[ad_1]

Shares of Exxon Mobil (XOM – Get Report) sold Friday, closing down 2.1% to $ 80.49 after the oil conglomerate released its first quarter financial results.

Given that Exxon has not met expectations in terms of financial and financial results, it is somewhat surprising that the stock is only slightly down. Add to that the fact that Exxon has rallied a bit over the past few months and should be pleasantly surprised to find that it has not gone down further.

The earnings of 55 cents per share exceeded expectations by 15 cents per share and decreased by 50% over the previous year, while revenues of $ 63.7 billion were well below estimates, $ 67.35 billion, and decreased by 6.7%.

Exxon's results also go hand in hand with Chevron's quarterly results (CLC – Get Report), which are vying for the acquisition of Anadarko Petroleum (APC – Get Report) in the midst of a fierce war. against Occidental Petroleum (OXY – Get Report).

Anadarko Petroleum is a stake in Jim Cramer Action Alerts PLUS club member. Do you want to be alerted before Jim Cramer buys or sells APC? Learn more now

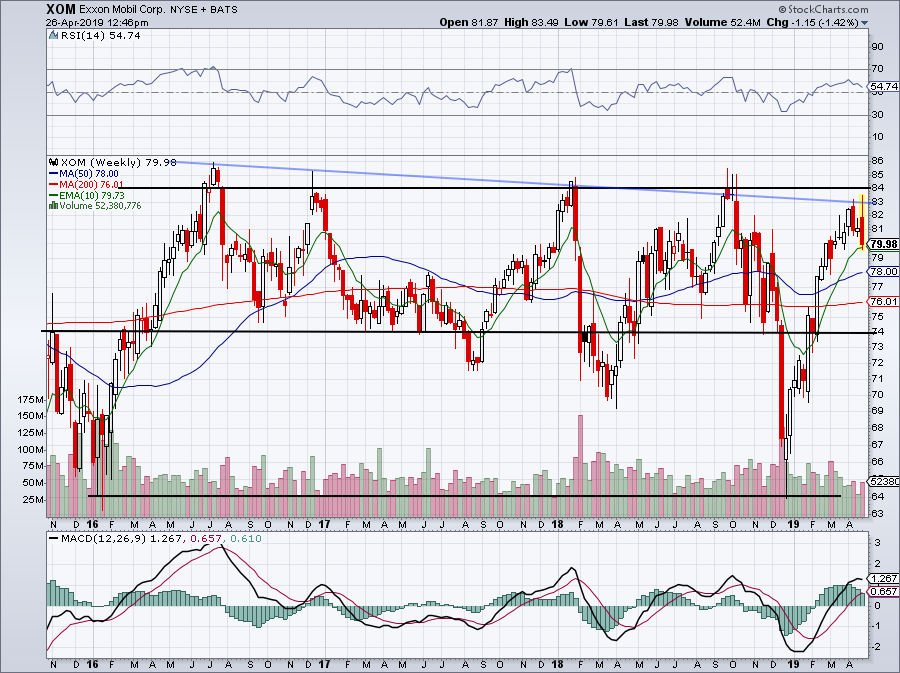

Exxon Mobil shares

After a report like this, bulls can not be held responsible for lack of urgency when considering taking a long position on the title Exxon Mobil. But should they show some urgency here?

For now, the stock is supported by the 10-week moving average. It's actually a pretty positive sign for bulls, even though it's certainly possible that it will not hold out next week. If that fails, a drop in the $ 70 should not be ruled out.

The stock has been stuck in a fairly narrow range over the last three years. With a few exceptions, support is generally around $ 74, with a price overrun of less than $ 70 occurring twice in the last 15 months. On the upside, gains are generally limited to $ 84, while a slight resistance to the bearish trend (blue line) weighs on the shares of Exxon Mobil.

So what now? Unfortunately, a gap of $ 64 will not be repeated without a merger effect, neither in the stock market, nor in the oil market (or both). This leaves this area of $ 72 to $ 74 a good place to consider a long position compared to the range rack.

Before getting there though, we need to see how Exxon Mobil does with the 10-week moving average. If it were to be held early next week, a rebound in the resistance zone of $ 83 to $ 84 will be in the cards. It should be noted that a rebound on this type of earnings report would be perceived as bullish, as few actions would normally be grouped together on such results.

That said, if the average 10-week moving support failed, a fall of 76 to 78 dollars would be expected. From there, we would need to determine if the stock sold in XOM is depleted or if lower prices are in store.

[ad_2]

Source link