[ad_1]

Foot Locker shares (FL – Get Report) were stomped on Friday, falling 16% to $ 44.40 after disappointing first quarter results.

This decline comes after the company reported a non-GAAP earnings per share of $ 1.53, missing estimates of 7 cents. Revenues of $ 2.08 billion increased 2.5% over the previous year, but also exceeded expectations by $ 30 million.

Foot Locker shares have now bottomed out in 52 weeks as investors approach each other to take the exit. Some people think that selling is an overreaction.

After all, same-store sales increased 4.6% in the quarter, while inventories rose only 10 basis points. Gross margins increased by 30 basis points (although operating margins decreased by 10 basis points) and revenues increased by 4.7% excluding currency effects.

At the end of the day, the beating is hardly surprising. Foot Locker missed net profit and net profit, as investors face growing tariff concerns, and expect earnings growth for the full year to be "high" only 10% compared to consensus expectations.

Foot Footer's actions

Until now, the report has only a limited effect on the whole of the space. The Nike (NKE – Get Report) action edged down only 0.6%, while Under Armor (UA – Get Report) (UAA – Get Report) rose by 34 points. basis during the day. Investors in Foot Locker shares only wish that's what their portfolios showed on Friday.

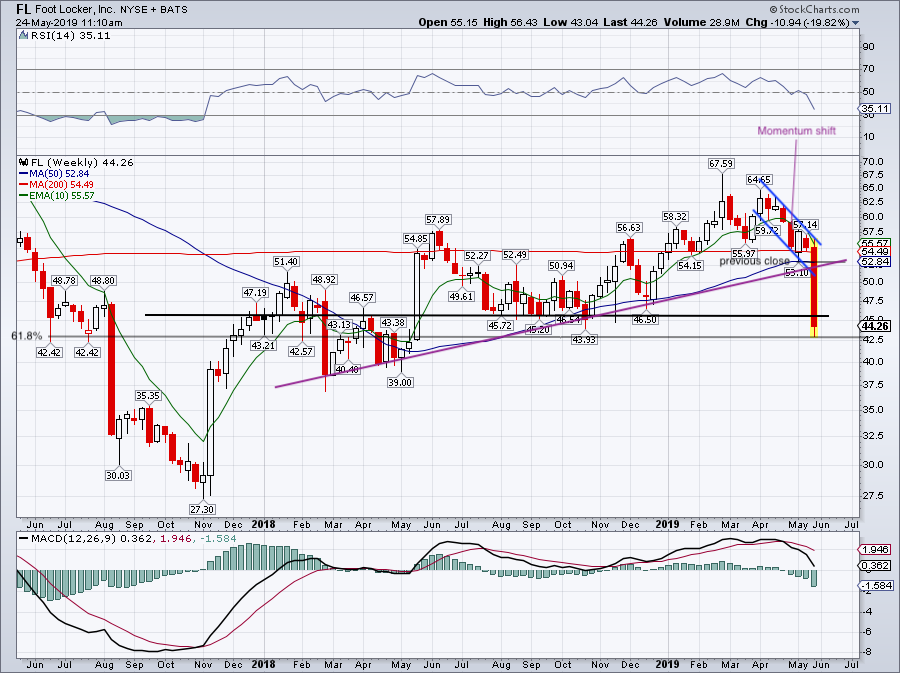

Four weeks ago, Foot Locker shares were below the 10-week moving average. When it failed to recover this level, it is a sign that the momentum has been reversed and has become bearish. This week, the stock also lost the 200-week moving average, which is another bearish development as the 10 weeks fell back and began to fall.

The post-benefit movement acts like another ball of destruction. Equities broke support for the uptrend (purple line), short-term channel support (blue line) and the 50-week moving average. Even the $ 45 to $ 46 sector could not carry the name. For the moment, the 61.8% retracement for the two-year range marks approximately the bottom.

This stock is decimated flat the same day. With so many levels of broken support, who wants to intervene here, now?

Certainly not me.

For some, the fundamentals will be sufficient. Revenue growth of 4%, high single-digit earnings growth, less than 10 times this year's earnings forecast and dividend of 3.4%. For traders or those who combine technical and fundamental, Foot Locker's actions will remain confidential until proven effective.

A closing below $ 42.50 would be bad news as it would suggest that the selling pressure has not faded yet. On the other hand, recovering between 45 and 46 USD would give investors a soft spot to measure themselves and give Foot Locker's shares a chance to bounce back. I would give this one a few days to wash before seeing if a potential background can settle.

[ad_2]

Source link