[ad_1]

The centerpiece of the evolution of any city is access to electricity. However, this fundamental element of modern life, and what most people take for granted, does not reach a large part of the population living in sub-Saharan Africa.

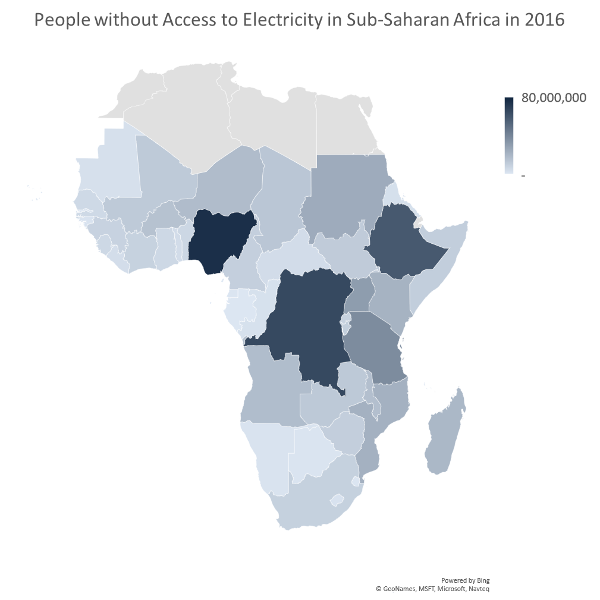

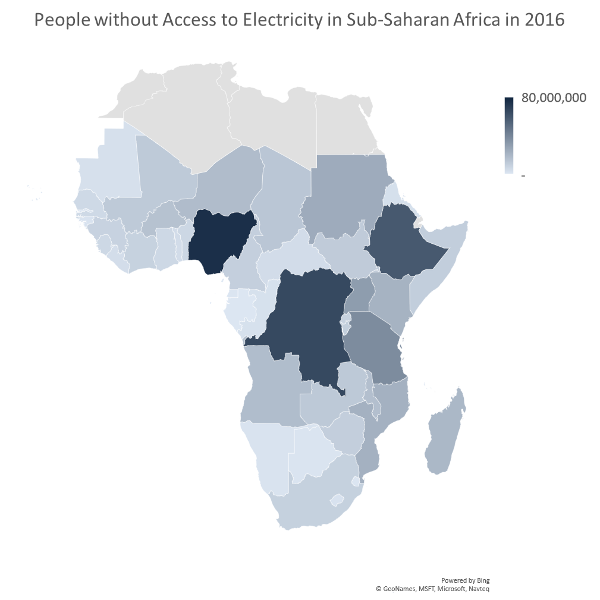

Only 40% of the inhabitants of this region have access to electricity. This number is even lower in rural areas, where less than 25% of the population can light a lamp at night (Figure 1). This is the third article in the series "Urbanization in Sub-Saharan Africa", following the "Master Plans of the City" and "Affordable Housing".

Access to Electricity in Sub-Saharan Africa: Current Situation

The annual growth rate in sub-Saharan Africa has been 7.5% per year since 2010, which is not fast enough to overcome significantly the current population growth of 2.8% per year over a short period. As a result, sub-Saharan Africa includes the largest number of people without access to electricity: 590 million people. Nigeria, DR Congo and Ethiopia are home to one-third of the population currently living without electricity in sub-Saharan Africa, ie 200 million people (Figure 2).

The International Energy Agency (IEA) expects investments of about $ 49.4 billion until 2030 would be required to ensure access to the company. 39, electricity for all in sub-Saharan Africa. If nothing is done and if investments in power generation and transmission lines are not progressing, more than 670 million people will not have access to electricity in Africa. sub-Saharan Africa by the end of the next decade.

the obstacle to the reduction of extreme poverty and constitutes a more pressing obstacle to economic growth than access to finance, bureaucracy and corruption. Any business in the modern world requires the use of electricity. Therefore, by not having access to this key element of current life, local businesses can only operate during the day.

Without electricity, trade in perishable goods becomes impossible, industries can no longer function, and urban areas become more difficult to control. during the hours of the night, which could lead to a higher crime rate. The production of all goods becomes manual and, therefore, such a business will have a significant competitive disadvantage compared to other companies that use electricity because it will not be able to reduce manufacturing. Full electrification will require increased investment in the region, including large scale and networked electricity generation capacity. In addition to low access, the region is facing problems such as low power consumption, low reliability, high cost per kilowatt and utilities at a loss

The availability of reliable and affordable energy widely available is essential to the development of a region this represents 14% of the world's population, but only 4% of its energy demand. Since 2000, sub-Saharan Africa has experienced rapid economic growth and energy consumption has increased by 45%. Many governments are intensifying their efforts to address the many regulatory and policy barriers that hinder investments in national energy supply. However, inadequate energy infrastructure may hinder urgent improvements in living standards. Although investments in new energy sources are on the rise, two out of every three dollars invested in the sub-Saharan energy sector since 2000 has been devoted to the development of resources for export.

Most sub-Saharan countries continue to host an environment where the electricity sector is controlled by the state. In such a situation, there is little incentive to move the network forward because financial penalties for poor performance are non-existent. The lack of commitment to advance the restructuring of the electricity sector is predominant and is one of the main reasons that prevents the electricity sector from reaching more and more. 39; users. Political instability, conflict and institutional weakness, which permeate a large number of countries in sub-Saharan Africa, also make any reform or investment in the sector risky.

Figure 1 – Access to Electricity in Sub-Saharan Africa

– Number of People Without Access to Electricity in Sub-Saharan Africa, 2016

However, even a power-controlled energy sector in sub-Saharan Africa

State can be effective. The definition of management performance incentives, with goals based on a well-designed performance benchmarking, is critical to improving the performance of public and municipal public services. These institutions play an important role in society as they strive to ensure access to electricity for low income citizens. To achieve this, transparent and realistic business plans are needed in addition to the contributions of civil society.

Many countries have introduced some form of competition, reducing the prevalence of fully monopolized and vertically integrated electricity sectors. However, in most cases, the reforms only helped to open up the production sub-sector to independent power producers, without much progress in improving the performance of existing integrated integrated services. Vertically integrated natural monopolies remain the norm in more than 80% of the countries of sub-Saharan Africa. In addition, even when PPIs can enter on paper, other barriers, such as lack of access to transportation facilities, limit their scale and impact.

The private sector commitment is important to advance access to electricity. lack of sufficient resources to undertake costly investments in electricity generation and transmission, and international donor sources are very limited. Although private sector participation has increased in much of the world, in sub-Saharan Africa, 50% of countries have not engaged the private sector in production or distribution.

China's Role in Renewable Energy in Sub-Saharan Africa

Sino-African relations have spread across a range of economic fronts, from banking to infrastructure and energy . Between 2000 and 2015, Chinese entrepreneurs were responsible for building 30% of new electricity generation infrastructure in sub-Saharan Africa. Between 2010 and 2020, China is attacking more than 200 projects, with a total generating capacity of 17 gigawatts (GW) in the region, equivalent to 10% of existing installed capacity in Africa. Saharan.

transmission and distribution of electricity, Chinese enterprises are active throughout the electricity chain, from cross-border transmission lines such as Ethiopia and Kenya to the United States. local urban and rural distribution networks, as in Angola or Equatorial Guinea

. and 2015, China's foreign direct investment (FDI) in energy sector development in sub-Saharan Africa, which includes electricity generation and transmission, amounted to $ 13 billion about one-fifth of all investment in the region.

The energy production projects run by Chinese companies in sub-Saharan Africa range from coal to renewable energy. One area that has seen increasing investment from Chinese companies is the production of solar energy. China is a leading supplier of photovoltaic (PV) panels for solar projects in Africa. Jinko Solar, the world's largest manufacturer of solar photovoltaic panels, has been present on the continent since 2014 with the opening of a photovoltaic panel plant in Cape Town, South Africa, with a capacity of annual capacity of 120 MW.

The region is JA Solar, another big Chinese solar technology company. With two South African partners, Solar Capital and Black Enterprise Empowerment, JA Solar is building the Orange project, a solar farm with a capacity of 86 MW. Located in Northern Cape Province, South Africa, the farm will be connected to the grid and will start production in 2018. The company also supplied 6.5 MW of solar panels in Namibia.

In Zimbabwe, the Chinese company ZTE Corporation is ready to build the Insukamini solar project with a power generation capacity of 100 MW. The $ 544 million plant will make up one-third of a 300 MW solar development in the country, including Zimbabwe's first three large solar parks. ZTE completed the feasibility study of the project in April 2017. However, due to the failure of the Zimbabwean government to settle arrears to the Chinese Export and Credit Insurance Corporation (Sinosure) China Exim Bank has stopped granting loans to the country's energy projects. delay the construction of the project.

The growing cooperation between the region and China can be observed by the creation of the China-Africa Alliance for Cooperation and Innovation in Renewable Energy (CARECIA). Launched in August 2017, this initiative aims to strengthen clean energy cooperation between China and Africa by helping to establish power and transmission systems in Africa through public-private partnerships (PPPs) focused on renewable energies. CARECIA has signed a memorandum of understanding with the Africa Renewable Energy Initiative (AREI) to formalize cooperation between China and the African continent on clean energy.

The members of the alliance include financial institutions, smart grids suppliers and manufacturers in the renewable energy subsector. Initially, the alliance will begin with some pilot projects before extending its influence across Africa. The pilot projects would consist of helping to build micro-grids in some African homes and villages, in combination with large-scale energy construction.

Technical innovations, especially in solar energy, offer the opportunity to progress faster in electricity. mini-grids and home systems. Historically, off-grid electricity sources have consisted of small diesel-powered generators used to offset unreliable grid supplies and to provide electricity to households and businesses that are not connected to the grid. and who can afford it.

the last decade. Meanwhile, there has been a growing interest in solar charge lanterns and small scale PV home systems that can provide lighting, media access and battery charging to households in rural areas. This interest has been boosted by technological advances that have made mini-grids using solar energy significantly cheaper than at the beginning of the decade.

Mini-grids provide a very interesting opportunity to increase the availability of electricity in areas where network expansion is costly. It also allows individuals to access electricity faster than waiting for large electrical infrastructure projects to reach their homes. Kenya, Tanzania, Nigeria and Rwanda are some of the countries with the largest investments in mini-grids, undertaking regulatory reforms to lower barriers to investment.

offer the opportunity to improve the quality of life of people without access to electricity in the most sparsely populated rural and remote areas of sub-Saharan Africa. However, even though domestic systems can provide more lighting and other basic amenities, they can not increase incomes and employment and reduce poverty in these areas, given the quantities limited electricity.

China's role in African power generation in the field of renewable energy also extends to hydropower. Among the main hydropower projects undertaken by the Chinese in the region, there is the 2 172 MW Caculo Cabaca hydropower project in Dondo, Angola. With construction starting in August 2017 and completion expected in 2022, the $ 4.5 billion project was a Chinese company that, at its peak construction, will employ nearly 10,000 people. After completion, the share of the population in Angola with access to electricity is expected to increase from 40% to 60% of the current population.

In Nigeria, a consortium of Chinese public construction companies won a $ 5.8 billion contract for the construction of the Mambila hydroelectric plant in the state of Taraba, with a capacity of production of 3,050 MW. The project will last six years and will be welcomed by the more than 75 million people currently living without electricity in Nigeria.

Chinese companies are also carrying out hydropower generation projects in countries such as Côte d 'Ivoire, Uganda and Zimbabwe. DR Congo

Energy projects led by the Government of Kenya and Rwanda

Kenya is implementing a project of 15 billion Kenyan shillings ($ 148 million) to expand its national network. The goal of the Last Mile Connectivity program is to connect to each home's network within a 600 m radius of a transformer. In order to reduce accessibility constraints and increase usage, connection fees were subsidized, households paying Ksh 15,000 ($ 148), funded up to three years. The World Bank estimates that the actual cost of the connection is approaching US $ 1,000.

The project started in April 2015 and consists of three stages. The first phase was completed in April 2017, allowing 1.5 million Kenyans to have access to electricity. The second phase began in April 2018 and the third phase will expand the network to connect 2.5 million more Kenyans to the national network.

The project, jointly funded by the Government of Kenya, the World Bank and the African Development Bank (AfDB) aims to connect 100% of the country's population to the national grid by 2020. Although being a very optimistic target to reach in just two years, Kenya's efforts to expand its electricity grid are commendable. the share of the population with access to electricity in 2010 and 2016: a jump from 19.2% to 56.0%.

Rwanda is also seriously addressing the issue of insufficient access to electricity. The country implemented in 2009 an ambitious Electricity Deployment Program (EARP). Initially, the goal was to increase access to electricity from 6% to 16% of the population over a five-year period. The project far exceeded expectations, achieving this goal in three years while lowering the cost of connection.

Rwanda benefits from its weak corruption and its firm commitment from the government to achieve the goal of universal access to electricity. Rwanda's rapid success has been facilitated by its small size and high population density, which has allowed access to electricity for a large part of the population over a short period of time. . However, even with these attributes, the program has faced challenges. Among these are weaker than expected demand and fragile public finances.

The next phase of EARP will extend activities to more remote rural areas with lower population density. The low electricity consumption of these new customers means that operating costs will not be covered by sales revenue and that subsidies will be needed to maintain rural consumer supply. Currently, it costs 56,000 Rwf ($ 65) for a Rwandan household to connect to the network, a price that is already subsidized and can be paid in installments over a period of one year. The World Bank has calculated the average actual cost per beneficiary over the period 2009-2013 at $ 980.

Nine years after the launch of the EEPP, Rwanda's electricity consumption levels in households and connected companies remain very modest. According to the World Bank, there was no indication of economic multiplier effects arising from the increase in the productive uses of electricity at the scale of a few small shops and businesses. services.

At the regional level, Rwanda ranks ninth on the World Bank's Facilitation Indicator but ranks 119 in world comparison (Table 1). This indicator captures the procedures, time and costs required for a company to obtain a permanent electrical connection to power a standardized warehouse. Kenya behaves a little better, ranking third at the regional level, but 71 st in the world. Countries in sub-Saharan Africa scored very low in this indicator, with only four countries in the top 100.

Figures from the World Economic Forum World Competitiveness Report (WEF) (GCR) show that only eight countries in sub-Saharan Africa ranked among the top 100 countries in the world. terms of quality of electricity supply (Table 1). Only four out of ten people living in Africa have access to a reliable supply of energy throughout the day, according to nearly 54,000 interviews in 36 African countries in 2014/2015 by the Afrobarometer research network.

Table 1 – Electricity Indicator and Quality of Electricity Supply Indicator

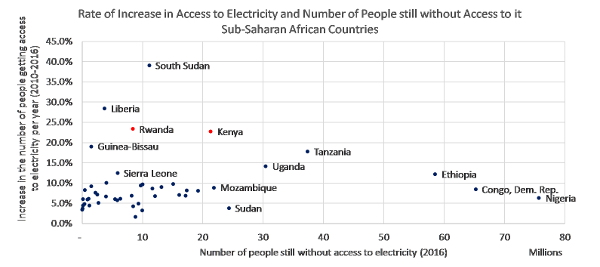

However, between 2010 and 2016, Kenya and Rwanda both experienced a double-digit annual growth rate the number of people with access to electricity: 22.7% and 23.3% respectively (Figure 3). Both countries still have a significant number of people without access to electricity, but at this rate, this reality should be significantly improved in the next 10 years. Currently, Kenya and Rwanda account for 21.3 million and 8.4 million people respectively without electricity.

Figure 3 also shows the critical situation facing Nigeria, Ethiopia and DR Congo in terms of access to electricity. These countries have a low annual growth rate of access to electricity, while tens of millions of people still live without electricity. South Sudan and Liberia show a rapid growth in the number of people receiving electricity. However, this abrupt development is explained by their very small initial population that had access to electricity in the first place. In 2016, South Sudan and Liberia had only 8.9% and 19.8% respectively of their population with access to electricity.

Figure 3 – Increased rate of access to electricity and number of people still having no access to electricity in sub-Saharan Africa. Africa

Transmission and Distribution Losses

Grid-connected grids have the potential to provide the largest volumes of electricity needed for the development of demanding industrial and business complexes. in energy. However, in a vast continent like Africa, electricity consumers can be located far away from major energy providers.

Hydropower plants depend on the geography of a river and are constructed considering a compromise between the portion of the water course turned into a dam, with minimal environmental damage, and to what extent this location is to the major consumers of electricity in the area. Wind energy must be located near the coast or at higher altitudes to achieve a minimum return on efficiency, and power plants that depend on raw imports, such as coal and liquefied natural gas (LNG), must be located near ports, which are the receiving points of these imports. Transmission and distribution lines (T & D) cover these distances between electricity generation and consumers. Despite its relatively lower costs in power generation, the quality and efficiency of T & D lines in sub-Saharan Africa are far from ideal.

In 2014, 11.7% of all electricity produced in sub-Saharan Africa was lost in quality T & D lines, while the world average was 8.3% that same year (Figure 4). Nigeria, DR Congo and Ethiopia, which jointly concentrate 200 million people without access to electricity – a third of the total sub-Saharan Africa – lost between 16% and 22% of their electricity production due to T & D inefficiencies. If these three countries could reduce their T & D losses to equal the world average, 18 million more people would have electricity

Figure 4 – Losses of transmission and distribution of electricity (% of production), 2014

that the transmission sector of Africa will need $ 3.2 billion and $ 4.3 billion dollars each year, until 2040, in order to achieve optimal T & D standards. This is about three times the current annual T & D expenditure on the continent. Currently, almost all investment in transmission in Africa is financed by public enterprises. This was also true for the rest of the world until the 1990s. Of the 38 countries in Africa, nine did not have transmission lines greater than 100 kilovolts (kV) and the combined total length The transport network of these countries does not reach the reach of the transport network of a country like Brazil, for example. more than half of the extension of the US T & D network.

Despite its large size, Africa also has fewer kilometers of transmission lines per capita than other regions. The length of transmission lines in mainland Africa is 247 km per million people. If we exclude South Africa, this indicator drops to 229 km per million people (Figure 5). Chile, for example, has a per capita transport line length almost three times that of sub-Saharan Africa.

The construction of transmission lines and the modernization of transmission capacity will be an essential element of the overall expansion of the electricity sector. As Africa needs transmission within and between countries, investments are needed at the national and regional levels. The inter-country T & D lines have the potential to connect larger sources of renewable energy to multiple electricity demand centers. This is the case of the Transmission Central Africa interconnection. The centerpiece of this project is the construction of the INGA Hydro power station. With more than 40 GW, the INGA project will have 85% more power than the largest hydroelectric plant in the world, the Chinese Three Gorges Dam. The Central African transmission lines will connect Chad to South Africa, crossing DR Congo, where the INGA dam will be located. Only this part of the project will cost $ 40 billion.

Africa needs to invest in long-haul lines and expand local transmission networks to a range of tensions. In addition to the Central African Transmission Project, two other major transmission projects are being considered for sub-Saharan Africa: the West Africa Power Transmission Corridor. , a 2,000-kilometer transmission line linking The Gambia to Ghana; and the North-South Transport Corridor, an 8,000-kilometer link that runs across the continent, from Egypt to South Africa, via East Africa. . After construction, these corridors will add more than 13,000 km to sub-Saharan Africa's transportation network

Figure 5 – Length of Transmission and Distribution of Electric Power Per Capita

Solar Power off-grid in Kenya

This reasoning justifies the expansion of electricity access centers on the premise that a high initial expenditure for the construction of production infrastructure and electricity distribution will be repaid by long-term economic growth. However, the dire economic situation of most countries in sub-Saharan Africa makes it too expensive to provide grid-based electricity to rural areas. The private sector has come in to help in the form of off-grid solar panels.

Founded in 2011, M-Kopa's success is tied more to its understanding of the target market than to the novelty of its product: photovoltaics (PV). The company has adopted a competitive and accessible financing system for people living on less than $ 2 a day.

The company's power system costs $ 200 and includes a solar panel, two LED bulbs, a LED flashlight and adapters. charge a phone. M-Kopa sells this kit to the end customer at an initial price of $ 35 and a daily payment of $ 0.50 for one year. After this period, the kit becomes the property of the customer. M-Kopa gives a two-year warranty for the kit and the battery lasts an average of four years.

The solar system uses a control box containing a mobile data chip, through which customers can buy credit. M-Pesa, the mobile money system developed by Safaricom, Kenya's dominant telecommunications company

The company can process payments, monitor system functionality and solve problems through its platform M- Kopanet. M-Kopa has connected more than 600,000 customers with its solar PV kit, of which 80% are in Kenya, the rest in Uganda and Tanzania. 80% of them earn less than $ 2 a day

The M-Kopa system has the potential to exploit a market of only 21.3 million people in Kenya. This is the number of people currently without access to electricity in this country. Of these, 88% live in rural areas, where an off – grid solution would be more practical and allow people to have enough electricity for their basic needs.

Waste energy in Ethiopia

An energy production plant (WTE) is being built on the outskirts of Addis Ababa, the capital city of Ethiopia, on which is supposed to bring huge gains to the city. The WTE plant will provide 30% of the capital needs of the capital and will incinerate 1400 tons of waste each day. The Reppie WTE factory, as its name suggests, is the result of a partnership between the Ethiopian government and a consortium of international companies. This is the first time in Africa

WTE facilities are not considered green solutions for treating waste since the result of any combustion process involving waste includes greenhouse gases such as CO2 . Cependant, c'est un premier pas dans la bonne direction car les décharges sont sujettes à la propagation de maladies et ont un potentiel immense pour endommager l'environnement.

Les plantes WTE sont également intéressantes car elles peuvent facilement être reproduites à travers le continent et aider d'autres grands pays africains. villes traitant des problèmes de déchets urbains. C'est une meilleure option que de construire une centrale au charbon ou d'inonder des hectares de terres pour la production d'hydroélectricité. L'usine de Reppie adopte une technologie de traitement du gaz qui aide à réduire les rejets de métaux lourds et toxiques générés par le brûlage.

Remarques finales

Un accès large à une électricité fiable et abordable est essentiel pour promouvoir un développement économique rapide en aval. Afrique saharienne. Cependant, ce ne sont pas les seules pièces du puzzle nécessaires pour créer une société urbaine florissante. Outre l'accès universel à l'électricité, l'Afrique subsaharienne devra continuer à résoudre les problèmes d'infrastructure de base afin de déclencher une croissance économique durable.

Le besoin non satisfait d'une réforme plus large qui ne se limite pas à relier les ménages pauvres au réseau; mais cela inclut aussi l'accès à l'eau, aux routes et au système d'égout, l'accès à l'éducation, à la santé de base et au financement des petites entreprises, peut avoir été la raison pour laquelle le projet EARP du Rwanda n'a eu qu'un impact économique positif. Le processus inexorable d'urbanisation, qui concentre un nombre croissant de personnes vivant à proximité, ne fait qu'accélérer le rythme auquel ces besoins d'infrastructure de base deviennent essentiels. Les réformes globales qui s'attaquent aux problèmes multiples d'une société urbaine ont les meilleures chances de réussir à promouvoir l'intégration humaine et la croissance économique.

Selon le scénario de l'IEA sur les nouvelles politiques dans World Energy Outlook la demande d'électricité en Afrique subsaharienne devrait plus que tripler d'ici 2040, atteignant 1 300 térawattheures (TWh) en vertu des politiques et mesures gouvernementales actuelles et proposées. D'ici 2040, la demande de l'industrie doublera tandis que la demande résidentielle augmentera de plus de cinq fois les niveaux actuels. Au rythme de 6% par an, la croissance de la demande d'électricité dépbadera donc la croissance du PIB au cours des 25 prochaines années à 2040. D'ici à 2040, la capacité totale de production d'électricité en Afrique subsaharienne devrait quadrupler à 385 GW. Les additions de capacité atteindront en moyenne 7 GW par an jusqu'en 2020, puis augmenteront aux environs de 10 GW par an dans les années 2020, et de plus de 13 GW par an dans les années 2030. Le secteur de l'électricité subsaharien devrait donc se développer progressivement, mais il restera loin derrière celui des autres pays en développement.

L'auteur, Otavio Veras, est badocié de recherche au Centre d'études africaines NTU-SBF, un organisme trilatéral. plate-forme pour le gouvernement, les entreprises et les universités pour promouvoir les connaissances et l'expertise sur l'Afrique, établie par Nanyang Technological University et la Singapore Business Federation. Otavio peut être atteint à [email protected].

Source link