[ad_1]

Getty Images

If investors are freaking out about the election and the stock market, you certainly wouldn’t know it from the latest bull run, which saw Wall Street register its best weekly performance since April.

The Dow Jones Industrial Average DJIA,

rose 6.9% over the five-day period, while the S&P 500 SPX,

jumped 7.3%. The highly technological Nasdaq Composite COMP,

outperformed the other two major benchmarks with an increase of 9%.

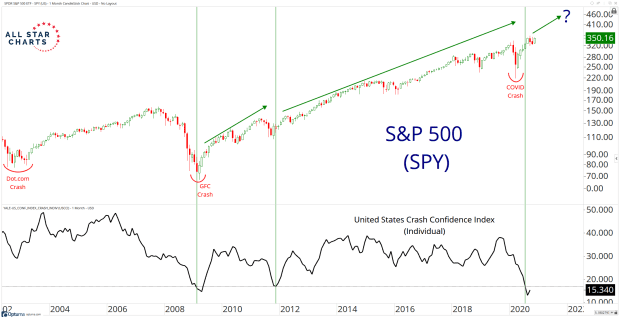

Despite the strong tension, the mood remains rather gloomy, according to Robert Shiller’s American Crash Confidence Index. Figures show that nearly 90% of investors believe that “a catastrophic stock market crash in the United States, such as that of October 28, 1929 or October 19, 1987, is likely within the next six months, including the event of a other countries crash and spread to the United States ”

Shiller, a Nobel Prize-winning economist and professor at Yale, reported the findings in a recent New York Times editorial. “The coronavirus crisis and the November elections have pushed fears of a major stock market crash to their highest level in many years,” he wrote. “At the same time, stocks are trading at very high levels. This volatile combination does not mean that a crash will occur, but it does suggest that the risk of a crash is relatively high. Now is the time to be careful. “

While Shiller warns that it’s time to be careful, JC Parets of the All Star Charts blog says the exact opposite. He used this table to emphasize his point:

“Anytime we’ve come down near these levels in the Crash Confidence Index, not only did the crashes not happen at all, but they were in fact historic buying opportunities in the market. fellow, ”Parets wrote in a blog post on Sunday. “I think today is no different.

In fact, Parets, taking a contrarian approach, says he’s never been more convinced investors are wrong that a crash is coming, so he’s stocking up on stocks.

“For me there is no holy grail. There is no magic indicator that tells us when to buy and when to sell. This is a weight of evidence approach that we are taking here, ”he explained. “This is further proof that buying stocks is always a better idea than selling them.”

[ad_2]

Source link