[ad_1]

The following is from a recent edition of Deep Dive, Bitcoin Magazine’s high-end market newsletter. To be among the first to receive this and other on-chain bitcoin market analysis straight to your inbox, Subscribe now.

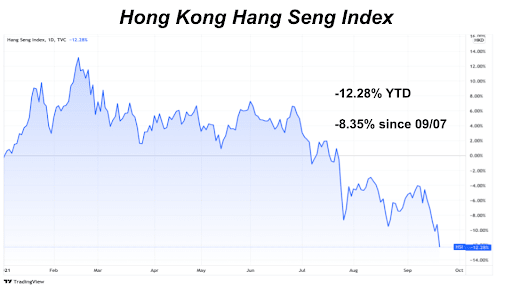

After covering real estate group Evergrande last week in Daily Dive # 060, our biggest concerns were the further spread of contagion to the Chinese economy and global markets. Since then, we have simultaneously witnessed a tidal wave of massive selling in the Chinese real estate market, rising Chinese bond yields and a larger correction in the S&P 500. Chinese junk continue to climb past their March 2020 highs to over 14%, while the Hang Seng Index has fallen a further 8.35% since September 7.

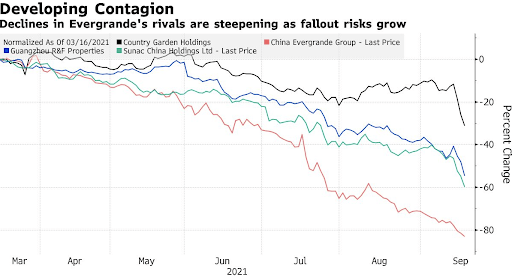

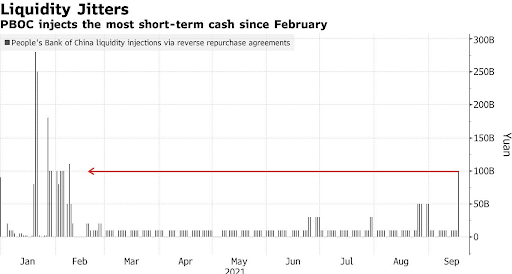

The biggest spread impacts so far have been in the over-leveraged Chinese real estate sector, with sales of stocks and bonds among other leading real estate developers like Country Garden Holdings and Sunac China Holdings. The next level of contagion spread would appear in China’s banking sector amid a tightening of liquidity. The People’s Bank of China on Friday injected 90 billion yuan ($ 14 billion) in funds, the most since February, to provide short-term liquidity to the banking system.

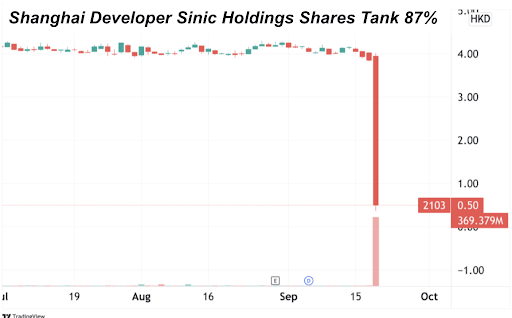

Shares of Sinic Holdings Group Company, a Shanghai-based real estate developer, plunged nearly 90% in massive volumes (about 14 times the average deal volume) before deals were halted. In an article published by Bloomberg, Philip Tse, Director and Head of Real Estate Research in Hong Kong and China at Bocom International Holdings Co Ltd. stated the following:

“It’s the same story as everywhere else – investors are concerned about liquidity. I think there are very likely margin calls on some of the major shareholders, ”looking at Sinic’s stock price trend this afternoon. “

[ad_2]

Source link