[ad_1]

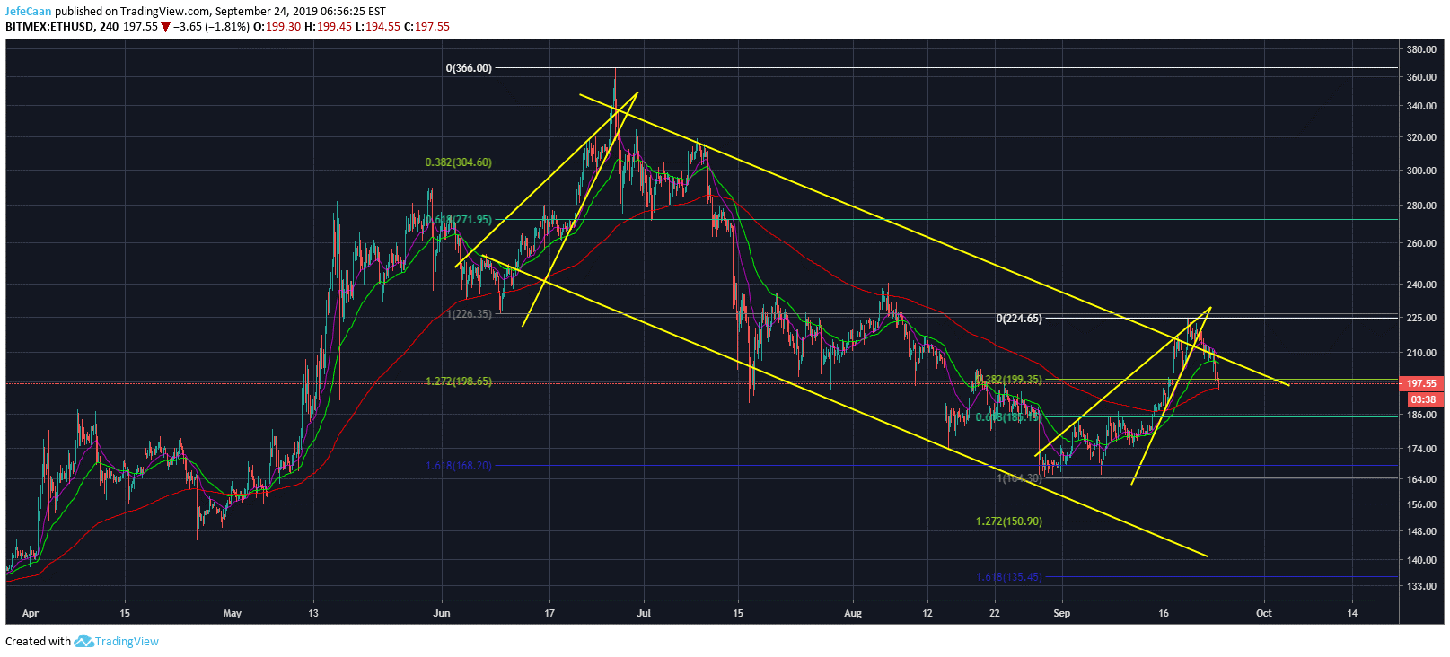

Ethereum (ETH) has returned to the downstream channel and is now closed below the 38.2% fib extension level over 4 hours. This is a major bearish development that suggests that further declines could follow soon. Most professional traders are aware of what is happening at this point, but they may want to see a rebound upward so that the best entries are selling short. That being said, I do not expect the ETH / USD to get relief so soon. It is very likely that the level of fiber extension will reach 61.8% around 61.8% to find temporary support before going back to the top of the descending channel. In the end, it is very likely that it drops below $ 80 to find its true bottom.

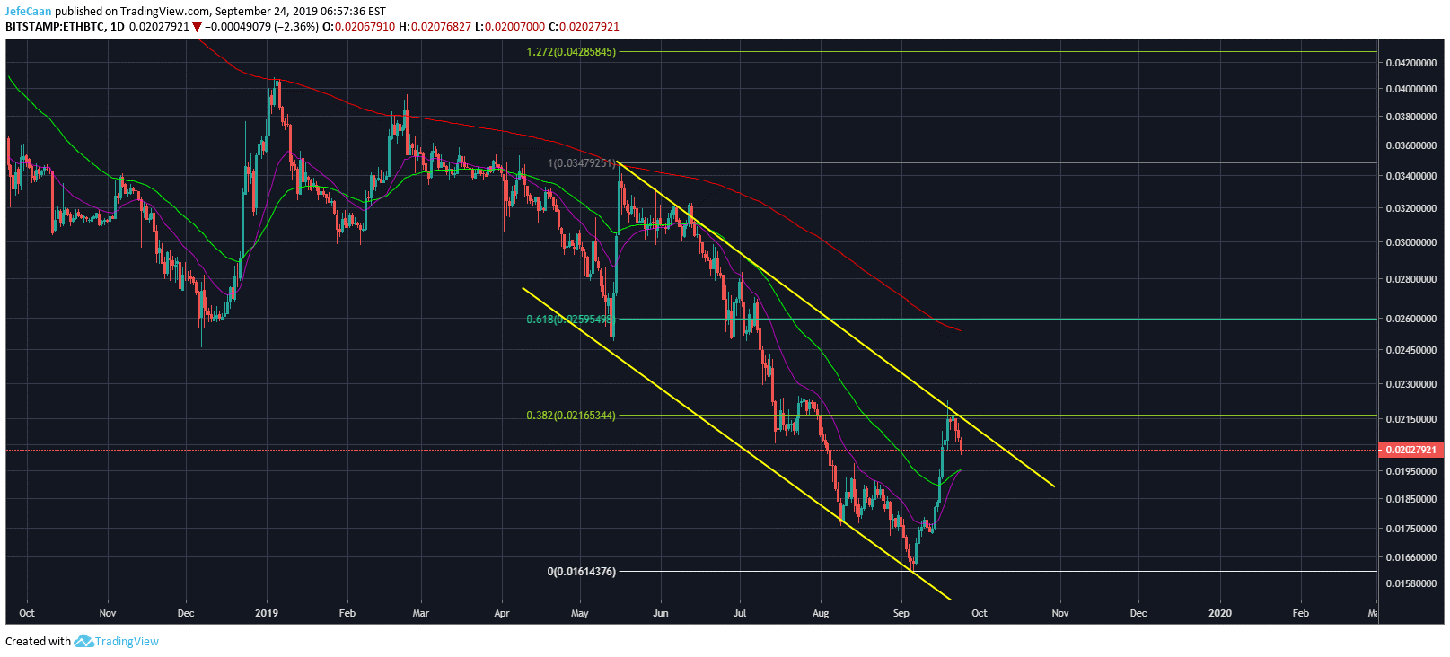

Like most other altcoins, Ethereum (ETH) dances on the air of Bitcoin (BTC), but it has recently taken initiatives. This has ended now and recently we have seen the price drop much more aggressively than Bitcoin (BTC). We must see if this trend remains intact, but we can not deny that Ethereum (ETH) has made a lot of big moves against Bitcoin (BTC) and now is the time to make a long and expected correction. The price has fallen in the descending channel against the US dollar, but it is now time that the latter corrects similarly against Bitcoin (BTC). Let's not forget that many unnecessary ICOs were built on the Ethereum blockchain (ETH) and that when the proverb will fly, as will be the case in the coming months, some people will knock on the door. Ethereum (ETH) and you do not want to hold Ethereum (ETH) when that happens.

Some investors and cryptocurrency enthusiasts do not like this when we talk about mitigating our risks. They want to keep saying that Ethereum (ETH) is a wonderful invention and what it will be worth in five or ten years. Well, we do not know what will happen in five or ten years to Ethereum (ETH). As traders, we are more interested in what is happening now. Even though we knew that Ethereum (ETH) would be a widely used blockchain in five years, as an investor, we would still want to maximize our returns by selling at a high price and buying low.

The daily chart for ETH / BTC shows us that the pair is ready to go down in the down channel. This is similar to what Ethereum (ETH) did against the US dollar, with the exception of a false escape in the case. In the case of Ethereum (ETH) versus Bitcoin (BTC), we found a rejection at the Fib retracement level of 38.2% and this was the end of it. The price started to fall from there and it is now very likely that the bottom of the current downtrend will be in the weeks and months to come.

[ad_2]

Source link