[ad_1]

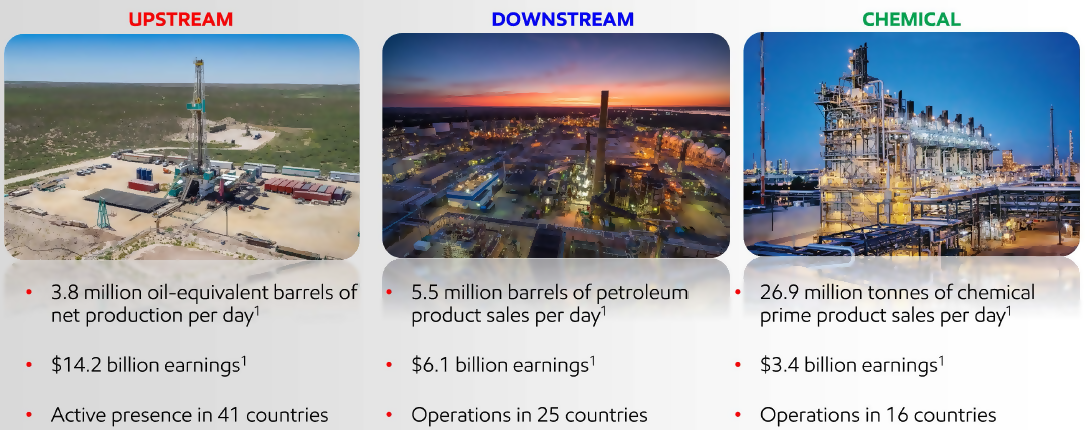

Exxon Mobil (XOM), one of the three largest energy companies in the world in terms of turnover, is part of the "big oil" or "supermajors" of the global oil and gas space. The entire oil and gas value chain – upstream, downstream and in chemicals. Upstream, the company operates in the fields of exploration, development and production, with a presence in ~ 41 countries.The sector produces about 3.8 million barrels of oil equivalent per day. by far the largest contributor to earnings at 60%, or $ 14.2 billion in 2018.

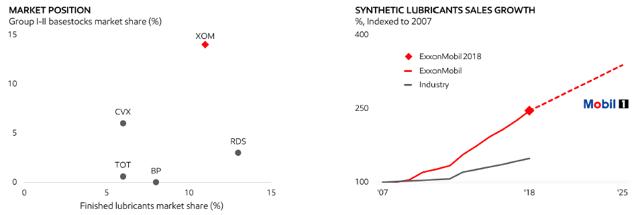

Downstream, Exxon operates as an integrated refiner, as well as a manufacturer and distributor of fuels, lubricant base oils, petroleum products and finished lubricants, with facilities in 25 countries. It ranks first for base oils and second for finished lubricants.

Source: XOM Investor Presentation, March 2019

Exxon's chemicals business operates state-of-the-art facilities in 16 countries and produces a variety of high-performance products such as polyethylene and paraxylene. The segment sells about 27 million tonnes of chemicals a day and generated a profit of $ 3.4 billion in 2018.

Source: XOM Investor Presentation, March 2019

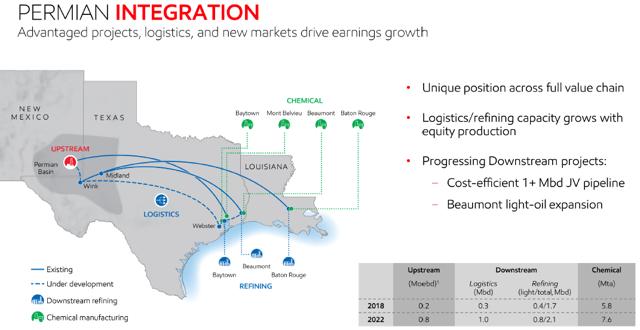

The integrated business model creates significant cost savings: Most of the chemical facilities, upstream and downstream of Exxon, are integrated, resulting in significant cost savings through shared resources, interconnected facilities and coordinated operating practices. For example, in North America, upstream activity produces oil and natural gas produced in the Permian and is transported through intermediate intermediate assets to refineries and chemical facilities along the US Gulf Coast and Midwest. , where higher value and finished products are produced.

The integrated business model is also being implemented outside the United States, in places such as Singapore, where the project will use a patented catalyst and process technology for upgrading refinery tailings. In addition to cost savings and improved margins, the integration also allows the production of high value products.

Aggressive capital expenditure program to double profits by 2025

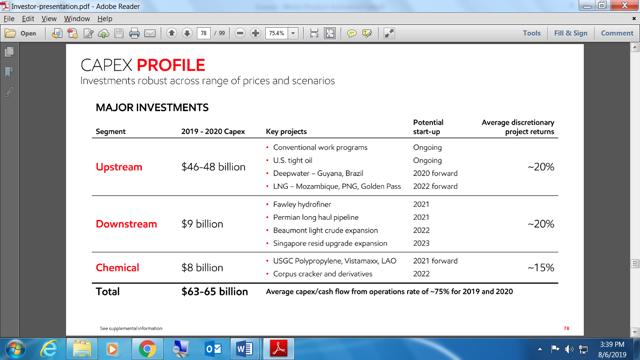

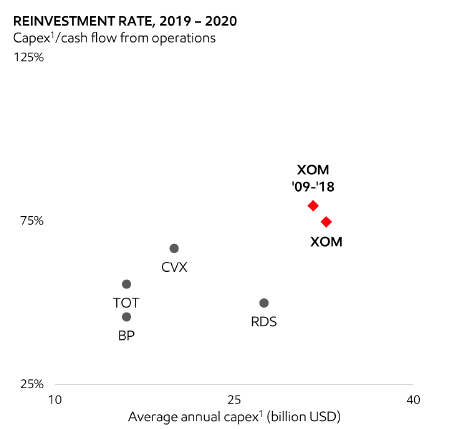

After years of low capitalization focused on high-cost assets in developed markets, Exxon has embarked on an aggressive reinvestment program focused on low-cost, high-yielding assets in frontier markets. The company plans to spend about $ 30 billion a year until 2025 (much more than other large oils such as BP (NYSE: BP) and Total (NYSE: TOT)), the bulk ( about 74%) to be spent. its main activities upstream, while its downstream activities and chemical activities will represent approximately 14% each, with an average project yield of approximately 20% for upstream and downstream, and 15% for chemicals .

|

|

|

Source: investor presentation XOM 2019

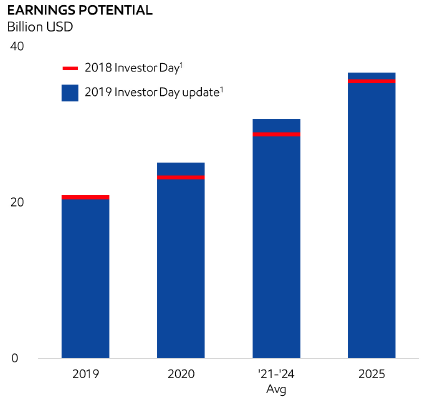

The program is expected to generate a $ 4 billion increase in earnings from 2019 to 2020, cumulative cash flow of $ 24 billion, while return on capital employed is expected to double to 15% from an average of 7% in 2016-2018. This ambitious program should also allow Exxon to regain its first place among the major oils.

|

|

|

Source: XOM 2019 Investor Presentation

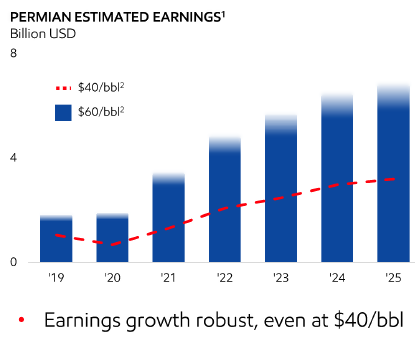

Five pillars of upstream growth – Permian production will cross a moebd by 2024: As previously mentioned, the bulk of Exxon's capital expenditure (74%) will be on upstream activity, which will result in an increase of 2.5 million moebd, bringing the total volume to 6.4. moebd by 2025. The Permian shale will be the largest contributor to the volume – (1.0 moebd) until 2024, while deepwater exploration and development in Guyana and Brazil will produce more than 900 kbd (kilos of barrels per day) by 2025. The new LNG projects in Mozambique and Papua New Guinea will add more than 25 mta of capacity by 2025, although the news has announced Thursday that Papua New Guinea wanted to renegotiate its agreement with Total (TOT) – which could defeat these expansion projects – or at least – diminish their economic advantage for XOM.

Although late in the Permian, Exxon has stepped up its platforms in the basin through the agreement with Bopco in 1Q17 and several other acquisitions since. Currently, the company is the largest operator of the Permian. It operates 48 platforms (as of March 5, 2019) and plans to increase this number to 55 by December 31. Driven by the continued ramp-up of the platforms, Permian production rose by 129,000 moebdos, up 89% year-on-year, bringing volumes up Exxon at 7.2%, up 7%, to 3.9 moebd.

|

|

|

Source: XOM 2019 Investor Presentation

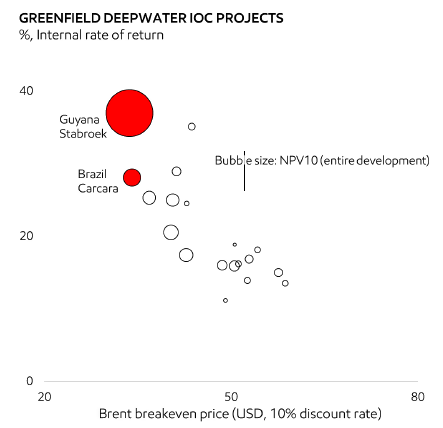

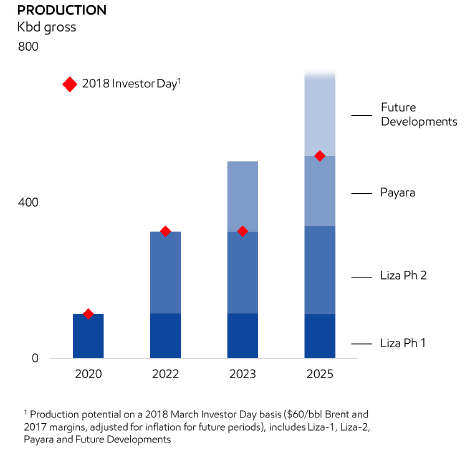

Guyana and Brazil – Deepwater plays with excellent project economics: Guyana and Brazil are at a breakeven point of between US $ 35 and US $ 40 per barrel of Brent, making them competitive with most US shale oil prices averaging $ 50 per barrel. In Guyana, Exxon discovered the Liza oil field in 2014 with about 3.0 billion barrels (billion oil equivalent per day) and has since raised the recoverable resource to 5.5 billion. The project reaches the threshold of $ 35 per barrel of brent. The development of phase 1 (Liza) will begin in 1Q20, the next phases are planned for 2022, 2023 and 2024/25, the project will produce 750 kbd (thousands or kilo barrels per day).

In Brazil, Exxon has acquired a significant portion of the pre-saline prolific oil fields, where oil lies under a layer of salt. The breakeven point for this project is slightly higher at US $ 40-45.

|

|

|

Source: XOM 2019 Investor Presentation

Four downstream projects underway downstream – focus on the integration of the Permian: Exxon also continues to invest in higher value fuels and lubricants, alongside downstream integration. The Beaumont Hydrofiner and the Rotterdam Hydrocracker will increase its production of ultra-low sulfur diesel (which is gaining in importance due to regulatory requirements), while increasing the company's ability to manage oil 250 kpj light at Beumont. A profitable 1.0 Mb / d pipeline is also underway, which will facilitate integration.

Source: XOM 2019 Investor Presentation

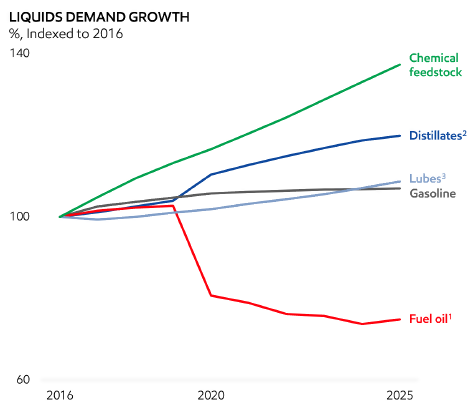

These downstream projects will capitalize on growing downstream activities, primarily driven by economic activity. For sulfur-based fuels, basic chemicals, distillates, lubricants and gasoline, they are expected to grow strongly.

Source: XOM 2019 Investor Presentation

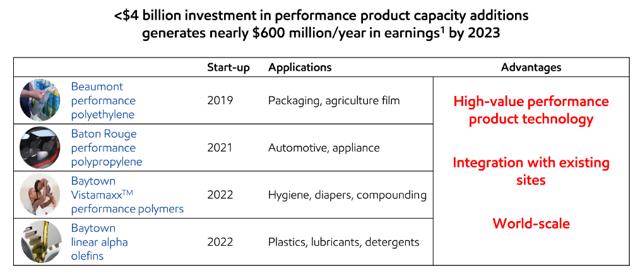

In the chemical sector, three new projects (including 1.3 million tons of high-density polyethylene – the main chemical product of Exxon used in packaging)

– were commissioned in 2018, generating sales growth of 6%. Projects under development include four industrial chemicals on the US Gulf Coast. (olefinic derivatives) and two new flow crackers (facilities that convert naptha and LPG to lighter hydrocarbons such as ethane), including 1.8 Mta, the largest ethylene cracker in the world in a joint venture with SABIC. Exxon's chemicals business enjoys significant competitive advantages because of its commodity advantages – the company receives food from its own facilities – and its integration into upstream production and refining facilities.

Source: XOM 2019 Investor Presentation

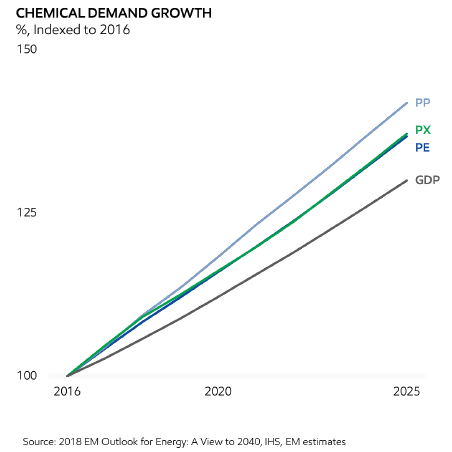

The increase in world population and the improvement of living standards, especially in emerging markets, continue to stimulate demand for chemicals. Global demand for chemicals will increase by about 45% over the next decade, according to Exxon Mobil's own estimates. Key factors in this category include an expanding middle class, which meets the needs of the packaging and consumer goods (polyethylene), automotive and appliance markets (polypropylene), and the growth of consumer goods. polymers (paraxylene). According to SIS estimates, these three chemicals grow about 1.5 times faster than their GDP.

Source: XOM 2019 Investor Presentation

Dividend growth may slow in the near term

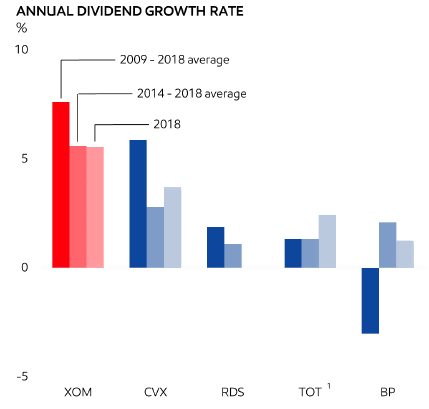

Exxon has been able to increase its dividend over the last 37 years, although its growth has slowed in recent years (5% compared to 2014-18, compared to around 7% compared to 2009-2018). However, the growth of the annual dividend remains much higher than that of other large oils. Given the significant investments planned over the next few years, the company's ability to generate this steady dividend growth could be put to the test.

Source: XOM 2019 Investor Presentation

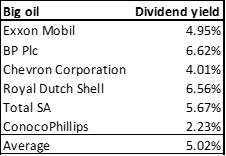

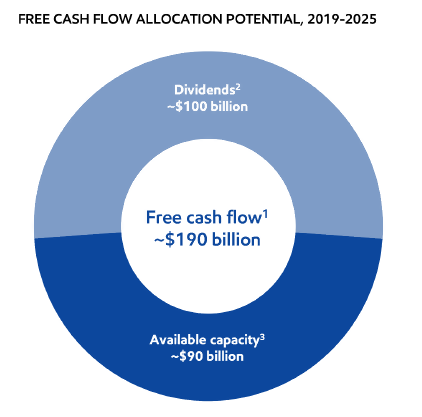

However, once the large portfolio of projects is fully online (planned for 2024-2025), growth could accelerate. The growth of the short-term dividend could also be maintained if the price of oil is favorable (USD 60 / barrel), as it allows the company to generate free cash flow of approximately USD 190 over 2019-2025, of which 100 billion USD could be paid dividends with the rest available for investment in increasing capacity. In terms of dividend yield, approximately 5.0% of Exxon is largely in line with the comparator group, but given the significant investments in the portfolio and potential earnings growth after completion, Exxon would make the game attractive dividends.

Source: Yahoo Finance

Exxon could also return money to shareholders through share repurchases. To go back in history, Exxon had been a major proponent of stock repurchases, spending about $ 210 billion over a decade before stopping them in the 2014/15 oil crash. While other large oil companies have taken over stock buybacks, Exxon has fallen behind as it favors investment over buybacks. With the highest expenses among the big oil companies, we think that Exxon might not start buying back shares in the near future.

Source: XOM 2019 Investor Presentation

Overview of the industry

Oil will continue to play a key role in the global energy mix

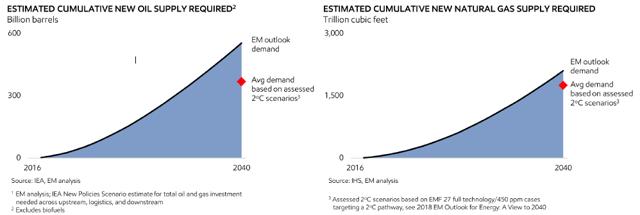

Despite the improvement of energy efficiency and the proliferation of electric vehicles, oil will continue to play a key role in the global energy mix. As long ascommercial Transportation and chemical raw materials will be the main drivers of oil, while growing demand for electricity will be the main driver of natural gas. Geographically, emerging markets such as China and India, with the growth of the middle class and the need for mobility, will be the main drivers of demand over the next decade.

Source: XOM 2019 Investor Presentation

While demand is expected to remain modest for both oil and gas, the nature of the depletion of this activity requires significant new supplies. International Energy Agency estimates that new oil and natural gas supplies will rise to 555 billion barrels and 2,100 billion cubic feet by 2040, respectively, which will require $ 21 billion in cumulative investment in oil and natural gas.

Source: XOM 2019 Investor Presentation

To close this depletion and increase its upstream activities, Big Oil continues to invest heavily in new oil assets through innovative projects and acquisitions. Shell (NYSE: RDS.A) (NYSE: RDS.B) and Total led the wave of acquisitions during the 2015 crisis, obtaining outstanding bids in US shale, mainly from Permain, while Exxon Mobil entered in play later (2017). In addition to shale, Big Oil also leverages low-cost, high-yielding assets in frontier markets such as Guyana and Brazil.

Results

2Q19

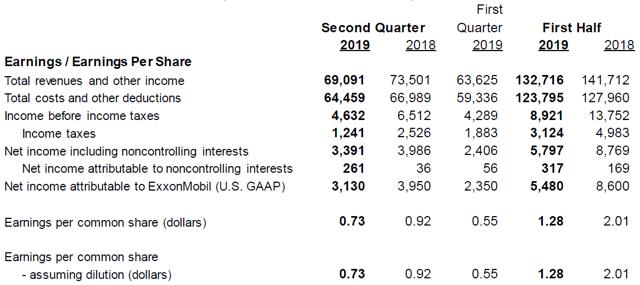

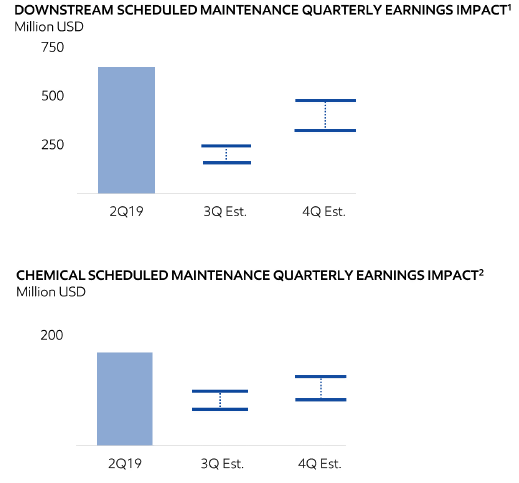

Exxon reported better-than-expected earnings in the second quarter, driven by strong upstream performance, partially offset by weak downstream and chemical businesses, as well as higher corporate and financial expenses . Net income increased 33.2% sequentially to $ 3.1 billion, or $ 0.73 per share, primarily due to a 13.4% increase in upstream earnings resulting from the higher crude prices (Brent + $ 5.63 and WTI + $ 4.93 resulting in a $ 5.09 increase in liquids production), partially offset by a 64% decrease in chemical revenues due to reduced margins due to longer downtime / maintenance.

On an annual basis, net income fell by 21%, mainly due to the poor performance of downstream (-38%) and chemical (-79%) businesses, due to downtime. and longer maintenance. However, upstream activity increased by 7.3% to $ 500 million due to the Alberta tax rate change, although lower liquid prices more than offset the 7.2% increase in volumes upstream. Overall, oil equivalent production increased 7 percent year-over-year to 3.9 million barrels per day, with liquids increasing by 8 percent (as a result of Permian basin growth), while natural gas volumes increased by 5%.

Despite satisfactory operating results, the free cash flow was negative in the second quarter due to the continued increase in spending on growth projects, mainly upstream. Cash flow from operations was $ 7.2 billion, up $ 1 billion from the first quarter, but free cash flow resulted in a negative balance of 0.8 billion dollars in investments of $ 8.1 billion during the quarter, reflecting investments in the Permian Basin.

Source: Publication of XOM 2Q Results

Perspective

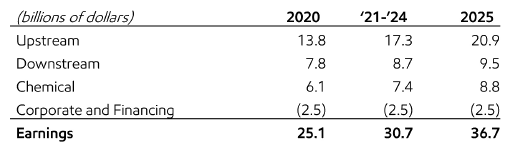

Despite short-term earnings weakness in challenging market conditions, Exxon Mobil's significant investments in portfolio construction will deliver solid results over the next few years, with 2020 as the benchmark. Management expects earnings of approximately $ 36.7 billion by 2025, almost double that of 2017, which was $ 19.7 billion, and exceeded $ 35.5 billion. the previous cycle's highs in 2014. This significant increase in earnings could allow Exxon to increase its dividends as well as its share buyback programs.

Source: XOM 2019 Investor Presentation

In the third quarter of 2019, results should be moderate and in line with those of the second quarter, with reduced downstream maintenance and chemicals being offset by reduced downstream Permal crude spreads and no tax advantage $ 500 million non-US upstream.

Source: Presentation of XOM 2Q19 results

Our take on expectations

Unfortunately, the prices of many oil and gas companies, including Big Oil and Supermajors, tend to move in tandem with rising and falling oil and gas prices. It seems that few integrated energy companies have the opportunity to smooth their profits by making profits in one sector of the supply chain, while another sector of the supply chain is under pressure.

Investing in a company such as Exxon Mobil should therefore be associated with higher volatility expectations than many other types of businesses and sectors other than energy. However, as a dividend game, we continue to enjoy the prospects of a fully integrated fully-cap company like Exxon, but we expect dividend growth to be limited in the near term.

We value the stock as a purchase at current prices, giving a dividend yield of about 5%. With today's downturn, we think the stock is slightly understated, but do not expect a lot of upside before oil and gas prices stabilize or the company resume its historical growth dividend above 5%.

Dividends for 2019 are expected to rise to $ 3.43, while those projected for 2020 are expected to reach $ 3.55, an increase of only 3.6%. There is potential for share repurchases, which would be another form of return of capital, but we do not anticipate any significant increase in dividend payments until 2022.

We are transferring the shares of our dividend growth portfolio to our income security portfolio.

The Income Strategist: Portfolio Strategies and Investment Ideas for Investors and Retirees.

The monthly price goes up

Our monthly subscription rate will be increasing to $ 50 / month from August 19th. If you want to lock the current rate of $ 40 a month, now is the time.

The annual subscription will remain at $ 400.

With additional features and benefits that include BlueLeaf Account Aggregation, Right Capital Financial Planning and the next launch The Income Club websiteWe believe that over a period of 12 months, members will appreciate the value they will derive from our service.

Disclosure: I am / we are long XOM. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: This article aims to identify an idea for further research and analysis and should not be considered as an investment recommendation. It does not provide personalized advice or recommendations to a specific reader. Also note that we can not cover all the relevant risks related to the ideas presented in this article. Readers should exercise due diligence and carefully review their investment objectives, risk tolerance, time horizon, tax position, liquidity needs and concentration levels, or contact their advisor to determine if the ideas presented here are adapted to their particular situation. In addition, none of the ideas presented here are necessarily related to NFG Wealth Advisors or any portfolio managed by NFG.

[ad_2]

Source link