[ad_1]

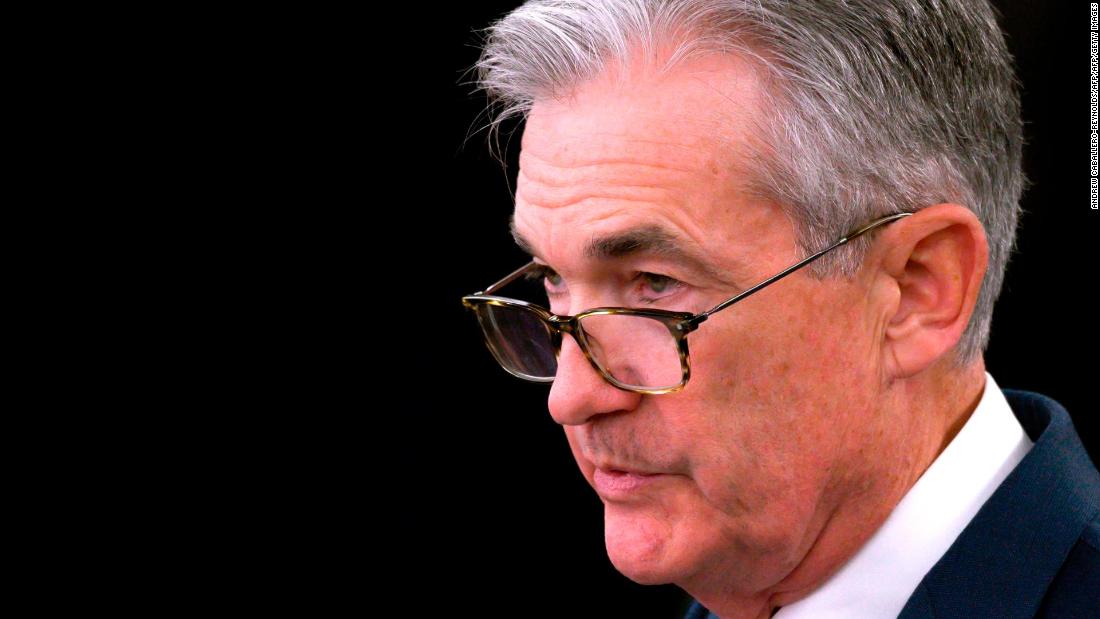

"We do not expect or expect a recession," Powell said during a discussion with Swiss National Bank President Thomas Jordan in Zurich.

"We will continue to act appropriately to support this expansion," Powell said.

The president's comments – the latest before the Fed officials' meeting at their next meeting in Washington on Sept. 17-18 – have been widely seen as a sign that policymakers are likely to cut spending again.

But investors already anticipated further cuts from the Fed since the first reduction in July in a decade, and not meeting these expectations could cause turbulence in the markets.

"The job market is well positioned," said Powell.

Even then, Powell recognized the "significant risks" facing the US economy in the eyes of policymakers. He cited commercial uncertainty, the slowdown in global growth in Germany, China and Europe, as well as moderate inflation.

For now, the Fed's president predicts that the US economy will continue to experience "moderate growth" for the rest of the year, mainly because of strong consumer spending, which has not been dampened by the turbulent trade war with China.

Powell noted that business uncertainty weighed on business investment and promised that the Fed would do everything in its power to continue supporting the US economy.

"Our obligation is to use our tools to support the economy," said Powell, who declined to comment on the Trump administration 's trade policy. "The uncertainty associated with trade policy is not something that central banks have the habit of dealing with."

Powell was again attacked earlier Friday by the president, who again accused the Fed of not having reduced enough rates. "They were way too early to raise [rates]and far too late to cut, "said Trump. Where did I find this guy, Jerome? Oh, you can not win them all. "

When asked at a question-and-answer session whether the president's criticism made his job better or worse, Powell said, "We are totally and totally focused on our jobs."

The Fed chairman has also been questioned about a controversial editorial by former New York President William Dudley, according to which the central bank, an independent agency, should consider allowing a war to "get the job done. commercial escalation that could hinder Trump's bid for re-election in 2020.

"Absolutely not," said Powell during the discussion. "Political factors have absolutely no role in our process and our colleagues would not tolerate it in our discussions."

He said the idea that the Fed would deviate from this idea is "simply wrong." The answer to this question is "a categorical nonsense."

[ad_2]

Source link