[ad_1]

Stocks are ready to exit on the last trading day of September – and the last day of the quarter – on a high note. But we say good riddance to the month that is expected to record the worst percentages of decline in a year for the S&P SPX,

and Nasdaq Composite COMP,

which has been at the forefront of fighting rising bond yields.

But while the Nasdaq continues to lag behind the year, it’s still teeming with companies Wall Street isn’t about to give up. Our call of the day from Citigroup brings together some of the best internet stock market bets from the US and beyond right now, giving the industry a boost.

“In a context of tightened regulations, geopolitical tensions and cases of COVID-19 still fully under control, we believe that the Internet sector will remain one of the most attractive options in the allocation of global portfolio given the technological innovation and efficiency of scale, and as investors weigh the potential for growth against the risks, ”said Citi’s global Internet team, in a recent conference call with clients .

But not all of these stocks are a sure thing. US analyst Jason Bazinet notes that investment banks and institutional investors are “just too optimistic” about upcoming advertising dollars for US internet stocks. After a strong rebound in growth from the second quarter of 2020, Wall Street banks are forecasting even stronger advertising growth going forward – $ 107 billion this year and $ 70-75 billion in 2022 and 2023, a- he declared.

While institutional investors attribute this growth to a “new era of higher advertising intensity for every dollar of economic activity,” Bazinet says this is really a rebound in economic activity, but the e-commerce has “already resumed”. For this reason, he does not recommend that investors buy Google’s parent company Alphabet GOOGL,

Facebook FB,

Twitter TWTR,

Pinterest Pins,

or Snapchat parent Snap SNAP,

“We think investors would be much better off buying Amazon AMZN,

where we’re only a few quarters away from locking in those tough lineups, and the track has kind of underperformed because of those tough e-commerce lineups, ”says the analyst.

It also highlights an under-the-radar segment that plays into this ad, with companies like IronSource IS,

or AppLovin APP,

which “quite simply booming” in the field of advertising for mobile games. Wall Street estimates aren’t too high on the industry either, he says.

Citi also offered a few Chinese choices, as analysts weighed in on the regulatory pressures the tech industry has been under this year. With e-commerce being a key cog in the domestic consumption wheel, it is probably the least threatened by Beijing’s initiatives, analyst Alicia Yap said. That said, online gambling is a riskier subset and the least likely to find government support, as this expense does not accrue to society, but only to businesses.

Citi’s top picks in China include online retailer JD.com JD,

“Because it still has the history of user growth” for active trading users, and is one of the few companies likely to see trends of margin improvement in the coming year .

Citi also recommends Baidu BIDU,

which Yap considers less exposed to regulatory headlines. The company is also awarded a few smart city projects – a government goal of using technology to improve urban infrastructure and services. “This should demonstrate Baidu’s ability to provide protection for data transfer and storage, etc.” Yap said.

Elsewhere, analyst Brian Gong said regulatory pressure is unlikely to reach Chinese video-sharing site Bilibili BILI,

shame. It is positive on the stock “thanks to its healthy ecosystem, continued user-level growth and decent monetization potential.”

Other choices include DHER European Delivery Hero,

and Just Eat Takeway GRUB,

and the multinational conglomerates Prosus PROSY,

and Yandex YNDX,

outside of Russia.

The buzz

The Senate is due to vote Thursday on legislation that would narrowly avoid a government shutdown by maintaining its funding until early December.

Federal Reserve Chairman Jerome Powell will testify before a House panel on COVID-19 relief at 10 a.m. EST.

On the data front, weekly jobless claims and a second quarter gross domestic product revision are expected before the market opens. In China, the official purchasing managers index contracted for the first time since early 2020, as the economy grapples with an electricity crisis and a slowdown in real estate.

Pharmaceutical group Merck & Co. MRK,

declared that it has agreed to acquire Acceleron Pharma XLRN,

which focuses on treating rare diseases, in an $ 11.5 billion deal.

AstraZeneca AZN,

AZN,

and the University of Oxford’s COVID-19 vaccine, showed 74% effectiveness in preventing the disease in a large, late-stage trial in the United States, Chile and Peru.

Galactic Virgo SPCE,

shares are skyrocketing in pre-market trading after the space tourism company announced the end of a Federal Aviation Administration investigation into its test flight with founder Richard Branson on board.

Longtime Tesla TSLA,

Bull Chamath Palihapitiya said he pulled the electric car company “within the last year or so” in favor of new investment opportunities.

Rapper Kanye West’s “perfect hoodie” sold out within hours at retailer Gap GPS,

and now appears on eBay, for well above the original price of $ 90.

The Broadway hit “Aladdin” was canceled Wednesday night after cases of COVID-19 were reported among the cast, a day after the show reopened.

The steps

ES00 futures contracts,

YM00,

NQ00,

point to a rally at the end of the quarter, with European equities SXXP,

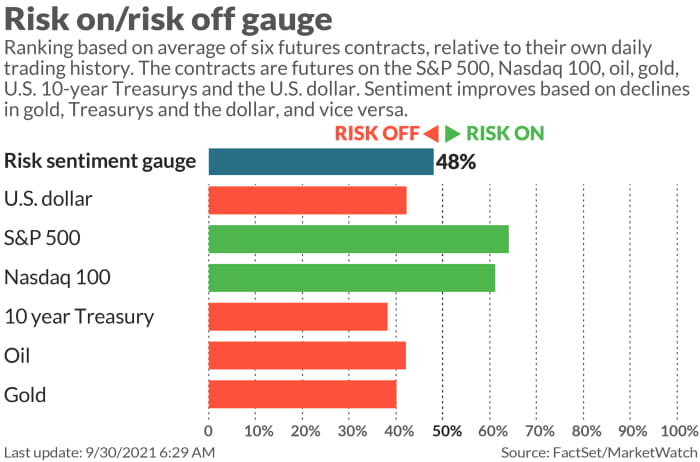

get a lift and Asian stocks mostly on the rise. The dollar DXY,

released some, resulting in GC00 gold,

a boost, and CL00 oil prices,

BRN00,

hold on.

Table

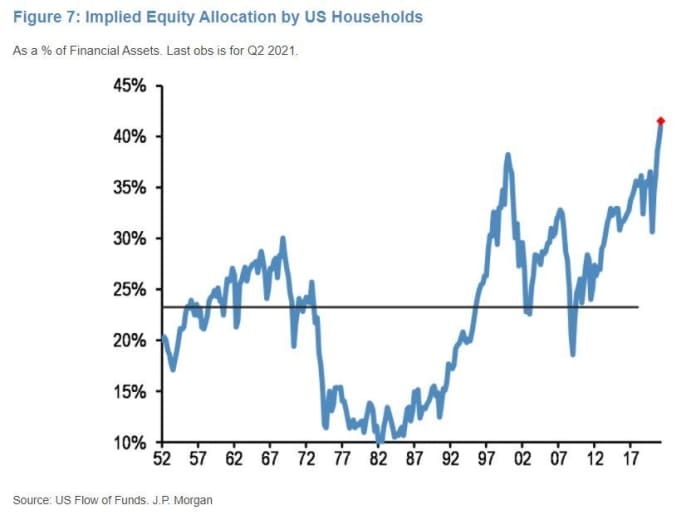

Are American households abusing this equity allocation? In a note to clients, JPMorgan strategist Nikolaos Panigirtzoglou noted a new record high in a recently released second quarter U.S. cash flow report.

“This measure of cash flow shown in Figure 7 shows a clear overextension among US households in terms of equity allocation, leaving them vulnerable in a risk scenario where the previous uptrend in equity markets begins to reverse. “said Panigirtzoglou.

Random readings

Army vet Eugene Bozzi says he’s trying to adjust to life in the limelight after catching an alligator in a trash can.

A fire devastated an Edinburgh cafe used by JK Rowling to write his first “Harry Potter” books, but his favorite table miraculously survived.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern Time.

Want more for the day ahead? Sign up for Barron’s Daily, a morning investor briefing, featuring exclusive commentary from the editors at Barron’s and MarketWatch.

[ad_2]

Source link