[ad_1]

"What can anyone do? Praise and blame. It is human virtue, it is human madness. "- Friedrich Nietzsche

Ok ok ok ok. So let me understand. The unemployment rate is 3.6%. The S & P 500 (SPY) is near new heights of all time. And yet, the Fed will probably reduce its rates three times this year? Can we all step back for a moment and think how crazy it is?

In my last Real Vision interview (S & P 500: There's still something ridiculously wrong (with Michael Gayed) | Trade Ideas), I've talked a lot about the Fed and the market expectations of 'interest. I am deeply concerned that the market is calling for rate cuts that the Fed could propose at this stage of the cycle as this suggests that there is much more fragility below the surface than the averages would want.

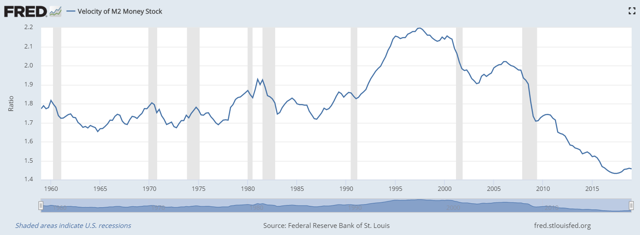

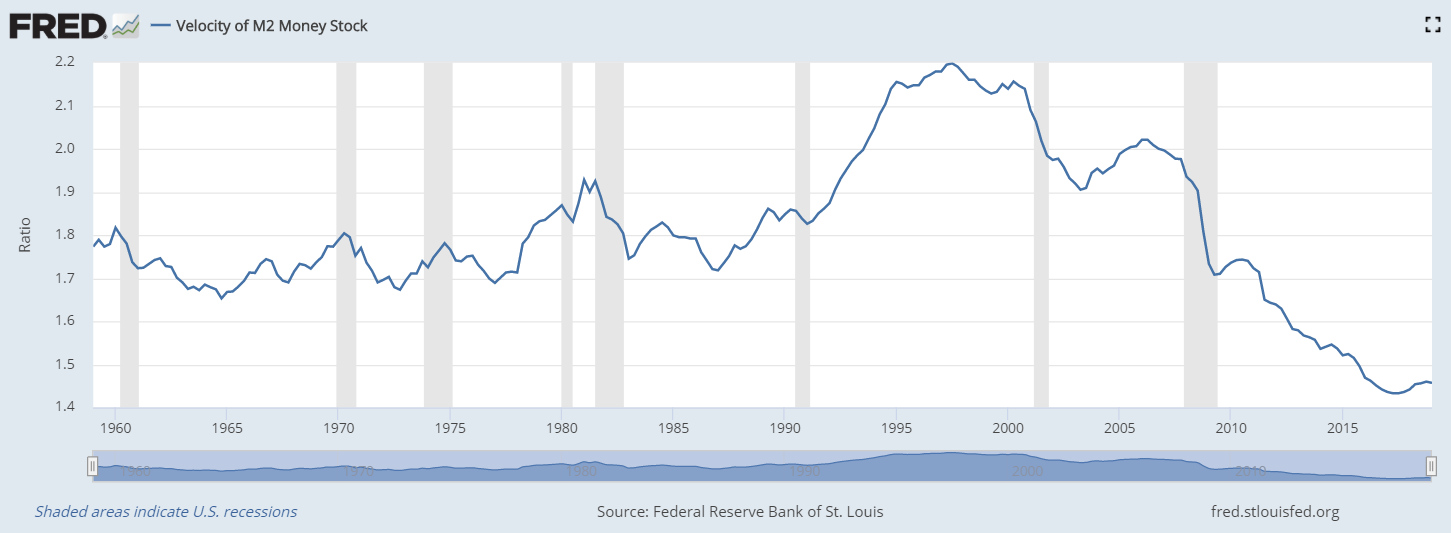

If the Fed started a cycle of rate cuts here, on an already weak basis, would that not be an admission of failure on the part of the Fed that all measures of quantitative easing, as well as Floods of liquidity, have not really created a virtuous cycle of reflation? Does this not mean that the United States will never be able to get out of a low interest rate environment and that we are finally in the trap of Japanese debt? How can we ever get a reversal of the speed of money if the Fed has conditioned the market to always expect lower rates, thus eliminating the urgency of using the capital more aggressively here and now if it will always be cheaper later?

This sounds like total madness, EXCEPT it is a maneuver intended to cause a downward trend of the US dollar (UUP). One of the things I said about Real Vision is that trade wars do not mean much if tariffs are canceled out by the movement of money, so the net effect is zero. A rising dollar tends to be a disinflationary force and, in many ways, acts as a form of tightening of the money supply. The Fed does not need to lower rates if the dollar goes down, which helps to import inflation into the United States. We may be starting to see the whites of this trend now, just as major resistance is being hit.

I guess that may be why Gold (GLD) shows signs of life. If the Fed actually tried to depreciate the dollar under the threat of a rate cut, one could witness a self-fulfilling trend starting more generally for precious metals and commodities, which would likely benefit from the fact that the dollar would be cheaper. a weaker greenback. Gold, Silver (SLV) and their respective miners (GDX) (SIL) are more and more interesting here, and it makes sense to see them start a nice uptrend here.

Needless to say, we continue to live in an unprecedented time. I'm happy that at least those who follow me on Twitter agree on what should happen next.

Markets are not as effective as conventional wisdom would have you believe. There are often gaps between market signals and investor reactions, which allows us to know if we are in a "risk" or "risk-free" environment.

the Delay report can give you an edge in reading the market so that you can make asset allocation decisions based on award-winning research. I will give you the signals – it's up to you to decide if you want to go on the offensive (that is, increase the exposure to risky assets such as stocks when risk is activated) or defense (that is, you lean towards more conservative assets such as bonds / cash when the risk is "off").

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: This writing is for informational purposes only. This is not an offer to sell, a solicitation to purchase or a recommendation regarding a securities transaction. Nor does it offer to provide consulting or other services from Pension Partners, LLC in any jurisdiction where such offer, solicitation, purchase or sale would be unlawful under the securities laws of that jurisdiction. country. The information in this document should in no way be construed as financial or investment advice. Pension Partners, LLC expressly disclaims any liability for actions taken on the basis of any or all of the information contained in this document.

The Lead-Lag report is provided by Pension Partners, LLC, a federally registered investment advisor. Registration as an investment advisor does not involve a certain level of skill or training. All opinions and opinions mentioned in this report constitute our judgments at the time of writing and are subject to change at any time. The information contained in this document is not intended to serve as a primary basis for investment decisions and should also not be construed as advice to meet the specific investment needs of a particular investor. The trading signals produced by the Lead-Lag report are independent of other services provided by Pension Partners, LLC, and the positioning of the accounts under the direction of Pension Partners may be different. Do not forget that investments involve risks, including capital loss, and past performance may not be representative of future performance. Pension Partners, LLC, its members, officers, directors and employees expressly disclaim any responsibility for actions taken on the basis of any or all of the information contained in this document.

[ad_2]

Source link