[ad_1]

Before Facebook (FB) published its first quarter results, the stock price had risen about 40% since the beginning of the year. The stock price rose 10% after office hours, as a result of the market's appreciation of the results.

The company has published strong statistics on users and its revenues have exceeded expectations. But not everything is perfect. Management is faced with the consequences of its security mistakes. In addition to the legal fees reported this quarter, the company will face additional expenses over the next few years.

In this context, the market values the company at the right price despite impressive revenue growth.

Source of the picture: TheDigitalArtist via Pixabay

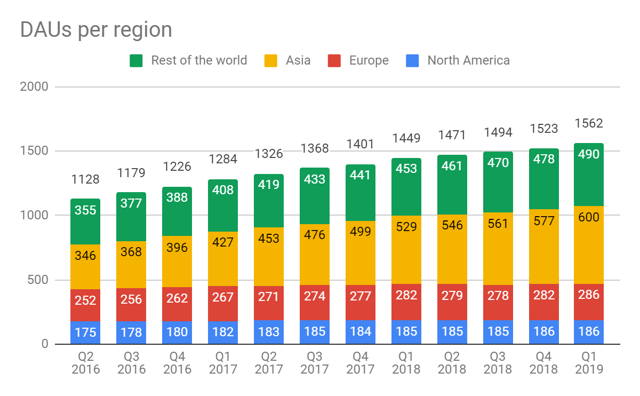

Strong user base

Although nearly 20% of the world connects to Facebook every day, daily active users have increased by 8% over the previous year. As a comparison, the Twitter (TWTR) and Snaphchat (SNAP) SADs increased by 11% over a much smaller number of users.

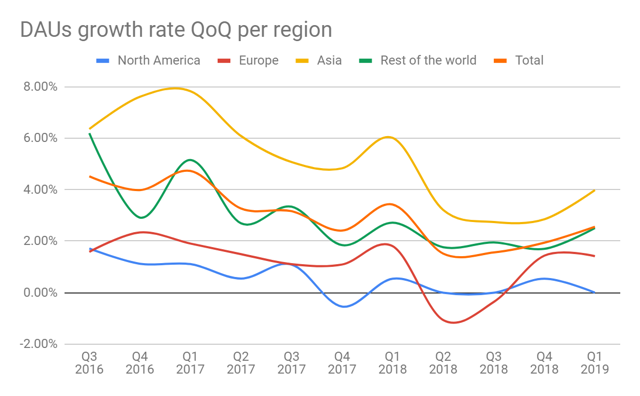

Growth is steady in all regions except the United States, where SADs began to stabilize several quarters ago.

Source: Author, according to the reports of the company

As a reminder, the figures do not include Instagram, WhatsApp and Oculus users. Management estimates that about 2.1 billion people use at least one Facebook app each day.

In addition, the slowdown in account management growth observed in recent quarters has stabilized.

Source: Author, according to the reports of the company

The solid user base is surprising considering the recent security and privacy issues that were made public after the Cambridge Analytica scandal.

In recent months, the list of security errors has been lengthened. Incidents bypass the most basic security principles. For example, Facebook has stored unencrypted passwords of hundreds of millions of users over the years.

More recently, Bloomberg announced that Facebook publicly publishes information about its users on the Amazon AWS platform (AMZN). And Facebook has asked new users for their email passwords, etc.

This series of events and the growth of users show that users are indifferent to the security problems of Facebook. The biggest risk to address these concerns is regulation.

In this context, the privacy-focused platform that Mark Zuckerberg talked about during the results call does not seem so critical to users. But the concept, which will be available in the long run, can be important to build confidence in regulators.

Impressive revenue growth

Facebook's security issues and reputation do not seem to worry advertisers either.

While SADs and UAMs increased by 8%, revenues increased 30% in constant currencies, indicating that advertisers are spending more on Facebook. In addition, during the results call, management indicated that the number of advertisers had also increased.

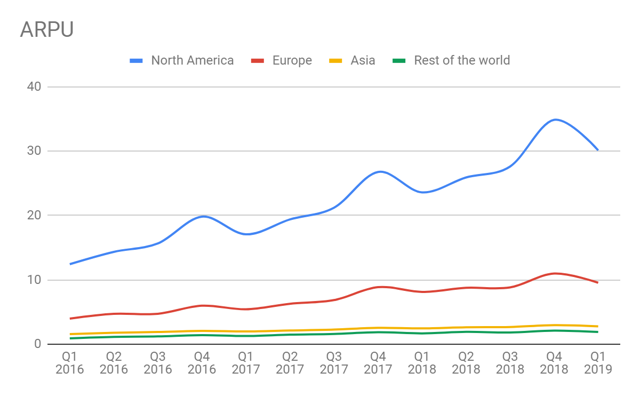

The decrease in average revenue per user (ARPU) compared to the previous quarter is due to the seasonal nature of advertising expenses. Compared to last year, ARPU has increased by about 16.1% and growth has been steady in all regions.

Source: Author, according to the reports of the company

Revenue growth is remarkable considering adverse tailwind events due to lower print revenues than the flow.

Security costs

In the context of these impressive results, the company faces the challenge of raising costs to solve security problems.. The additional expenses are double.

The first aspect of security concerns, visible during this quarter, is that the company will face legal fees.. The company reported a legal expense of $ 3 billion as a result of the FTC investigation. These costs could even increase, with management indicating a range of $ 3 billion to $ 5 billion.

And the threat of fines and court costs does not stop there. For example, at the beginning of the year, Vietnam accused Facebook to break the cyber laws. In addition, Facebook is having difficulties with the German antitrust regulator because of its policy on user data..

The second aspect of moving to a more secure environment is that Facebook's spending will continue to increase. During the earnings conference, management raised the 2014 spending growth outlook by 55%, including $ 3 billion in legal fees this quarter.. But beyond exceptional costs, management has also indicated aggressive investments beyond 2019 to improve security. The outlook for operating margin decline to around 35% in the long term has not changed.

Back to a stock price of $ 200

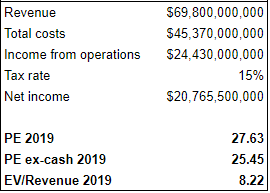

At a stock price of about $ 200, the market evaluates the company at a PE ratio of nearly 25.45 times the cash.

Source: Author

The calculation assumes:

- Revenue growth in fiscal year 2019 by 25% compared to 2018.

- Operating margin at 35%.

- Tax rate of 15%.

Despite the growth, the market does not value the company at a discount given the uncertainties surrounding the legal costs with many lawmakers.

In addition, the 15% tax rate may not be sustainable in the long run. The 2018 annual report states that Facebook generated pre-tax pre-tax income of $ 16.56 billion while providing approximately $ 1 billion in taxes. The corresponding tax rate is 6%. According to the OECD, the average corporate tax rate in the world is 21.6%. Some European countries, such as France, have begun to introduce a tax on income to offset the low tax rate due to tax optimization.

In any case, even with a tax rate of 15%, a PE ratio before cash exceeding 25x is not a good deal considering the additional costs that will offset some of revenue growth of 25%.

Conclusion

Facebook has posted impressive revenue growth of 26% over the previous year. Despite a large user base, both UAM and UADs increased by 8%.

Security issues have been done audience in recent months has not impacted user growth and advertisers' spend.

But the biggest threat to society is the costs of dealing with regulators. In addition to court fees for past mistakes, improving security and privacy will incur additional fees.

In this context, the stock price at 200 USD does not represent a good deal. The payout ratio of equity is greater than 25x and the company is also exposed to the risk of higher tax rates.

NoteIf you enjoyed this article and would like to receive updates on my latest searches, click on "To follow"next to my name at the top of this article.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link