[ad_1]

U.S. Central Bank Vice President Richard Clarida said on Wednesday that the Federal Reserve could start cutting back on major asset purchases this year. Additionally, that the first interest rate hike since the onset of Covid-19 could take place in 2023. Meanwhile, although Fed members have said inflation will be transient, business leaders some of the larger institutions are complaining about rising inflation.

Looming Jobs Report Richard Clarida Says Decline Could Happen This Year

At the end of 2019, the Federal Reserve and many central banks around the world began to implement monetary easing practices. Since then, the Fed’s money supply has swelled after the onset of Covid-19, eclipsing decades of money creation in less than a year. The US central bank has kept the monetary valve in place and has yet to turn it off, while the cost of goods and services in America has risen dramatically.

Plus, as the real economic situation is felt by tenants, landlords, and businesses that have been forced to close, Wall Street is in the midst of one of the biggest bull races of all time. This week the Nasdaq and S&P 500 are set to break records again and economists believe the stock market is not situated in reality.

On July 29, Bitcoin.com News reported on the recent Federal Open Market Committee (FOMC) meeting and Fed members explained that monetary easing will continue and interest rates will remain close to zero. “I think we are a long way from making further substantial progress towards the maximum employment target,” US Central Bank President Jerome Powell said on July 28.

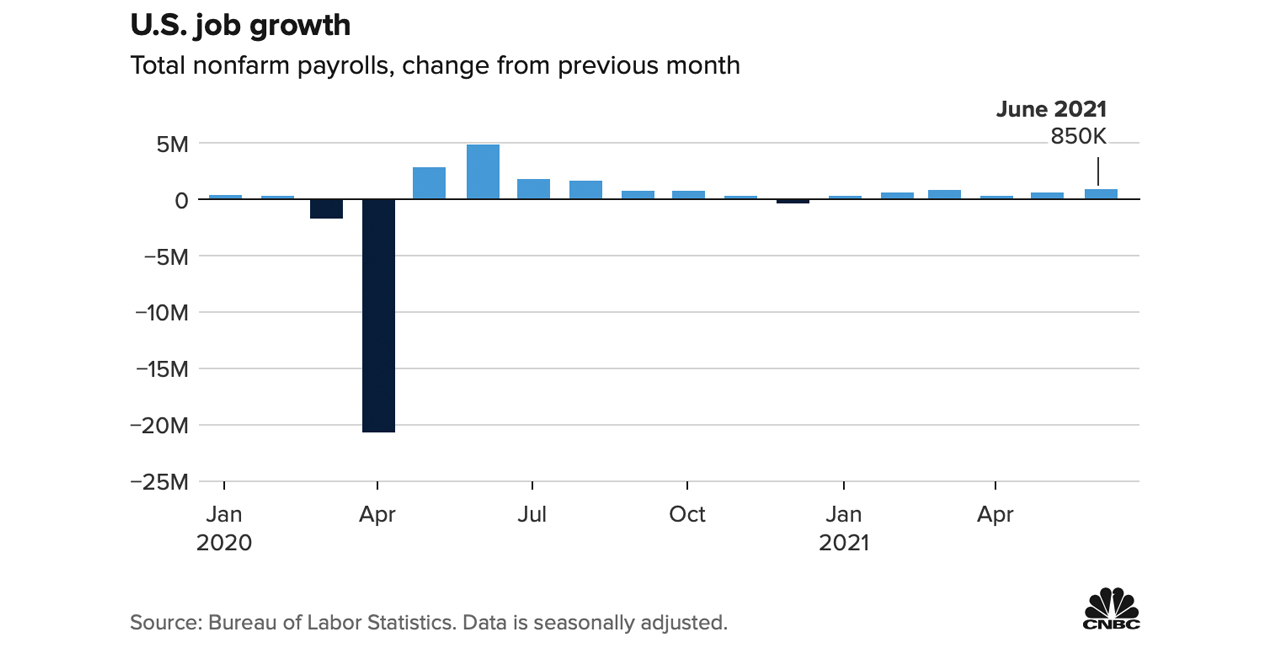

The Bureau of Labor Statistics jobs report was released on Friday and analysts believe the report may prompt the Fed to act sooner. Ahead of the release of the job report, Michael Hewson, analyst at CMC Markets, told Barron’s on Friday that investors were speculating on the results of the labor statistics.

“There has been a lot of speculation about the importance of today’s jobs report in terms of the timing of a possible reduction in asset purchases,” Hewson said. “As well as expect a possible rate hike, whether early 2023 or late 2022. The reality is that whatever number is today, the picture is unlikely to be any clearer afterwards. declining numbers, “he added.

The tapering could occur this year, according to statements by Fed Vice President Richard Clarida. Vice President Clarida explained in a recent interview with the Peterson Institute for International Economics that the reduction in large asset purchases stemming from QE (quantitative easing) could occur in 2021. The Fed Vice President also noted that ‘It was possible that the central bank could raise interest rates. by 2023.

Clarida further suggested evaluating the labor statistics in the United States and whether or not they have improved enough to reduce monetary easing policy. “I think we will find out more about the job market over the next few months than we do now,” Clarida said. The Fed vice chairman added:

The recovery and expansion after the pandemic is unlike anything we’ve ever seen, and it will serve us well to remain humble in predicting the future. The start of policy normalization in 2023 would therefore be very much in line with our new flexible framework for targeting average inflation.

On Friday morning, the Bureau of Labor Statistics released the jobs report which notes that employers added 943,000 jobs in July. The 10-year treasury bill and equity markets received mixed signals and foreign markets were also fairly neutral when the US labor statistics were revealed. The Bureau of Labor Statistics indicates a much stronger labor market than the months of May and June.

Business leaders worried about US inflation, Senator Joe Manchin criticizes Fed’s monetary easing policy

Americans and business leaders across the country are worried about runaway inflation rising too quickly for the Fed to control. In another report published by Reuters, he shows that there is a significant disconnect between the Fed’s opinion on inflation and those who see it in the market.

“The bosses of the big multinationals are worried about rising inflation, but the very people who are charged with controlling price growth – the central bankers – seem unfazed,” Reuters journalists Francesco Canepa and Mark wrote on Friday. John.

West Virginia Senator and Democrat Joe Manchin wrote a letter to the Fed and explained that the central bank must stop its easy money policy as soon as possible.

“With the end of the recession and our strong economic recovery well underway, I am increasingly alarmed that the Fed continues to inject record amounts of stimulus into our economy,” Manchin wrote. “I am deeply concerned that the continued stimulus proposed by the Fed and the proposed additional fiscal stimulus will lead to overheating of our economy and inevitable inflationary taxes that hard-working Americans cannot afford,” Manchin pointed out in his letter.

Gold bug and economist Peter Schiff agreed with the West Virginia senator, but said he underestimates the problem of inflation. “Yes, Senator Joe Manchin is right”, Schiff tweeted Friday. “But he grossly underestimated the problem of inflation and the Fed’s ability to turn off the monetary taps. The inflation train has left the station and if the Fed declines, it will be the markets and the economy that will derail, ”added Schiff.

Despite people’s concerns about inflation and the Fed’s monetary easing, the US central bank has not turned off the money tap. Sven Henrich of Northman Trader said on August 3 that it “looks like the Fed’s balance sheet is growing again” and three days later he wrote that “the Fed’s balance sheet grew by $ 14 billion over the past week.”

What do you think of the Fed’s possible cut this year? Are you worried about rising inflation? Let us know what you think of this topic in the comments section below.

Image credits: Shutterstock, Pixabay, Wiki Commons

Warning: This article is for informational purposes only. This is not a direct offer or the solicitation of an offer to buy or sell, nor a recommendation or endorsement of any product, service or business. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or allegedly caused by or in connection with the use of or reliance on any content, good or service mentioned in this article.

[ad_2]

Source link