points every time we click on a new pipeline article, so forgive me for my mandatory pair. If by chance you have not seen these two graphs before, examine them and think about the consequences. The rest of us can quickly analyze the analysis of ET operating results.

In order for us to analyze what is happening in Energy Transfer and why the next few years offer so many benefits, we need to start by understanding the recent operating results as well as the guidance provided by management in recent teleconferences. For those of you who do not listen to quarterly teleconferences and do not read the research reports of Wall Street brokerage firms, it is important to understand that ET regularly smashes Wall Street estimates for more than a year. One year. Analysts were forced to repeatedly adjust their quarterly and annual upward expectations, while earlier projects such as Dakota Access Pipeline, Rover and Revolution had started and had begun to increase production. In fact, the industry as a whole is booming, as oil and oil production capacity has been reduced with the development of shale production in various basins. Business is strong at all levels.

At the same time, management was required to publish the S-1 forecast last fall, as requested by the SEC, when ET acquired the ETP at a 10% premium. Advice, once offered, often leads investors and analysts to ask for more. Given that the ET is doing so well, management has been pleased to be more open and has, for the moment, continued to offer more insight into short-term expectations as well as additional moderate guidance. It is here that our analytical effort begins.

Some facts:

For the first quarter of 2019, ET achieved an EBITDA of $ 2.8 billion and a DCF of $ 0.6313 per share. End-of-year forecasts continue to be EBITDA of approximately $ 10.8 billion and $ 2.30 per share in the DCF. The annual dividend continues to be $ 1.22 per share. There are approximately 2.6 billion shares and the FCD's forecast is expected to exceed USD 1.08 per distribution share (USD 2.30 – USD 1.22 = USD 1.08), or approximately USD 2.808 billion. Management plans to spend approximately $ 5 billion on new projects in 2019, BUT management suggests in the future that the company will spend (invest) between $ 3 billion and $ 4 billion a year in the future. Management also claims that the environment is currently the best investment environment ever seen, suggesting that new projects can generate high returns for teens (over 16% – 18% ROI).

Some hypotheses:

In order to calculate future figures from the 2019 results, we need to make certain assumptions. First, we ignore the risk of a recession that could slow down the shale revolution and possibly interfere with ET's operating results. Secondly, we assume that ET will complete its projects on time and get a return on investment of 14% (we expect higher results, but needless to include 16% return on investment, just assume a reasonable success rate. Third, we assume that spending on new projects will remain at $ 3.5 billion a year for four consecutive years (this is a reasonable assumption that is useful for this exercise.) And finally, we simply assume that mgmt does not buy back any stock, repays any debt, and does not make any acquisitions Oh, and for the record, we believe that ET is overexploited in 2019 with excessively high margins, so the EBITDA of 10, The current $ 8 expected for this year is about $ 300 million, which means we are using $ 10.5 billion.Operating year-end base …. (in fact, we think that ET will probably increase the forecast for 2019 in the fall to about $ 10.9 billion, but let's not know what I said).

So, let's say that ET ends in 2019 with an operating EBITDA of $ 10.5 billion and a DCF of about $ 2.20 (less than the forecast and less than what I really think that's going to happen). They will do). The $ 5 billion invested in 2019 should have the effect of significantly increasing the operating results of next year. In addition, it is very important to recognize that ET has invested several billion in previous years in delayed projects, such as all Mariner East pipelines and the Marcus Hook terminal. This last point is significant because it means that several billion dollars in addition to the $ 5 billion newly invested this year will start to bring in money, once these delayed projects are completed and put into service. For the record, we believe that all ME pipelines will be completed this fall and that they will begin to be operational by the end of the year. As such, we assume that $ 2.0 billion or more has already been invested but nothing in 2019 will yield in 2020 and the return on investment will reach 9% (we recognize that the ME system has exceeded the budget and yields will be lower than expected.

In order not to exaggerate our argumentation, we assume that 50% of the $ 5 billion invested in 2019 will be commissioned in 2019 and are already included in the numbers that allow ET to meet its 2019 targets. another half of the $ 5 billion should then be used and benefit to 2020 and beyond.

By 2020, we will therefore assume that half or $ 2.5 billion invested in 2019 generates a return on investment of 14% and an additional $ 2.0 billion (money already invested and does not require no new debt) generating a return on investment of 9%. For the purposes of calculating the cost of the new debt required to complete projects in the second half of 2019, we will use the end-of-year CDF management guidance of $ 2.30, we subtract the payment from the distribution of 1.22 USD and we have about 1.08 USD of 2.6 billion USD. we see that ET can invest $ 2.808 in 2019 and borrow $ 2.2 billion to carry out the $ 5 billion new projects of the year.

Again, to determine the amount of the 2020 number increases from 2019, we then take half of the $ 5 billion spent, or $ 2.5 billion, and half the debt needed to finance the investments of the second half of 2019; The past year has seen new investments of $ 2.5 billion and new debt of $ 1.1 billion. We can then calculate how much EBITDA and FCD the company will earn. Once done, we can simply add the 9% return on investment from the $ 2 billion in backlogged projects that are likely to be in service by the end of the year.

$ 2.5 billion x 14% = $ 350 million less the cost of debt out of the $ 1.1 billion borrowed. $ 1.1 billion x 5% = interest of $ 55 million. The $ 2 billion of newly completed projects are starting to yield $ 2 billion x 9% = $ 180 million. Adding all this, in 2020 we will see an EBITDA increase of 350 + 180 million dollars = 530 million dollars, then subtract the 55 million dollars of interest and we get more or less a growth of the FCD of about 475 millions of dollars. Given that there are 2.6 billion shares, we can see that the FCD could increase by $ 475/2600, or about 18 cents.

Now, remember that we said that ET was earning more than our income in 2019 and that the conditions were just too good and too harsh. Also, to extrapolate in the future, we decided to reduce our starting point. We used EBITDA of $ 10.5 billion and 2.20 DCF for the end of 2019. From there, we can add the calculations directly above: EBITDA goes from 10.5 billion dollars to 530 million dollars = 11 300 billion dollars in 2020 and the FCD of $ 2.20 per share + 18 cents per share to 2.38 dollars per share. If management decides to increase the dividend in 2020 and roughly at the same rate as the FCD, then it could easily afford to bring the distribution to around $ 1.37. Assuming this rapid increase in dividends is aggressive, it also uses a large portion of free cash flow that otherwise could be used to reduce debt even more quickly than this exercise allows. If you think they can postpone a dividend increase for a year or if you increase the dividend half as fast as I suggest here, you have to recognize that the deleveraging rate will be faster than this that my numbers suggest. Either the dividend increases quickly, or the leverage decreases faster than my figures show.

For this exercise, I demonstrate that ET can increase the dividend quickly while dropping its leverage to 4.0, but I doubt that they are doing them both in a straight line, as shown below. They will probably continue to focus on deleveraging for another year or two, but to demonstrate the power of the company and facilitate the analysis, we show AND using a linear approach focused on both deleveraging and dividend increases. dividend each year of the amount that DCF increases each year, or about 0.17 per year.

The following years then become much easier to calculate (thank goodness), as we use only $ 3.5 billion in new projects generating a return on investment of 14% and a cost of debt of 5%. In addition, we increase the payout of the distribution by the same increase as in DCF. (Again, about 0.17 cents a year).

2021:

EBITDA of $ 3.5 billion x 14% = $ 490 million. DCF of 2.38 USD last year – dividends of 1.37 USD = 1.01 USD / share x 2.6 billion shares = 2.6 billion USD free cash flow that can be invested in new projects. $ 3.5 million in projects – $ 2.6 million in free cash flow = $ 900 million in new debt needed for this year, costing $ 45 million in EBITDA interest of $ 490 – interest of $ 45 million $ = $ 445 million in addition to DCF = growth of 17.1 cents. The EBITDA for 2021 thus increases from 11,390 USD to 11,790 USD and the CDF per share from 2,38 USD + 17 cents to 2,55 USD. We also assume that the dividend distribution increases by the same amount to $ 1.54 / share, compared to $ 1.37 in 2020.

2022:

Once again, an additional EBITDA of $ 3.5 billion x 14% = $ 490 million. FDC of the previous year of 2.55 USD – dividends of 1.54 USD = 1.01 USD / share x 2.6 billion USD = 2.6 billion USD of available cash that can be invested in new projects. $ 3.5 billion in new projects – $ 2.6 billion in free cash flow = $ 900 in additional debt needed to carry out this year's projects at a cost of $ 45 of additional interest. As in the previous year, EBITDA increased by $ 490 million in 2022 less interest of $ 45 million, leaving approximately $ 445 in additional CDN (of course, the ex-ante maintenance caps would be to increase, but the change of this rate is not known and we assume for this exercise it remains more or less stable). EBITDA ended the year at 11.79 USD + 0.90 USD = 12.28 billion USD and the FCD per share climbed to 2.55 USD + 0.17 = 2.72 USD per share. We assume the dividend is $ 1.71 per share.

2023

Let's avoid typing all the repetitive arithmetic and conclude that EBITDA increases by $ 490 million and reaches $ 12.78, while the DCF increases by 0.17 cents to $ 2.89. For fun, we assume that the dividend will reach 1.88 USD, which corresponds to the increase of the DCF.

Leverage decreases significantly and the dividend increases by 40%

To reasonably guess where the debt / EBITDA could end up by the end of 2023, we have to go back in time. It's complicated and we're going to make assumptions and assumptions, but from what we understand, AND currently has an adjusted leverage ratio of 4.7 and its goal is to end 2019 at a level close to 4.5. If we multiply by 4.5 the forecast of EBITDA of $ 10.8 billion, we estimate that the adjusted end-of-year debt 2019 should be about $ 48.6 billion. We can now add the additional debt of $ 900 million needed to carry out the $ 3.5 billion of annual investments invested each year. In 2020, 2021, 2022 and 2023, we get 4 years x $ 900 = a new debt of $ 3.6 billion, which we then add to the amount of $ 48.6 billion in 2019 and at the end of 2023 with adjusted total debt of approximately $ 52.2 billion. Take the EBITDA figure of 12.78 USD for 2023 and find that D / EBITDA leverage has been reduced to 4.08 (52.2 USD divided by 12.78 USD = 4.08). At the same time, our calculations assumed that DCF ends 2023 at $ 2.89 and the dividend rises to $ 1.88. If we assume that this company is then considered to have managed to deleverage about 4.0 and that it can trade up to 9 to 10 x DCF, then, the stock increases to $ 26 to $ 29 per share and we collect approximately $ 7.11 of largely untaxed distributions throughout the four-and-a-half-year journey. From the current price of $ 14.20, this means we could win $ 19 to $ 22 a share or 134% to 155%. It's a bit incredible, but we think it's reasonable and quite possible if the company chooses to focus on leverage and dividends in a straight line.

AND may not choose to increase the dividend so quickly?

Before ending this exercise, consider the other very possible scenario, where ET mgmt decides to keep more cash flow while increasing the dividend at a slower pace than expected. We will not run out with more math because the conclusion is very easy to understand. If ET does not increase the dividend as quickly as we have shown above, they will obviously need to issue less debt and the debt / leverage ratio will decrease the faster. Nobody currently knows it, but if ET wants to reduce the DEBT / EBITDA ratio to less than 4.08, for example to 3.9 or less, they can easily do it as an alternative. There is no doubt that management will hold many discussions with investors when making this decision. Do they choose to bring the dividend back to $ 1.88, as I described, or do they decide to increase it to about $ 1.50? while they have a leverage much lower than 3.9? Enterprise Products Partners (EPD) currently has a leverage ratio of about 3.6 and the EPD security is trading between 11 and 13 x DCF on a regular basis. We think that the EPD is also undervalued, although not as much as it is currently. In fact, if EPD ended up trading a bit higher, in the range of 12 to 14 x DCF in the future, then ET could choose to stay focused on the rapid reduction in leverage under 3.9 so that it can also get a higher valuation, like 10 to 11. x DCF maybe. If they pay smaller distributions a year, they borrow less debt and the DCF increases faster than what I have described. With smaller distributions, the DCF 2023 will probably reach $ 3.00 per share and Energy Transfer has every incentive to increase to more than $ 30 to $ 33 per share. Once again, we earn more than 100%.

Whether it is a high dividend or an extremely low leverage ratio, it seems highly likely that the transfer of energy will allow our investors to achieve excellent returns in the next few years.

Disclosure: I am / we are long ET, EPD, KMI, MPLX. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link