[ad_1]

The frantic price action in stocks like GameStop Corp. has led many retail brokers over the past few days to impose a series of restrictions on trading activity.

But there are still a number of ways investors can get exposure to GameStop GME,

and other companies like AMC Entertainment Holdings, AMC,

even through some analysts warning investors to do more than a spoonful of caution.

“People who own them or are considering buying them should be aware of the risk they are taking,” Todd Rosenbluth, head of ETF and mutual fund research at CFRA Research said via email.

Lily: Here are the biggest pressures on the stock market including GameStop and AMC

“If they think GME will go higher, then that’s their choice, even though we have a sell recommendation on the stock. People think index ETFs are static, but they clearly aren’t, ”he said.

To see now: Pelosi says Congress will be part of GameStop’s scrutiny

Rosenbluth’s comments serve as an appeal to investors to raise awareness, including around what they own. They come in the midst of a fight between individual investors and Wall Street hedge funds that has raged for days, causing ripple effects in the markets.

On Wednesday, GameStop closed at a record high of $ 347.51 after rising 135%, while the price of AMC shares quadrupled. The unusual price action has caused people inside and outside Wall Street to worry that a group of investors emboldened by conversations on discussion forums like Reddit could wreak havoc on the market.

“Investors looking for diversification benefits of ETFs should

aware of what’s inside to avoid taking excessive risks, ”wrote CFRA’s Rosenbluth.

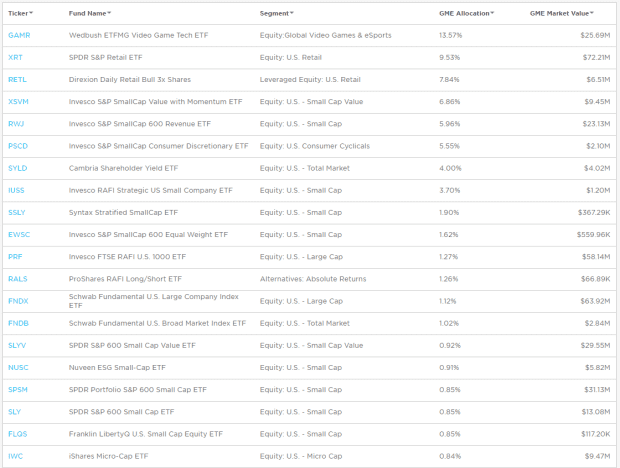

For example, he noted that the popular SPDR S&P Retail Fund XRT,

which is commonly referred to by its ticker symbol XRT, has seen a big leap in GameStop in proportion to its holdings, through its stratospheric rise, which accounts for 20% of the fund.

ETF.com

“Equal weighted XRT is now dominated by GME,” Rosenbluth wrote in a note.

CFRA also says that Wedbush ETFMG Video Games Tech ETF GAMR,

has a 14% position in GameStop.

Another thing to consider, Rosenbluth said, is that when looking for ETFs to gain exposure to GameStop, or other popular stocks highlighted by online forums, is that some ETFs are now underexposed to GameStop, and others due to their sudden growth.

GameStop’s market value was $ 17 billion, at last check, after peaking in market cap of around $ 24 billion on Wednesday, an impressive rise from its estimate of $ 1.3 billion to start 2021. .

Other ETFs exposed to GameStop include Direxion Daily Retail Bull 3x Shares RETL,

Invesco S&P SmallCap Value with Momentum ETF XSVM,

Invesco S&P SmallCap 600 Revenue ETF RWJ,

and Invesco S&P SmallCap Consumer Discretionary ETF PSCD,

ETF.com

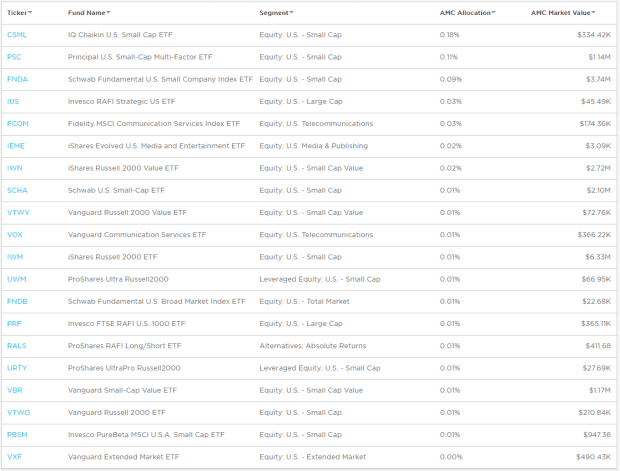

For AMC Entertainment Holdings, 27 ETFs hold exposure, with IQ Chaikin US Small Cap ETF CSML,

Main PSC US Small Cap Multi-Factor ETF,

Schwab Fundamental US Small Company Index, FNDA,

and Invesco RAFI Strategic US ETF IUSS,

representing the best funds, according to ETF.com.

In Thursday’s trading, the markets were primarily trying to shake off a significant slowdown on Wednesday in part inspired by concerns about the spillover effects of wild trading from AMC, GameStop and others.

The Dow Jones Industrial Average DJIA,

and the S&P 500 SPX index,

leaped higher and were on track to recoup much of the losses from their worst one-day fall in three months.

[ad_2]

Source link