[ad_1]

The GMB union, which represents many Asda workers, said the staff had suffered months of uncertainty as a result of the Sainsbury agreement – management must now provide them with adequate support .

GMB UNION

(@GMB_union)For Asda workers, it is the good CMA decision regarding Sainsbury's proposed merger. Parts of stores and depots should have been sold, with jobs at risk – and no real benefit to customers or communities.

GMB UNION

(@GMB_union)The workforce has gone through months of uncertainty, worrying about what will happen, wondering if any stores or depots would be sold under his feet. It's time for Asda to move forward and give stability and security to employees who work day after day to make the company profitable.

Sainsbury's shares sank to the bottom of the FTSE 100 rankings.

They are now down 6% to 220p, which remains a low of 33 months.

Connor Campbell, from SpreadEx, said:

In a move that seems both shocking and unsurprising, the competition and market authority ended the merger between Sainsbury's and Asda on Wednesday, stating it had no other The choice to block the deal against it has described it as a "less good shopping experience" for all British supermarket buyers.

Sainsbury's – who has already had a difficult start to the year in 2019 due to speculation that the CMA would be unhappy with the eventual reconciliation – has fallen by more than 6% at the news, a decline that could worsen as the day progresses. This also leaves the supermarket barely above £ 2.10, which means that the annual results of the coming week will be an interesting read.

If you're just listening to yourself, here's Zoe Wood's story of the sinking of the Sainsbury merger with Asda:

The unions also welcome the end of "Sasda".

Bev Clarkson, National Officer for Unite, said the Sainsbury workers would be particularly relieved.

"The merger and the possibility of store closures and job losses have been destabilizing, causing great uncertainty at a time when the supermarket imposed changes to contracts that left many workers out of pocket.

"Staff will now appeal to senior management to provide them with the certainty necessary so that they can focus on customer service."

Which? welcomes the decision of the AMC

Caroline Normand, director of the consumer advocacy group "Which?", Stated that the CMA was perfectly right in curbing the case:

"The CMA is right to block this merger, which could have reduced competition in the industry, which would cause many problems for buyers, including lower prices, lower quality and choice, and a shopping experience." more mediocre.

She also points out that both companies have difficulties with fast-growing discount chains:

"Sainsbury's and Asda have recently fallen behind in this area of confidence – the two companies ranking in the last four of our annual supermarket survey and their rivals like Aldi and Lidl have better provided buyers with what they want . "

Molly Scott Cato, Green Party MEP, is delighted that Sainsbury and Asda are not merging as this would have put even more pressure on suppliers.

Molly Scott Cato MEP

(@MollyMEP)I am pleased to hear that the regulator of competition has intervened to prevent the merger between Sainsbury's and Asda.

I wrote to @CMAgovUK ask them to take this action

Monopoly in our food system means pressure on our farmers and more miles of food#LocalFoodRockshttps://t.co/rD2TGdQwyW

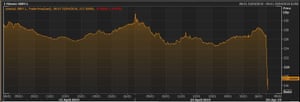

Sainsbury shares slide

Sainsbury shares have fallen to their lowest level since the summer of 2016, as trading began in London.

Shares fell by more than 5% as investors reacted to the end of the merger with Asda. That brings them back to 214p, 226p last night.

Sainsbury stock quote this week Photo: Refinitiv

As you can see here, Sainsbury's share jumped last April when the deal was announced, but has come under pressure more recently.

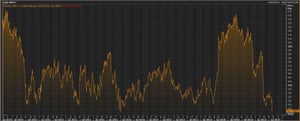

And on a longer view …. Photo: Refinitiv

City brokers, Jefferies, have lowered their price target for Sainsbury's from 230 to 230 pence, so stocks may be under pressure again today.

Update

Mike Coupe, CEO of Sainsbury's Photograph: Toby Melville / Reuters

Analysts in the city also speculate on the precarious position of Mike Coupe in Sainsbury, while his big contract with Asda is in ruins.

Tom Stevenson, Director of Investments at Fidelity, says the CMA's decision is a blow:

"Confirmation that competition oversight has blocked the planned merger between Sainsbury and Asda, owned by Walmart, will come as no surprise after the release of its March interim direct report, which has clearly signaled its deep concern about the deal. .

Mike Coupe, Sainsbury's chastised boss, will be brave when he announces next week's results, but his reputation and future prospects suffer.

Neil Wilson of Markets.com also thinks that Cup could go to the cashier.

Mike Coupe remains absurdly hypocritical. "The specific reason for wanting to merge was to drive down prices for customers," he said today. Nobody, let alone the CMA, has cracked. Will Cup stay? I doubt it, it might be the moment for Cup to go out.

The real concern for Sainsbo is, what is it now? Sainsbury's is the restricted medium, losing market share to discounters and at the same time to several high-end brands. While Aldi and Lidl are constantly gaining market share and Tesco is rebounding, Sainsbury's is feeling the effects. The concern is that there was no credible plan aside from this merger.

At the end of last year, Sainsbury's announced that it had spent £ 17 million in costs related to the Asda case.

Steve Dresser, a retail badyst, says the final bill will be higher – money that could have been spent on improving stores or cutting prices.

Steve Dresser

(@Dresserman)JS had spent £ 17 million on the Asda deal last November. Total number? (£)

Although the Asda-Sainsbury merger failed, it was not a useless effort.

This has provided us with one of the clbadic CEO gaffes of recent years, when Mike Coupe was filmed singing "We are in the Money" on the day of the signing of the agreement.

This rather undermined his claim to be motivated by what was best for the customers.

Update

Sainsbury's CEO, Mike Coupé, must now feel the heat after he has so firmly handled the ADSA contract that the CMA has upset him.

Professor John Colley of Warwick Business School points out that the whole process has been disruptive.

"It's good news for customers. Sainsbury CEO Mike Coupé may have promised to give customers a billion-pound savings over three years, but that figure has never been verifiable or credible.

"Prices go up and down all the time. Over three years, it would have been impossible to estimate what prices would have been without the merger.

"Allowing two channels – Tesco and Asda-Sainsbury's – to share nearly 60% of the market would have had the effect of reducing choice and competition, leading to the risk of higher prices.

"The main beneficiaries of this merger would have been the shareholders of Asda-Sainsbury.

"Mr. Cup will now experience some pressure from these shareholders because the unsuccessful bid will have cost a lot in consulting fees and a huge distraction for management.

Graham Hiscott of the Daily Mirror agrees that the coupe is under fire.

Graham Hiscott

(@ Grahamhiscott)The real pressure is now on Sainsbury boss Mike Coupe, after the collapse of the Asda merger and falling sales. "Sainsbury's is a great company and I am confident in our strategy." Still, Sainsbury's stock price has been cut by a third since last summer.

ASDA's parent company, Walmart, also expressed disappointment at the decision. What are we doing now?

CEO, Judith McKenna, said Walmart's goal was to "continue to position Asda as a strong UK retailer that delivers to customers."

Walmart will ensure that Asda has the resources to do this.

There has been speculation that Asda could be sold, possibly to a private equity firm … but McKenna's comments suggest that Walmart will keep them.

Ashley Armstrong

(@Ammstrong_says)Asda & Walmart terminates its agreement after the CEO's veto to the deal. Judith McKenna, boss of Walmart, said "Walmart will ensure that Asda has the necessary resources" to position the supermarket as a strong retailer. So, not a bastard reflex

Roger Burnley, CEO of Asda, says he is disappointed with today's decision.

He also acknowledges that the merger worried many Asda employees, who could have lost their jobs if the merger had been successful, stating:

We are disappointed with their findings, but we will continue to find ways to put money back into customers' pockets and provide them with quality and quality service in an ever-changing and challenging marketplace.

I've always been acutely aware that last year was a troubling time for all of our colleagues and I am extremely grateful for their commitment and dedication during this time. We are now focusing on the most important work we all have: delivering to our customers. "

Sainsbury: The case is canceled!

Sainsbury has confirmed that his takeover of Asda, worth 7 billion pounds, is now dead.

Chief Executive Officer Mike Coupe (for whom today's decision carries a heavy blow) said the two companies had agreed to end the deal.

Cup also dreads the watchdog of competition, claiming that his reasoning is wrong:

"The specific reason for wanting to merge was to drive down prices for customers. The CMA's conclusion that we would be raising prices after the merger does not take into account the dynamic and highly competitive nature of the UK grocery market. The CMA today takes £ 1 billion from the pockets of its customers.

"Sainsbury's is a great company and I am confident in our strategy. We strive to provide our customers with quality, value for money and quality service, while facilitating purchases from us. "

SAINSBURY-ASDA FUSION BLOCKED

Hello.

Attempts to create the largest supermarket group in the UK were crushed by the competition authorities this morning.

Sainsbury and Asda have learned that their merger, announced last year, could not be realized because it would be just bad news for the consumer.

In a scathing judgment, which has just been published, the Competition and Markets Authority ruled that the combination of the two companies would have resulted in higher prices, lower quality, poorer range on the market shelves and a shopping experience overall worse.

The AMC also concluded that online shoppers would also suffer from higher prices and reduced quality of service.

Motorists could also be stung, paying more for gas at more than 125 sites near Sainsbury and Asda gas stations.

Stuart McIntosh, Chair of the Panel, states:

It is our responsibility to protect the millions of people who shop at Sainsbury's and Asda every week. As a result of our in-depth investigation, we found that this agreement would result in higher prices, reduced quality and choice of products or a poorer shopping experience for all UK buyers.

We concluded that there was no effective way to address our concerns, other than to block the merger.

Autorité de la concurrence et des marchés

(@CMAgovUK)We blocked the Sainsbury / Asda merger after finding that it would lead to:

? Higher prices for groceries and fuel

? Less choice and lower quality of products

?️ A bad shopping experience

Learn more: https://t.co/FrOpssqwS7 pic.twitter.com/lJQtk9BbeC

This is a blow for both companies, especially Sainsbury (the UK's second supermarket chain), which has lost market share in recent months in the retail sector, which is still competitive.

Sainsbury had conducted the merger today vanished through a takeover of Asda, number 3 on the market and owned by Walmart.

Reaction to follow!

We also have a new health check in British and American factories:

L & # 39; s calendar

- 11:00 BST: IWC Industry Trends Report

- 1:30 pm (Paris time): US orders for durable goods

Update

[ad_2]

Source link