[ad_1]

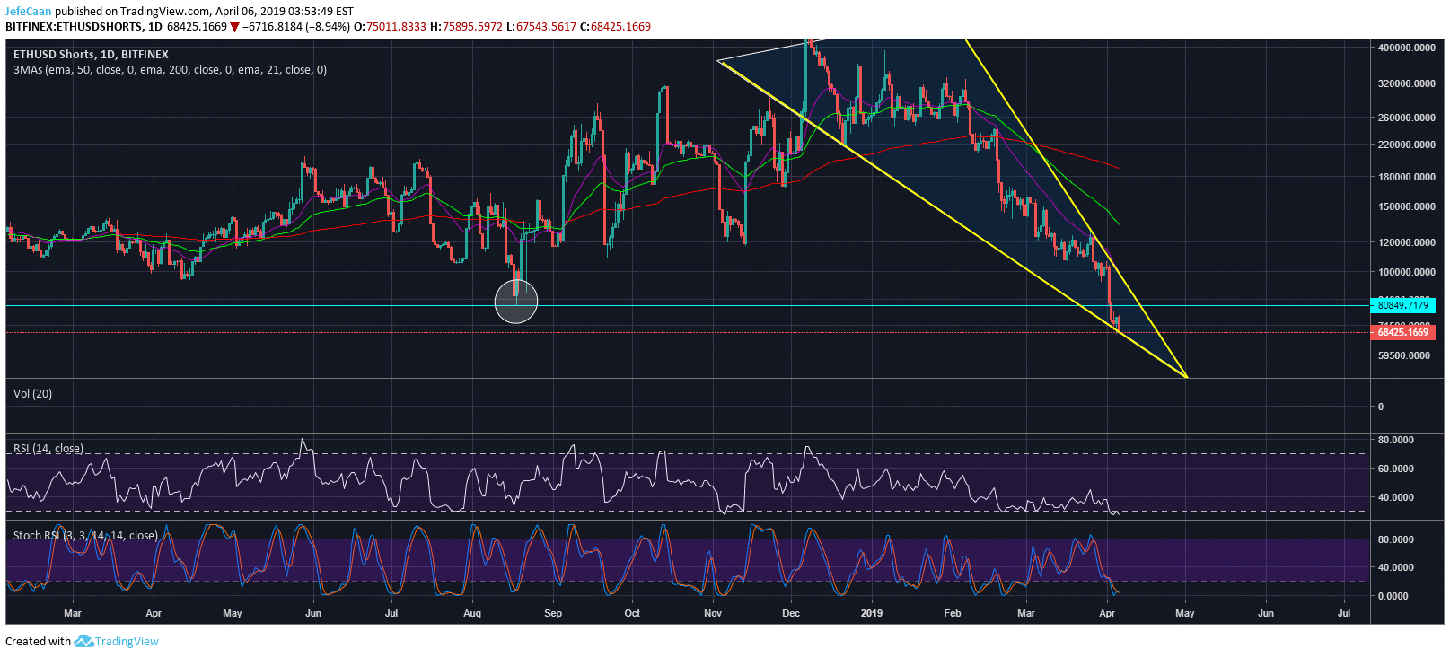

Ethereum margin shorts (ETHs) have now dropped to record lows as the bearish resolution continues to weaken after the series of pumps that have seen the ETH / USD rally rise in recent days. Professional traders are looking for short entries, but the ETHUSDShorts daily chart shows that retailers are so scared that the number of margin shorts must fall to a new historical low of Bitfinex. The stochastic RSI for ETHUSDShorts suggests a reversal of trend over the next few days. The number of marginalized shorts has declined in a declining range that is expected to rise as early as next week, depending on the weekly Ethereum (ETH) closure. There is no doubt that the ETH / USD report is expected to drop dramatically over the next few weeks. He can not decline immediately, but he may have to decrease.

In some of our previous analyzes, we mentioned the fact that Ethereum (ETH) has never been overbought since the beginning of the bear market. This is a very big deal and it indicates the impending threats of massive decline that could see the price drop to double digits. With regard to the catalyst that could trigger this decline, there is no need to look further than the SEC. We have seen supervisory authorities crack down on ICO projects in the past. If something similar happened this time, we could see Ethereum (ETH) taking a huge hit and the price could go down in no time. Even most professional analysts who believe that the bear market is too much in agreement that the price would have waited too long for a sharp decline in the coming weeks. If Bitcoin (BTC) closed the week below its 50-week exponential moving average, the market could begin to decline as early as next week.

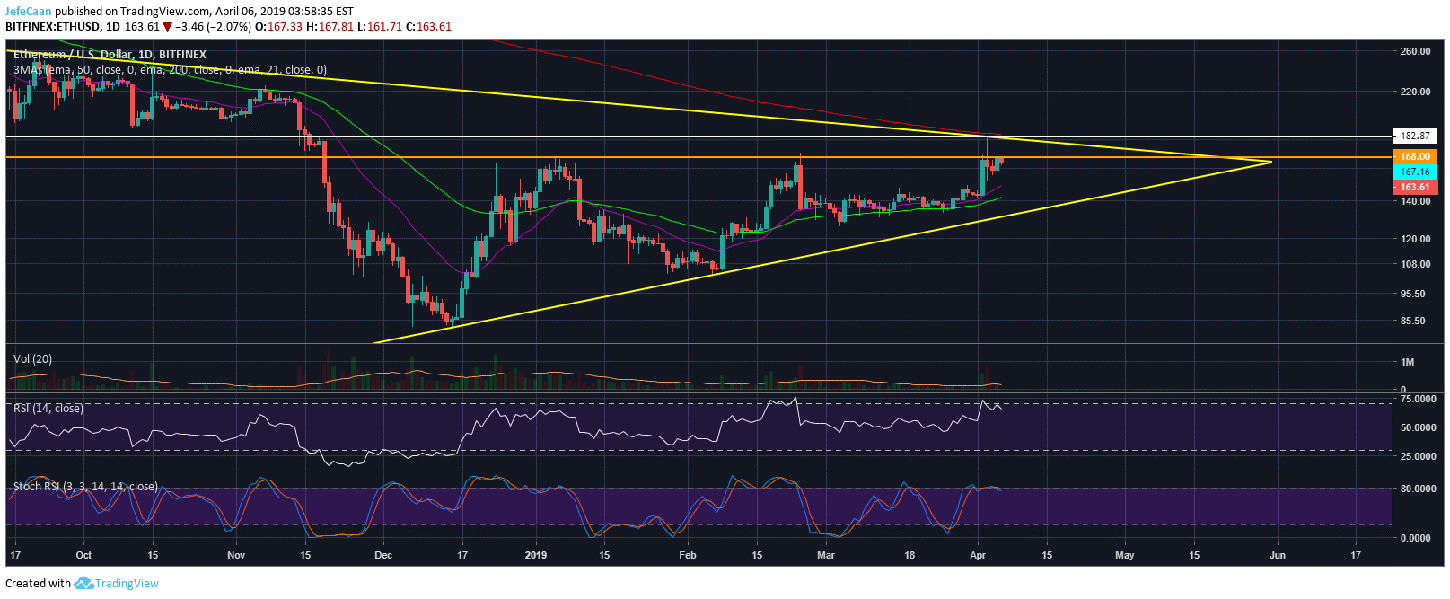

Bitcoin (BTC) is in a difficult situation, but not as difficult as Ethereum (ETH). The daily chart for ETH / USD shows that the price was strongly rejected at the 200-day EMA and is now struggling to exceed a strong resistance at $ 168. If the price faces a rejection and further decreases, we would expect it to close the week under its exponential moving average of 21 weeks, which would put the last nail in its coffin and pave the way for a strong double-digit decline.

Ethereum (ETH) is currently trading a bear pennant that is likely to fall. The daily stochastic RSI is extremely overbought and the weekly stochastic RSI is close to levels never seen since the beginning of the bear market. The volume bars on the daily chart indicate that the last day's sales volume has exceeded the purchase volume during the pump. All these indicators lead to the conclusion that this temporary price hike has nothing to do with a real interest of buyers in the market and a sharp decline is imminent.

[ad_2]

Source link