[ad_1]

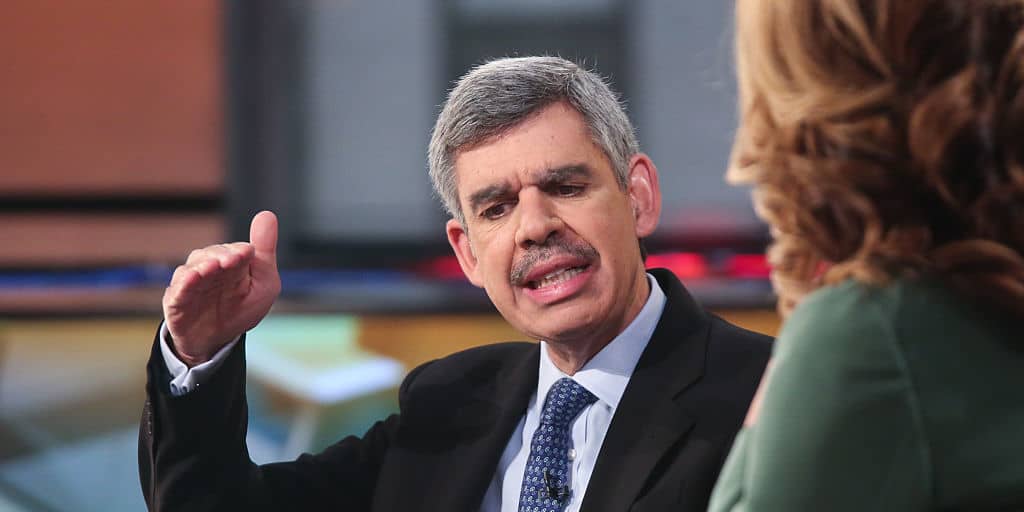

Mohamed El-Erian

Getty Images

Investors had plenty to be thankful for last week, given the behavior of the stock market in the face of the surge in COVID-19 cases and some potentially worrying signs on the economic front.

As Friday’s closing bell marked the end of the shortened holiday period, the Dow Jones Industrial Average DJIA,

had accumulated a stellar 2.2% gain to close at 29,910.37 after closing above 30,000 earlier in the week for the first time. The S&P 500 SPX,

and Nasdaq Composite COMP,

also hit records.

“

“You should care about a long term account.

“

Mohamed El-Erian, president of Queens’ College University, Cambridge and economic adviser to Allianz, is not so sure the breathlessness will last.

“I can see why the market has adopted the best destination and embraced this improvement in travel,” he told Yahoo Finance in an interview Friday. “But we still have a pretty bumpy trip. And I suspect that we will unfortunately see some companies come under a lot of pressure in the coming months.

El-Erian acknowledged that investors are taking risks and that there are valid reasons to support such a move, particularly the Federal Reserve’s clear intention to remain a safety net for the market as well as the promise to a vaccine finally ending the crisis. pandemic in sight.

“As long as we think there’s a vaccine, and as long as we think central banks are going to minimize any damage to the markets, not to the economy, to the markets up to that point, which you will get, it’s the people. stretching for more returns, ”he explained.

But, he warned, there is a potential problem these two factors cannot resolve: bankruptcies, which he says are ongoing. “I say to investors, be careful,” he said. “Do another granular analysis, because as you strive for more return, you take a lot more risk of default and bankruptcy. And that’s not something central banks can save you from. “

El-Erian also touched on decoupling the bullish trend in the stock market from what’s happening in the real world. “The gap between Main Street and Wall Street is very, very big, and it’s growing,” he says. “And it’s not healthy for the company, and it’s not healthy for the long-term markets. You should be worried about a longer term calculation, especially if the economy is not improving quickly and not validating what is a very high asset crisis.

Watch the full interview

–

[ad_2]

Source link