[ad_1]

Kathy Lien, Managing Director, Foreign Exchange Strategy for BK Asset Management

Daily Exchange Market Report June 5, 2019

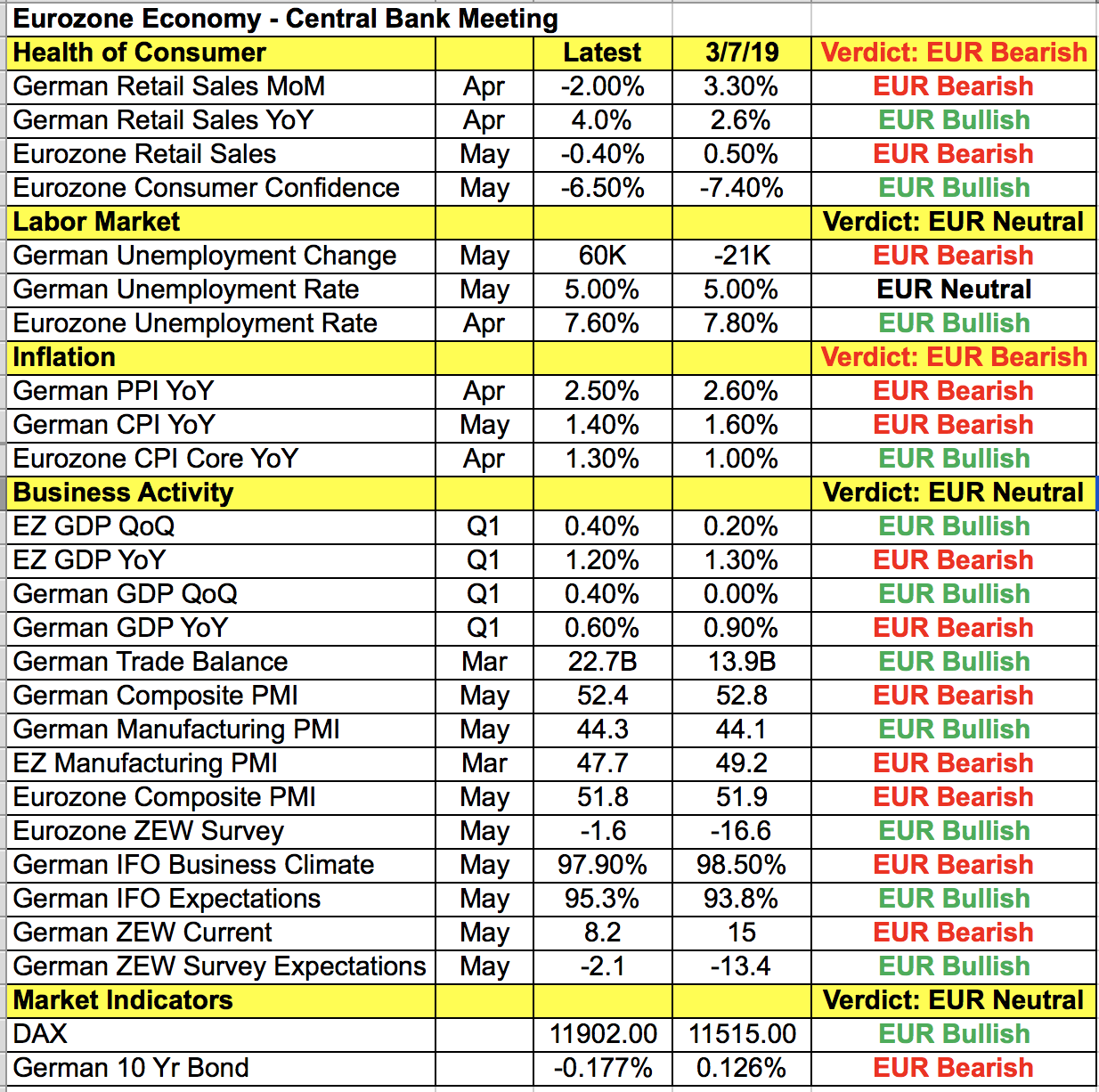

Thursday's European Central Bank will be a big one. have rallied for 4 consecutive days this week, but sellers come back before the rate decision.

What to expect from the ECB:

- Details on their new long-term targeted refinancing operation

- Updated Economic Projections

- New advanced guidance

In March, the ECB announced a series of new loans likely to stimulate the economy of the euro area. They said the details of this program known as TLTRO-III would be provided in June. Now that time is up, traders are eager to see how generous the program will be, what its price will be, and whether the interest rate will be negative, zero, or close to zero. Their inflation and growth forecasts will also be updated and ECB President Draghi will explain the possibility of taking additional measures if growth or inflation falters.

The euro area is in a phase of weak growth and despite some improvements, the main factors of monetary policy – consumer spending – have weakened. German sales fell -2% in April, well below market expectations. German also experienced the largest increase in 4 years and, partly because of categorization changes, the Ministry of Labor warned that this was the first sign of a weakening economy. For now, the EU has escaped auto tariffs, but a simultaneous slowdown in the United States and China will weigh heavily on the economy. If the ECB believed that additional stimulus was justified before the US imposed a new set of tariffs on China, the need for adaptation has only increased since then.

crashed during the commissioning of TLTRO-III and the sale could resume if the central bank lowered its growth and inflation forecasts. But that may not be enough. Given the magnitude of the EUR / USD bidding, investors may have already discounted the transparency of the ECB and explained their economic projections downward. The key to success for the euro will therefore be to modify its forecasts and talk about new loan programs going beyond the current TLTRO.

Fusion Media or anyone involved in Fusion Media will not accept any liability for loss or damage arising from the use of the information, including data, quotes, graphics and buy / sell signals contained in this site Web. Please be fully aware of the risks and costs associated with financial market transactions. This is one of the most risky forms of investing possible.

[ad_2]

Source link