[ad_1]

Co-produced with PendragonY for High dividend opportunities.

summary

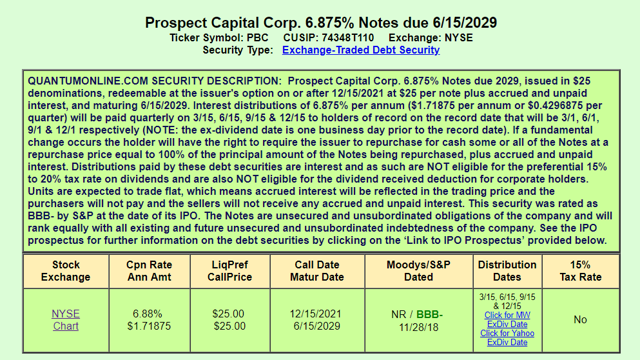

AT High dividend opportunitieswe are always looking for juicy dividends trading at attractive valuations. This week, we spotted a Obligation baby of poor quality it is currently yield 7.06%. The link in this article is the Prospect Capital Corporation Rating 6.875% (PBC), which matures in 2029, is issued by Prospect Capital (PSEC), one of the largest commercial development companies (BDCs), which invests in debt securities (loans) and equity securities in smaller companies. It also invests in secured loan obligations (CLO). It is one of the largest BDCs, it is listed on the stock market since 2004 and has issued hundreds of bonds. PBC is rated BBB-, an investment grade, by S & P. The current yield is 7.06%. It's first callable on Dec. 15, 2021, but does not expire before June 15, 2029. In the report below, we will compare the PBC with other bonds issued by PSEC and other similar "child bonds" to highlight pricing errors and why we think the PBC is extremely opportunistic investment now.

L & # 39; opportunity

The PBC has fallen since the peak of $ 25.30. Currently, this bond is trading at a considerable discount to other similar Prospect Capital bonds. Why does he negotiate this cheap? It seems like a stubborn salesman is in the process of liquidating his position. PBC has only been trading for a few months since it is a relatively new bond. The seller is probably one of the subscribers. They had to have unsold stocks at the time the show was placed, and the sale has created a great opportunity for price error.

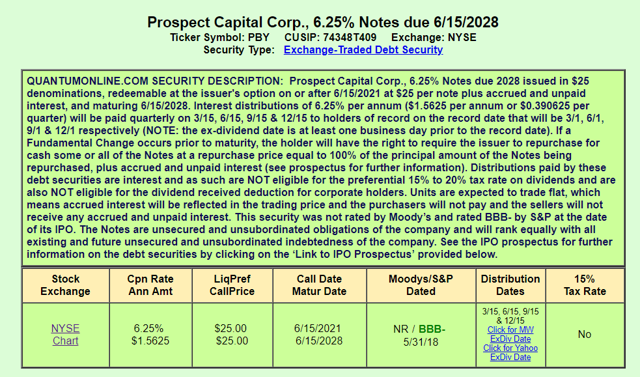

Below you will find a Quantumonline chart showing the details of CBP.

Source PBY: Quantumoline (or QOL)

1- Incorrect evaluation compared to the baby link of the PBC

Here are the details on Prospect Capital Corp., 6.25% notes due on the 15/06/2028 (PBY), a sister bond for baby issued by the same company (PSEC). PBY is first callable in December 2021 and expires in June 2028 (just one year before the PBC). Its coupon rate is 6.25%. It closed recently at $ 24.12. That's a current yield of only 6.48%.

PBC Source: QOL

This very similar baby sister bond is trading at a yield discount of 0.5% compared to PBC. Note that PBC is callable six months later than PBY and expires a year later. It also has a higher coupon rate of 6.875% and yields 7.06%. That & # 39;s significantly higher than the very similar Baby Bond PBY. Both bonds are rated BBB- by S & P, which is an investment grade rating.

Other bonds issued by Prospect Capital

PSEC has a very interesting, smart and secure financing. He has issued hundreds of relatively small bonds with a wide variety of maturities, some close and others shortly. This significantly reduces the risk of refinancing because it is not necessary to raise large amounts of cash at a time. This may partly explain why S & P considers their bonds as investment grade.

Currently, PSEC has three "Baby Bond" issues that trade on the stock exchange as does PBC. All other PSEC bonds are traded on the "corporate bond market" and are not "children's bonds". The three issues of publicly traded debt are PBY, PBB and PBC and have a lot more liquidity than other corporate bonds. By examining only children's bonds that occupy a similar position in the capital layer, PBC trades at a much higher yield.

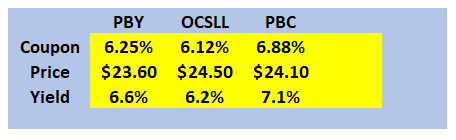

- PBY, with call and expiry dates very similar to PBC exchanges with a yield of 6.6% which is about 49 basis points lower than PBC yield of 7.06%.

- PBB (another baby link from the same company), which has the same coupon rate as the PBY but is callable at the end of this year (in 2019), has an even lower yield of 6.3%, or about 82 basis points lower.

PBC Vs. Oaktree's notes of 2024

Most bonds / notes issued by BDC are not rated. However, we were fortunate to locate a bond rated BDC with exactly the same BBB-S & P rating that PBB carries with a maturity quite close to that of PBC. This link is the Oaktree Specialty Lending Corp., 6.125% Senior Notes due 30.04.2028 (OCSLL), currently trading at a rate of return of approximately 6.24%. This is roughly the same as the PBB but the yield is much lower than that of the CBP. OCSLL is issued by the business development company Oaktree Specialty Lending Corp (OCSL). A PBB comparison with a similar bond issued by another BDC shows that PBB has a reasonable price. Since the price of PBC offers a much higher return, this means that the PBC is undervalued and that PBB is not too expensive.

Source QOL and author calculations

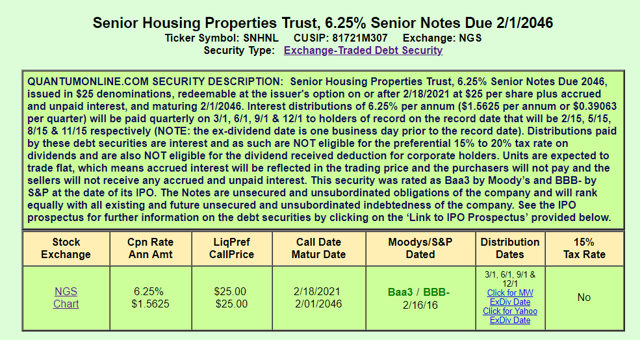

PBC compared to SNHNL

Another link for baby noted in the same way is Senior Housing Trust Trust, Senior Notes Due 1/2/2046 (SNHNL), which is issued by Senior Housing Properties (SNR), a real estate REIT specializing in health care. Although SNHNL has a much later deadline, it is callable on 18/02/2021, which is about the same time as PBC. It is also rated BBB- by S & P. It is currently trading at $ 25.71 which gives it a current yield of 6.08%, 98 basis points lower than that of the PBC. CBP yields are 1% higher than those of SNHNL.

SNOLL Source QOL

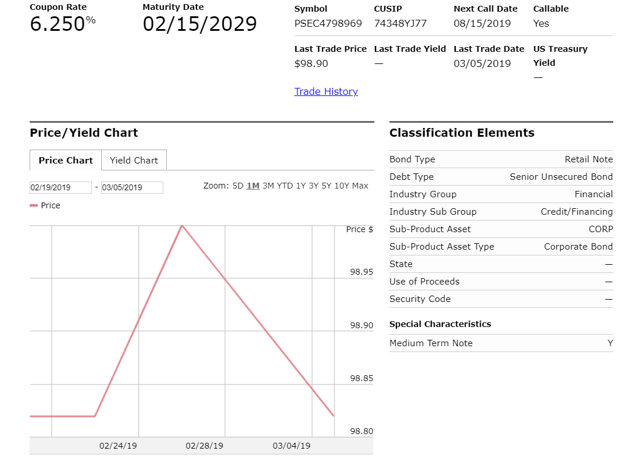

PBC Vs. Ordinary PSEC bonds

As noted above, Prospect Capital has many bonds that are traded on a regular bond exchange (not small bonds that trade on the stock exchanges). We have located several bonds with a maturity similar to that of CBP and reporting only about 6.3%, against 7.06% for CBP. For example, below is a downloaded image of ordinary Prospect Capital bonds maturing in February 2029 (CUSIP 74348YHV6).

The above-mentioned corporate bonds traded this week at a price of $ 98.82 for a return of 6.3%, compared to 7.0% for PBC. This is a significant performance difference. PBC should trade up to $ 25.80 (or more than 6%) to be fair value against this corporate PSEC obligation!

Why is the recent PBC price cut a golden opportunity?

PBC closed at $ 25.30 on February 1st. Since then, the price has fallen slightly, with a slight decrease compared to the ex-dividend date of March 1st. It seems that a stubborn salesman is in the process of liquidating an important position in PBC. Below is the CBP price chart.

PBC Price Table (Source: NYSE)

And the decline in the price of the PBC stock is certainly not tied to common stock or a societal problem. As shown in the graph below (source E * TRADE), while PSEC was volatile, for much of the period of slow PBC decline, the price of PSECs increased.

PSEC Common Stock Price Table

Ex-dividend date

PBC distributed its ex-dividend dividend on March 1st. PBC is now below the level where it was traded, except during the late December crash. Its performance is significantly higher than that of the very similar Baby Bond PBY and a similar corporate bond issued by PSEC. We suggest buying now before returning to a price more in line with the PBY. Our reasoning is based on more than 20 years of investment in fixed income securities. So whether you are a short term trader or want to buy and keep PBC, we think the time to buy is now. With a current yield of 7.06% and a credit rating of the highest quality, it is a very good value for money. The next ex-dividend date is June 1st.

Other comments on the security of CBP

The very good reasons we call PBC Safe are:

- The low refinancing risk that we mentioned earlier.

- The fact that a BDC has never defaulted on an obligation. PSEC went through the financial crisis of 2008, one of the worst financial crises in history, without any failure.

- PSEC has a low leverage effect on its balance sheet. The target is 0.7x to 0.8x net debt / equity.

As many of you already know, until recently, the law did not allow BDCs to benefit from leverage greater than 1: 1 (50%). Recent legislation allows BDCs to benefit by as much as 2 to 1. However, PSEC's leverage is still well below 1 to 1 according to its latest filing with SEC 10Q. Investors in BDC bonds should certainly monitor the balance sheets of their BDCs, but for now, things are looking good in terms of PSEC balance sheet.

summary

The PBC is a bond that can be a good addition for conservative investors and retirees seeking a return with low price volatility and lower risk. The logic of buying PBC is relatively simple. It sells cheaply compared to similar PSEC bonds, as well as the more similar BDC bonds that we could find with the same level of risk. In addition, PBC has good security, a medium-term maturity (just over 10 years before the due date, but less than three years up to a possible call date), a good liquidity and it has recently been sold for no apparent reason. We see no reason why he is negotiating such a yield differential between PBY, SNHNL, OCSLL and ordinary PSEC bonds.

The PBC should soon return to $ 25.50 and could easily reach $ 26. This price would align its performance with that of PBY. This is an easy short-term plus value of more than 5% in addition to the very attractive yield of 7% plus. Note that we recommend PBC as an investment to hold until maturity and not as a transaction. This is a less risky bond recommended to conservative investors and retirees, "a purchase and collect income" type of situation.

Thank you for reading! If you liked this article, please scroll down and click Follow next to my name to receive future updates.

Disclosure: Our members have a first look at all of our high yield stocks selections.

High Dividend Opportunities: The # 1 Service for Investors and Retirees on Income

We are the largest community of income and retiree investors with over 2000 members. This is a Top-Rated service, ranked # 1.

We recently launched our Preferred Stock & Bond portfolio for conservative income investors.

Take advantage of our free 2 week trial to get instant access to our model portfolio targeting 9 to 10% return, our preferred share portfolio and revenue tracking tools. You also have access to our report entitled "Our favorite choices for 2019"

REGISTER HERE

Disclosure: I am / we have long been PBC, PBY, OCSLL. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link