[ad_1]

My FANGMAN sophisticated index fell by 4.3% today, its maximum since December 24th.

It's a rare moment in recent years when US government regulators are simultaneously attacking four tech giants and social media: Facebook, Amazon, Google, and Apple. These four companies are part of my FANGMAN index, which also includes Microsoft, Nvidia and Netflix.

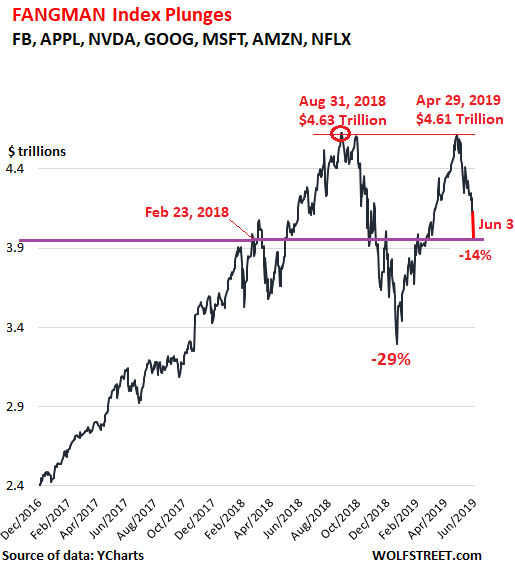

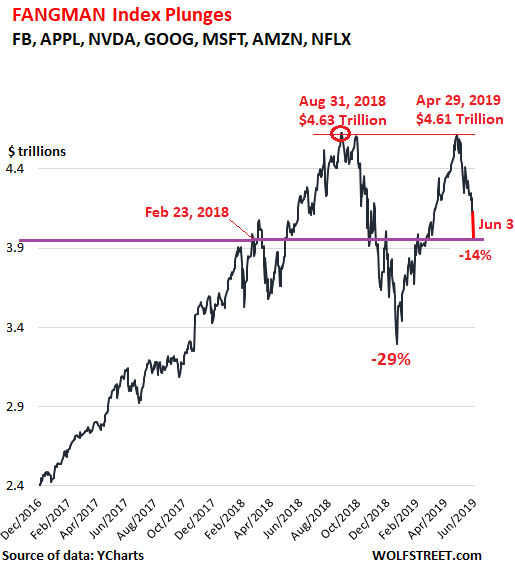

The index plunged 4.3% today, the largest percentage decline since the famous 4.6% fall of December 24, 2018. In dollar terms, the market capitalization of $ 137 billion dollars has been removed. During the last four trading days, the FANGMAN index fell 6.6%. I highlighted today's movement in red (market capitalization data via YCharts):

The index has experienced cerebral surges and recesses over the past two years. It peaked on August 31, 2018 (at $ 4.63 billion), then plummeted 29% on December 24 ($ 3.29 billion), then exploded by 40% as of April 29th. But that day, at $ 4.61 billion, he failed to delete the month of August. high. And then the sale started.

Since April 29, the FANGMAN index has fallen 14.0%, a market capitalization of $ 645 billion, giving up 49% of the rise after Christmas in just five weeks.

I watch these stocks because of their excessive weight over the entire stock market and because they range from highly overpriced to immensely overvalued, depending on the stock – and symptomatic for a large part of the stock market.

But considering the sale of the last few weeks, there has not been a lot of regulatory pressure since Friday.

On Friday, the Wall Street Journal reported that, according to its sources, the Justice Department "laid the groundwork" for an antitrust investigation on Google, the world's largest advertising platform. Reuters reported Monday that Google "still refused to comment."

The WSJ summarized the problem:

The rise of technology has seen three corporate titans that did not exist 30 years ago – Amazon, Google and Facebook – suddenly seize the power to influence a great deal. part of the US economy and society, from the stock market to political speech, from personal buying habits to the way small businesses sell their wares.

With their huge size and dominance, networks, data caches and economies of scale are all advantages that make it difficult for new competitors to succeed. Many companies that compete with these giants in a sector also depend on their platforms to reach their customers, and they complain about being unfairly squeezed.

The European Union's competition regulators have already imposed three mega-fines on Google, for a total of 8.2 billion euros in three years:

- In June 2017, a EUR 2.42 billion fine was imposed on Google for abusing its leading search engine position by giving preferential treatment to its own comparison service.

- In July 2018, Google was fined 4.34 billion euros for pushing smartphone manufacturers to use its Android operating system.

- And in March 2019, Google has been fined 1.5 billion euros for its search related commercials.

Over the weekend, it was announced that the FTC would have jurisdiction over a possible antitrust investigation of Amazon's practices. And on Monday, Reuters reported that "Amazon declined to comment on Monday".

According to sources, the FTC would also have jurisdiction over a possible antitrust investigation on Facebook, which also has Instagram and WhatsApp.

The FTC has long been investigating Facebook for violation of privacy. In 2012, he approved a final deal with Facebook, "resolving accusations that Facebook would have cheated consumers by telling them that they could keep their private information on Facebook and then repeatedly authorizing their sharing and publication This regulation included a consent decree that Facebook would have violated Facebook by sharing user data with Cambridge Analytica.

In April, Facebook announced a $ 3 to $ 5 billion fine for these violations. Senators Richard Blumenthal (Conn.) And Josh Hawley (R-Mo.), Members of the Senate Judiciary Commission, described this decision as a "Facebook market" that does not go far enough in managing l & # 39; company. be accountable to its users and impose changes.

"Even a multi-billion dollar fine involves a write-down for the company, and heavy penalties have done little to deter big tech companies," they wrote in the letter. "Fines alone are insufficient. In-depth reforms must finally make Facebook responsible for its actions. We are deeply concerned that unique penalties of any size every two or three years are unfortunately enough to effectively limit Facebook. "

They proposed a series of reforms, including: "Personal responsibility must be recognized from the top of the board of directors to the product development teams." And they added, "It's also time for the FTC to learn lessons under-executed."

Still according to sources, the Justice Ministry would have jurisdiction over a possible antitrust investigation on Apple, which is already entangled in an investigation by EU regulators, following a complaint from Spotify according to which he would abuse his power. application downloads.

This puts the four companies simultaneously under the US regulatory microscope. And obviously, officials are expanding to inform the media. On Monday, Reuters reported that "informed people about the case say that neither the Justice Department nor the FTC have contacted Google or Amazon about polls, and that the company's executives are unaware of the problems examined by the regulators ". media.

The division of competence was the first essential step. The rest could take years.

Sources told Reuters on Monday that the government "is preparing to investigate whether Amazon, Apple, Facebook and Google are abusing their enormous market power … by setting up what could be a large-scale investigation and without previous on some of the largest companies in the world. "

The congress appears to be on board, according to Reuters:

Senate Judiciary Committee Chair Lindsey Graham, a Republican, told Reuters that the business model of companies such as Google and Facebook should be scrutinized. "It's so powerful and so unregulated," he said.

Senator Marsha Blackburn, another Republican, said the panel would do what it called a "deeper dive" into big tech companies.

Democratic Senator Richard Blumenthal, who said Monday that US law enforcement forces should do more than wring weight in the face of corporate weight, has also bothered. "Their predatory power requires a strict and rigorous investigation and antitrust action," wrote the Senator.

Now let's see how this will happen – if the result will actually change business practices, or if fines will simply drive up the cost of doing business, costs that can be written off as "one-time fees" that analysts and the financial media rule out eagerly report on the revenues and hurriedly send them into oblivion where they have no importance. But for now, the FANGMAN index shows that there is a price to pay.

Do you like to read WOLF STREET and want to support it? Using ad blockers – I fully understand why – but you want to support the site? You can give "beer money". I like it a lot. Click on the beer mug to find out how:

Would you like to be informed by email of the publication of a new article by WOLF STREET? Register here.

[ad_2]

Source link